stany needed. E34 (LO 1,22), AP Leong Corporation encounters the following situations: 1. Luong collects $1,300 from a customer in 2022 for services to be performed in 2023. 2. Luong incurs utility expense which is not yet paid in cash or recorded 3. Luong's employees worked 3 days in 2022 but will not be paid until 2023. 4. Luong performs services for customers but has not yet received cash or recorded the transaction 5. Luong paid $2,800 rent on December 1 for the 4 months starting December 1. 6. Luong received cash for future services and recorded a liability until the service was performed. 7. Luong performed consulting services for a client in December 2022. On December 31, it had not billed the client for services provided of $1,200. 8. Luong paid cash for an expense and recorded an asset until the item was used up. 9. Luong purchased $900 of supplies in 2022; at year-end, $400 of supplies remain unused 10. Luong purchased equipment on January 1, 2022; the equipment will be used for 5 years 11. Luong borrowed $12,000 on October 1, 2022, signing an 8% one-year note payable. Both the interest and the note will be paid in 1 year Instructions Identify what type of adjusting entry (prepaid expense, uneamed revenue, accrued expense, or accrued revenac) is needed in each situation at December 31, 2022 Prepare adjusting entries from selected data.

stany needed. E34 (LO 1,22), AP Leong Corporation encounters the following situations: 1. Luong collects $1,300 from a customer in 2022 for services to be performed in 2023. 2. Luong incurs utility expense which is not yet paid in cash or recorded 3. Luong's employees worked 3 days in 2022 but will not be paid until 2023. 4. Luong performs services for customers but has not yet received cash or recorded the transaction 5. Luong paid $2,800 rent on December 1 for the 4 months starting December 1. 6. Luong received cash for future services and recorded a liability until the service was performed. 7. Luong performed consulting services for a client in December 2022. On December 31, it had not billed the client for services provided of $1,200. 8. Luong paid cash for an expense and recorded an asset until the item was used up. 9. Luong purchased $900 of supplies in 2022; at year-end, $400 of supplies remain unused 10. Luong purchased equipment on January 1, 2022; the equipment will be used for 5 years 11. Luong borrowed $12,000 on October 1, 2022, signing an 8% one-year note payable. Both the interest and the note will be paid in 1 year Instructions Identify what type of adjusting entry (prepaid expense, uneamed revenue, accrued expense, or accrued revenac) is needed in each situation at December 31, 2022 Prepare adjusting entries from selected data.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 2MCQ: In December 2019, Swanstrom Inc. receives a cash payment of $3,500 for services performed in...

Related questions

Question

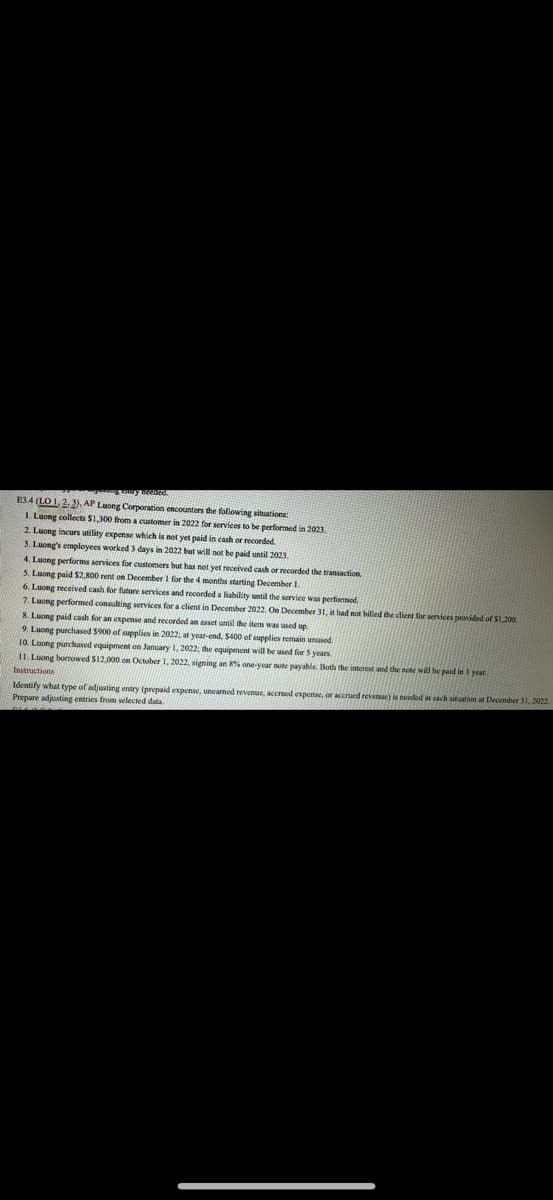

Transcribed Image Text:834 (LO 1,2,2), AP Luong Corporation encounters the following situations:

1. Luong collects $1,300 from a customer in 2022 for services to be performed in 2023.

2. Luong incurs utility expense which is not yet paid in cash or recorded.

3. Luong's employees worked 3 days in 2022 but will not be paid until 2023.

4. Luong performs services for customers but has not yet received cash or recorded the transaction.

5. Luong paid $2,800 rent on December 1 for the 4 months starting December 1.

6. Luong received cash for future services and recorded a liability until the service was performed.

7. Luong performed consulting services for a client in December 2022. On December 31, it had not billed the client for services provided of $1,200.

8. Luong paid cash for an expense and recorded an asset until the item was used up

9. Luong purchased $900 of supplies in 2022; at year-end, $400 of supplies remain unused.

10. Luong purchased equipment on January 1, 2022, the equipment will be used for 5 years.

11. Luong borrowed $12,000 on October 1, 2022, signing an 8% one-year note payable. Both the interest and the note will be paid in I year.

Instructions

Identify what type of adjusting entry (prepaid expense, unearned revenue, accrued expense, or accrued revenue) is needed in each situation at December 31, 2022

Prepare adjusting entries from selected data.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT