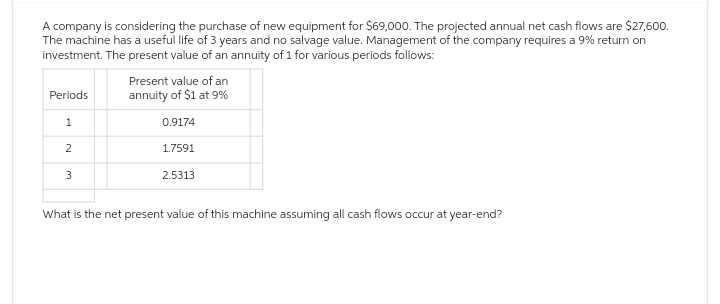

A company is considering the purchase of new equipment for $69,000. The projected annual net cash flows are $27,600. The machine has a useful life of 3 years and no salvage value. Management of the company requires a 9% return on investment. The present value of an annuity of 1 for various periods follows: Periods 1 Present value of an annuity of $1 at 9% 0.9174 2 3 1.7591 2.5313 What is the net present value of this machine assuming all cash flows occur at year-end?

A company is considering the purchase of new equipment for $69,000. The projected annual net cash flows are $27,600. The machine has a useful life of 3 years and no salvage value. Management of the company requires a 9% return on investment. The present value of an annuity of 1 for various periods follows: Periods 1 Present value of an annuity of $1 at 9% 0.9174 2 3 1.7591 2.5313 What is the net present value of this machine assuming all cash flows occur at year-end?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 10MC: On August 1, 2019, Kern Company leased a machine to Day Company for a 6-year period requiring...

Related questions

Question

am.103..

Transcribed Image Text:A company is considering the purchase of new equipment for $69,000. The projected annual net cash flows are $27,600.

The machine has a useful life of 3 years and no salvage value. Management of the company requires a 9% return on

investment. The present value of an annuity of 1 for various periods follows:

Periods

1

Present value of an

annuity of $1 at 9%

0.9174

2

3

1.7591

2.5313

What is the net present value of this machine assuming all cash flows occur at year-end?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,