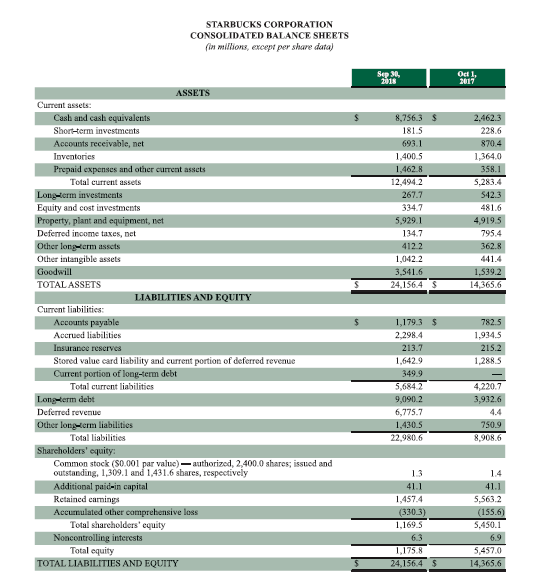

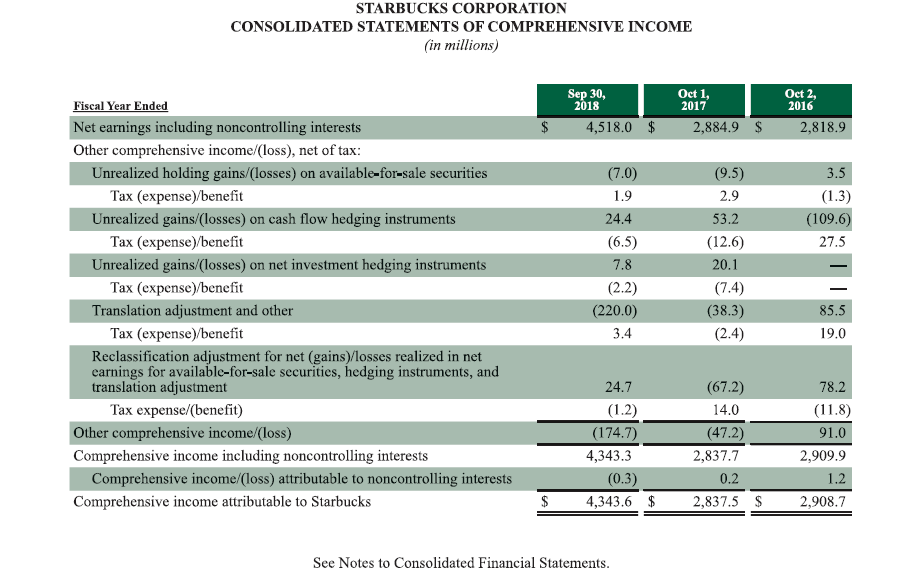

STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Sep 30, 2018 Oct 1, 2017 ASSETS Current assets Cash and cash equivalents 8,756.3 $ 2,462.3 181.5 Short-term investments 228.6 Accounts receivable, net 693.1 870.4 Inventories 1,400.5 1,364.0 Prepaid expenses and other current assets 1,462.8 358.1 Total current assets 12,494.2 5,283.4 Longterm investments Equity and cost investments Property, plant and equipment, net Deferred income taxes, net 267.7 542.3 334.7 481.6 5,929.1 4,919.5 795.4 134.7 412.2 362.8 Other longerm asscts Other intangible assets Goodwill TOTAL ASSETS 1,042.2 441.4 1.539.2 3,541.6 24.156.4 14,365.6 LIABILITIES AND EQUITY Current liabilities 1,179.3 S Accounts payable Accrued liabilities 782.5 2,298.4 1,934.5 Insurance reserves 213.7 215.2 Stored value card liability and current portion of deferred revenue Current portion of long-term debt Total current liabilitics 1,642.9 1,288.5 349.9 4,220.7 5,684.2 Long-term debt Deferred revenue 9,090.2 3,932.6 6,775.7 4.4 Other longtem liabilities 1,430.5 750.9 Total liabilities 22,980.6 8,908.6 Shareholders' equity: Common stock (S0.001 par value)-authorized, 2,400.0 shares; issued and outstanding, 1,309.1 and 1,431.6 shares, respectively 13 14 Additional paid-in capital Retained carmings 41.1 41.1 5,563.2 1,457.4 Accumulated other comprehensive loss Total shareholders' equity (330.3) 1,69.5 (155.6) S,450.1 Noncontrolling interests Total equity 6.3 6.9 1,175.8 5,457.0 24,156.4 TOTAL LIABILITIES AND EQUITY 14,365.6 STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME in millions Sep 30, 2018 Oct 1, 2017 Oct 2, 2016 Fiscal Year Ended Net earnings including noncontrolling interests $ 2,884.9 $ 2,818.9 4,518.0 Other comprehensive income/(loss), net of tax: Unrealized holding gains/(losses) on available-for-sale securities (7.0) (9.5) 3.5 Tax (expense)/benefit 1.9 2.9 (1.3) (109.6) Unrealized gains/(losses) on cash flow hedging instruments 24.4 53.2 Таx (еxpense)benefit (6.5) (12.6) 27.5 Unrealized gains/(losses) on net investment hedging instruments 7.8 20.1 Таx (еxpense)benefit (2.2) (7.4) Translation adjustment and other (220.0) (38.3) 85.5 Таx (еxpense) benefit Reclassification adjustment for net (gains)/losses realized in net earnings for available-for-sale securities, hedging instruments, and translation adjustment (2.4) 3.4 19.0 24.7 (67.2) 78.2 Tax expense/(benefit) (1.2) 14,0 (11.8) 91.0 Other comprehensive income/(loss) (174.7) (47.2) Comprehensive income including noncontrolling interests 4,343.3 2,837.7 2,909.9 (0.3) Comprehensive income/(loss) attributable to noncontrolling interests 0.2 1.2 Comprehensive income attributable to Starbucks 4,343.6 $ 2,837.5 $ 2,908.7 See Notes to Consolidated Financial Statements

STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Sep 30, 2018 Oct 1, 2017 ASSETS Current assets Cash and cash equivalents 8,756.3 $ 2,462.3 181.5 Short-term investments 228.6 Accounts receivable, net 693.1 870.4 Inventories 1,400.5 1,364.0 Prepaid expenses and other current assets 1,462.8 358.1 Total current assets 12,494.2 5,283.4 Longterm investments Equity and cost investments Property, plant and equipment, net Deferred income taxes, net 267.7 542.3 334.7 481.6 5,929.1 4,919.5 795.4 134.7 412.2 362.8 Other longerm asscts Other intangible assets Goodwill TOTAL ASSETS 1,042.2 441.4 1.539.2 3,541.6 24.156.4 14,365.6 LIABILITIES AND EQUITY Current liabilities 1,179.3 S Accounts payable Accrued liabilities 782.5 2,298.4 1,934.5 Insurance reserves 213.7 215.2 Stored value card liability and current portion of deferred revenue Current portion of long-term debt Total current liabilitics 1,642.9 1,288.5 349.9 4,220.7 5,684.2 Long-term debt Deferred revenue 9,090.2 3,932.6 6,775.7 4.4 Other longtem liabilities 1,430.5 750.9 Total liabilities 22,980.6 8,908.6 Shareholders' equity: Common stock (S0.001 par value)-authorized, 2,400.0 shares; issued and outstanding, 1,309.1 and 1,431.6 shares, respectively 13 14 Additional paid-in capital Retained carmings 41.1 41.1 5,563.2 1,457.4 Accumulated other comprehensive loss Total shareholders' equity (330.3) 1,69.5 (155.6) S,450.1 Noncontrolling interests Total equity 6.3 6.9 1,175.8 5,457.0 24,156.4 TOTAL LIABILITIES AND EQUITY 14,365.6 STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME in millions Sep 30, 2018 Oct 1, 2017 Oct 2, 2016 Fiscal Year Ended Net earnings including noncontrolling interests $ 2,884.9 $ 2,818.9 4,518.0 Other comprehensive income/(loss), net of tax: Unrealized holding gains/(losses) on available-for-sale securities (7.0) (9.5) 3.5 Tax (expense)/benefit 1.9 2.9 (1.3) (109.6) Unrealized gains/(losses) on cash flow hedging instruments 24.4 53.2 Таx (еxpense)benefit (6.5) (12.6) 27.5 Unrealized gains/(losses) on net investment hedging instruments 7.8 20.1 Таx (еxpense)benefit (2.2) (7.4) Translation adjustment and other (220.0) (38.3) 85.5 Таx (еxpense) benefit Reclassification adjustment for net (gains)/losses realized in net earnings for available-for-sale securities, hedging instruments, and translation adjustment (2.4) 3.4 19.0 24.7 (67.2) 78.2 Tax expense/(benefit) (1.2) 14,0 (11.8) 91.0 Other comprehensive income/(loss) (174.7) (47.2) Comprehensive income including noncontrolling interests 4,343.3 2,837.7 2,909.9 (0.3) Comprehensive income/(loss) attributable to noncontrolling interests 0.2 1.2 Comprehensive income attributable to Starbucks 4,343.6 $ 2,837.5 $ 2,908.7 See Notes to Consolidated Financial Statements

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.3C

Related questions

Question

conduct horizontal and vertical analyses for the balance sheet and income statement accounts and report any significant observations for a two-year period.

Debt Financing

- Use basic financial analysis to examine any horizontal changes in Starbucks’ short- and long-term debt over time.

- Use basic financial analysis to examine any vertical changes in Starbucks’ short- and long-term debt over time.

Transcribed Image Text:STARBUCKS CORPORATION

CONSOLIDATED BALANCE SHEETS

(in millions, except per share data)

Sep 30,

2018

Oct 1,

2017

ASSETS

Current assets

Cash and cash equivalents

8,756.3 $

2,462.3

181.5

Short-term investments

228.6

Accounts receivable, net

693.1

870.4

Inventories

1,400.5

1,364.0

Prepaid expenses and other current assets

1,462.8

358.1

Total current assets

12,494.2

5,283.4

Longterm investments

Equity and cost investments

Property, plant and equipment, net

Deferred income taxes, net

267.7

542.3

334.7

481.6

5,929.1

4,919.5

795.4

134.7

412.2

362.8

Other longerm asscts

Other intangible assets

Goodwill

TOTAL ASSETS

1,042.2

441.4

1.539.2

3,541.6

24.156.4

14,365.6

LIABILITIES AND EQUITY

Current liabilities

1,179.3 S

Accounts payable

Accrued liabilities

782.5

2,298.4

1,934.5

Insurance reserves

213.7

215.2

Stored value card liability and current portion of deferred revenue

Current portion of long-term debt

Total current liabilitics

1,642.9

1,288.5

349.9

4,220.7

5,684.2

Long-term debt

Deferred revenue

9,090.2

3,932.6

6,775.7

4.4

Other longtem liabilities

1,430.5

750.9

Total liabilities

22,980.6

8,908.6

Shareholders' equity:

Common stock (S0.001 par value)-authorized, 2,400.0 shares; issued and

outstanding, 1,309.1 and 1,431.6 shares, respectively

13

14

Additional paid-in capital

Retained carmings

41.1

41.1

5,563.2

1,457.4

Accumulated other comprehensive loss

Total shareholders' equity

(330.3)

1,69.5

(155.6)

S,450.1

Noncontrolling interests

Total equity

6.3

6.9

1,175.8

5,457.0

24,156.4

TOTAL LIABILITIES AND EQUITY

14,365.6

Transcribed Image Text:STARBUCKS CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

in millions

Sep 30,

2018

Oct 1,

2017

Oct 2,

2016

Fiscal Year Ended

Net earnings including noncontrolling interests

$

2,884.9 $

2,818.9

4,518.0

Other comprehensive income/(loss), net of tax:

Unrealized holding gains/(losses) on available-for-sale securities

(7.0)

(9.5)

3.5

Tax (expense)/benefit

1.9

2.9

(1.3)

(109.6)

Unrealized gains/(losses) on cash flow hedging instruments

24.4

53.2

Таx (еxpense)benefit

(6.5)

(12.6)

27.5

Unrealized gains/(losses) on net investment hedging instruments

7.8

20.1

Таx (еxpense)benefit

(2.2)

(7.4)

Translation adjustment and other

(220.0)

(38.3)

85.5

Таx (еxpense) benefit

Reclassification adjustment for net (gains)/losses realized in net

earnings for available-for-sale securities, hedging instruments, and

translation adjustment

(2.4)

3.4

19.0

24.7

(67.2)

78.2

Tax expense/(benefit)

(1.2)

14,0

(11.8)

91.0

Other comprehensive income/(loss)

(174.7)

(47.2)

Comprehensive income including noncontrolling interests

4,343.3

2,837.7

2,909.9

(0.3)

Comprehensive income/(loss) attributable to noncontrolling interests

0.2

1.2

Comprehensive income attributable to Starbucks

4,343.6 $

2,837.5 $

2,908.7

See Notes to Consolidated Financial Statements

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning