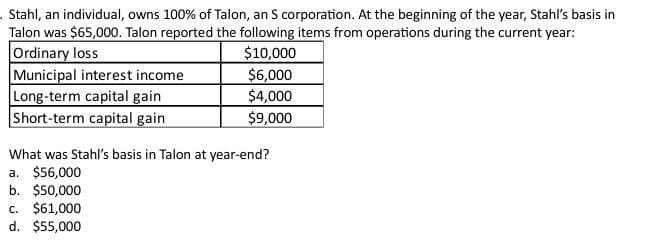

Stahl, an individual, owns 100% of Talon, an S corporation. At the beginning of the year, Stahl's basis in Talon was $65,000. Talon reported the following items from operations during the current year: Ordinary loss Municipal interest income Long-term capital gain Short-term capital gain $10,000 $6,000 $4,000 $9,000 What was Stahl's basis in Talon at year-end? a. $56,000 b. $50,000 c. $61,000 d. $55,000

Stahl, an individual, owns 100% of Talon, an S corporation. At the beginning of the year, Stahl's basis in Talon was $65,000. Talon reported the following items from operations during the current year: Ordinary loss Municipal interest income Long-term capital gain Short-term capital gain $10,000 $6,000 $4,000 $9,000 What was Stahl's basis in Talon at year-end? a. $56,000 b. $50,000 c. $61,000 d. $55,000

Chapter12: S Corporations

Section: Chapter Questions

Problem 27P

Related questions

Question

Full solution this question

Transcribed Image Text:Stahl, an individual, owns 100% of Talon, an S corporation. At the beginning of the year, Stahl's basis in

Talon was $65,000. Talon reported the following items from operations during the current year:

Ordinary loss

Municipal interest income

Long-term capital gain

Short-term capital gain

$10,000

$6,000

$4,000

$9,000

What was Stahl's basis in Talon at year-end?

a. $56,000

b. $50,000

c. $61,000

d. $55,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you