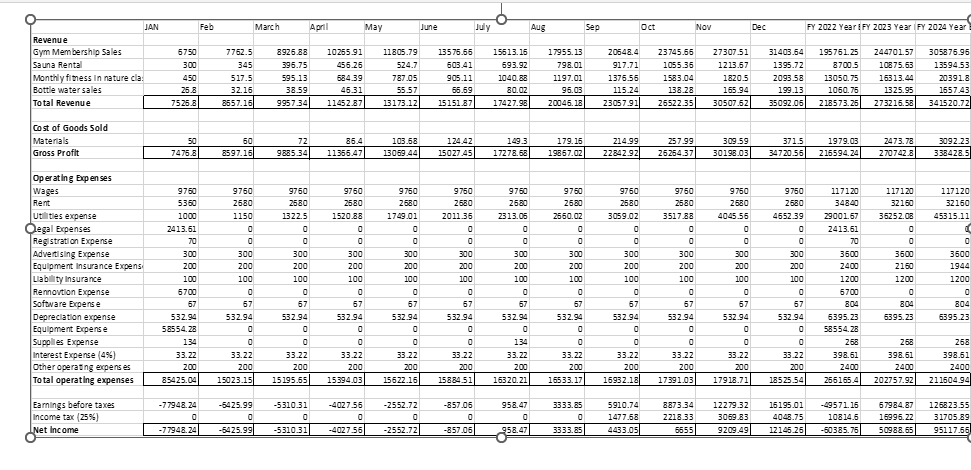

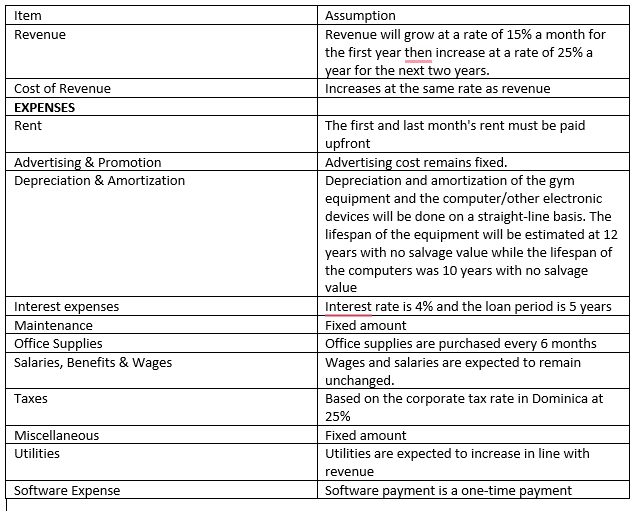

Start up expenses: To start the gym, the initial total investment required is $162,544.55EC. This figure includes all operational costs for the first month, including equipment costs, legal fees for drafting partnership contracts, business registration fees, renovation costs for painting the space and installing fixtures, mirrors, front desk etc. This figure also includes all operational costs for the next six months which is comprised mostly of rent and salaries. Between January and June 2022, the gym is expected to generate a loss since it is a new entity and therefore the partners have found it necessary to have enough capital on to cover the expenses for these months. To attain a loan from the National Bank of Dominica Ltd, at least 10% equity and 20% collateral is required. Therefore, all five partners have come to the agreement to each invest $18,000 EC. Cumulatively, equity in the business would be $90,000. This equity will fully cover the cost of equipment ($58,544.28c) which will then be used to secure an $80,000 loan from the bank. An excess of $7,455.45 would be available if the loan is approved for the full amount. These excess funds will be used to cover unforeseen expenses. Notes: - Gym membership is $270EC a month - Gym operates 5am – 9pm - Monday to Saturday - Bottle of water is $2.68c each - Case of water = $50ec - Employees: Part time o Yoga instructor – teaches 3 classes a week (beginners, intermediate, advance yoga) = Salary per class = Paid $60 per class = $720 a month o Pilates instructor = teaches 2 classes a week @ same rate as yoga instructor = $480 a month o 2 Spin class instructors(morning and evening instructors) = teaches morning= 3 days a week @ above rate = $1440 a month (cumulatively) o Bootcamp instructor = 3 days a week = 720 o 4 front desk operators/ weight room operators/Sauna operators = 2 shifts, 6 days a week – 5am -1pm and 1pm-9pm – Paid $400 a week - Corporate tax rate for Dominica is 25% - Each class will have 15 students - Equipment: o 16 yoga mats o 16 exercise balls o 4 treadmills o 3 elliptical machines o 16 spin bikes o 20 dumbells (per type) o 2 total gyms o 2 stair climbers Prepare a Balance Sheet

Start up expenses:

To start the gym, the initial total investment required is $162,544.55EC. This figure includes all operational costs for the first month, including equipment costs, legal fees for drafting

Notes:

- Gym membership is $270EC a month

- Gym operates 5am – 9pm - Monday to Saturday

- Bottle of water is $2.68c each

- Case of water = $50ec

- Employees:

Part time

o Yoga instructor – teaches 3 classes a week (beginners, intermediate, advance yoga) = Salary per class = Paid $60 per class = $720 a month

o Pilates instructor = teaches 2 classes a week @ same rate as yoga instructor = $480 a month

o 2 Spin class instructors(morning and evening instructors) = teaches morning= 3 days a week @ above rate = $1440 a month (cumulatively)

o Bootcamp instructor = 3 days a week = 720

o 4 front desk operators/ weight room operators/Sauna operators = 2 shifts, 6 days a week – 5am -1pm and 1pm-9pm – Paid $400 a week

- Corporate tax rate for Dominica is 25%

- Each class will have 15 students

- Equipment:

o 16 yoga mats

o 16 exercise balls

o 4 treadmills

o 3 elliptical machines

o 16 spin bikes

o 20 dumbells (per type)

o 2 total gyms

o 2 stair climbers

Prepare a

Step by step

Solved in 2 steps