ST. JOHNS COUNTY, FLORIDA BALANCE SHEET - GOVERNMENTAL FUNDS September 30, 2015 St. Johns County Community TransportationRedevelopment Governmental Other Total General Govemmental ASSETS Trust Funds Funds Equity in pooled cash and cash equivalents Investments Accounts and notes receivable (net of allowance for uncollectibles) Notes receivable $ 25,564,656 $2,304,434 S 20,804 30,711,687 58,601,581 107,463,868 25,357,773 31,198,759 50,907,336 1,105,035 448,450 60,773 2,434,739 2,002,123 1,959,864 308,617 804,737 300,000 748,450 receivable Advances to other funds Due from other funds Due from other governments Inv Other assets 65,899 287,030 47,659 2,484,320 2,204,662 3,340,936 136,640 1,094,042 260,489 11,786 319,337 177,893,293 TOTAL ASSETS LIABILITIES AND FUND BALANCES LIABILITIES $59,193,902 $35,379,267 $ 20,804 S83,299,320 Accounts payable and accrued liabilities Customer deposits Advances from other funds Due to other funds Due to other governments Interest payable $ 5,278,481 $2,643,117 75,000 3,378 3,771,189 11,696,165 490,115 2,484,320 2,997,718 2,067,079 409,984 2,484,320 95,261 663,102 609,967 1,971,728 94,565 90 178,944 8,449,104 revenue 842,046 TOTAL LIABILITIES 2,812,772 3,378 9,312,189 20,577,443 FUND BALANCES Nonspendable Restricted Committed 2,883,189 290,808 347,659 67,183,188 67,486,832 ned 32,291,596 8,751,261 41,047,447 Unassigned TOTAL FUND BALANCES TOTAL LIABILITIES AND FUND BALANCES 47,570,801 50,744,798 59,193,90235,379.267 S 45,050,463 157,315,850 20,804S83,299.320177,893,293 520,338) 32,566,495 73,987,131 The accompanying notes are an integral part of the financial statements.

ST. JOHNS COUNTY, FLORIDA BALANCE SHEET - GOVERNMENTAL FUNDS September 30, 2015 St. Johns County Community TransportationRedevelopment Governmental Other Total General Govemmental ASSETS Trust Funds Funds Equity in pooled cash and cash equivalents Investments Accounts and notes receivable (net of allowance for uncollectibles) Notes receivable $ 25,564,656 $2,304,434 S 20,804 30,711,687 58,601,581 107,463,868 25,357,773 31,198,759 50,907,336 1,105,035 448,450 60,773 2,434,739 2,002,123 1,959,864 308,617 804,737 300,000 748,450 receivable Advances to other funds Due from other funds Due from other governments Inv Other assets 65,899 287,030 47,659 2,484,320 2,204,662 3,340,936 136,640 1,094,042 260,489 11,786 319,337 177,893,293 TOTAL ASSETS LIABILITIES AND FUND BALANCES LIABILITIES $59,193,902 $35,379,267 $ 20,804 S83,299,320 Accounts payable and accrued liabilities Customer deposits Advances from other funds Due to other funds Due to other governments Interest payable $ 5,278,481 $2,643,117 75,000 3,378 3,771,189 11,696,165 490,115 2,484,320 2,997,718 2,067,079 409,984 2,484,320 95,261 663,102 609,967 1,971,728 94,565 90 178,944 8,449,104 revenue 842,046 TOTAL LIABILITIES 2,812,772 3,378 9,312,189 20,577,443 FUND BALANCES Nonspendable Restricted Committed 2,883,189 290,808 347,659 67,183,188 67,486,832 ned 32,291,596 8,751,261 41,047,447 Unassigned TOTAL FUND BALANCES TOTAL LIABILITIES AND FUND BALANCES 47,570,801 50,744,798 59,193,90235,379.267 S 45,050,463 157,315,850 20,804S83,299.320177,893,293 520,338) 32,566,495 73,987,131 The accompanying notes are an integral part of the financial statements.

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

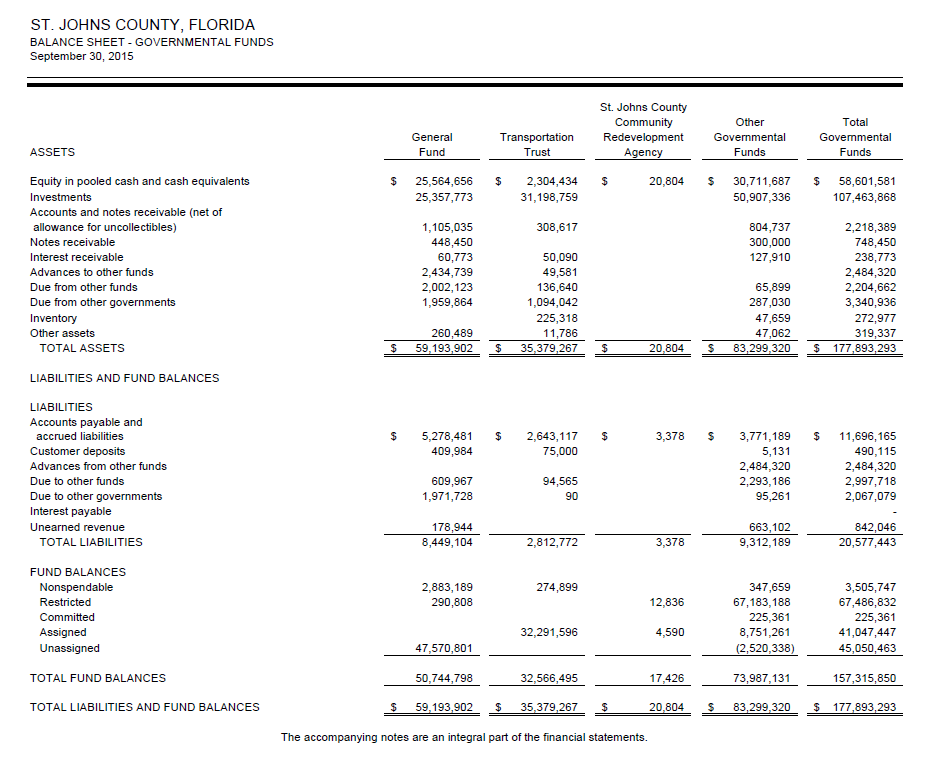

Using the Balance Sheet in the St. Johns County, Florida 2015 CAFR calculate the following ratios for each of the five (5) funds shown and for the “Total Governmental Funds:”

a. Current Ratio

b. Net Working Capital

c. Debt Ratio 1

d. Debt Ratio 2

e. Unrestricted Net Assets Ratio

f. Response Ratio

Transcribed Image Text:ST. JOHNS COUNTY, FLORIDA

BALANCE SHEET - GOVERNMENTAL FUNDS

September 30, 2015

St. Johns County

Community

TransportationRedevelopment Governmental

Other

Total

General

Govemmental

ASSETS

Trust

Funds

Funds

Equity in pooled cash and cash equivalents

Investments

Accounts and notes receivable (net of

allowance for uncollectibles)

Notes receivable

$ 25,564,656 $2,304,434 S

20,804 30,711,687 58,601,581

107,463,868

25,357,773

31,198,759

50,907,336

1,105,035

448,450

60,773

2,434,739

2,002,123

1,959,864

308,617

804,737

300,000

748,450

receivable

Advances to other funds

Due from other funds

Due from other governments

Inv

Other assets

65,899

287,030

47,659

2,484,320

2,204,662

3,340,936

136,640

1,094,042

260,489

11,786

319,337

177,893,293

TOTAL ASSETS

LIABILITIES AND FUND BALANCES

LIABILITIES

$59,193,902 $35,379,267 $

20,804 S83,299,320

Accounts payable and

accrued liabilities

Customer deposits

Advances from other funds

Due to other funds

Due to other governments

Interest payable

$ 5,278,481 $2,643,117

75,000

3,378 3,771,189 11,696,165

490,115

2,484,320

2,997,718

2,067,079

409,984

2,484,320

95,261

663,102

609,967

1,971,728

94,565

90

178,944

8,449,104

revenue

842,046

TOTAL LIABILITIES

2,812,772

3,378

9,312,189

20,577,443

FUND BALANCES

Nonspendable

Restricted

Committed

2,883,189

290,808

347,659

67,183,188

67,486,832

ned

32,291,596

8,751,261

41,047,447

Unassigned

TOTAL FUND BALANCES

TOTAL LIABILITIES AND FUND BALANCES

47,570,801

50,744,798

59,193,90235,379.267 S

45,050,463

157,315,850

20,804S83,299.320177,893,293

520,338)

32,566,495

73,987,131

The accompanying notes are an integral part of the financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education