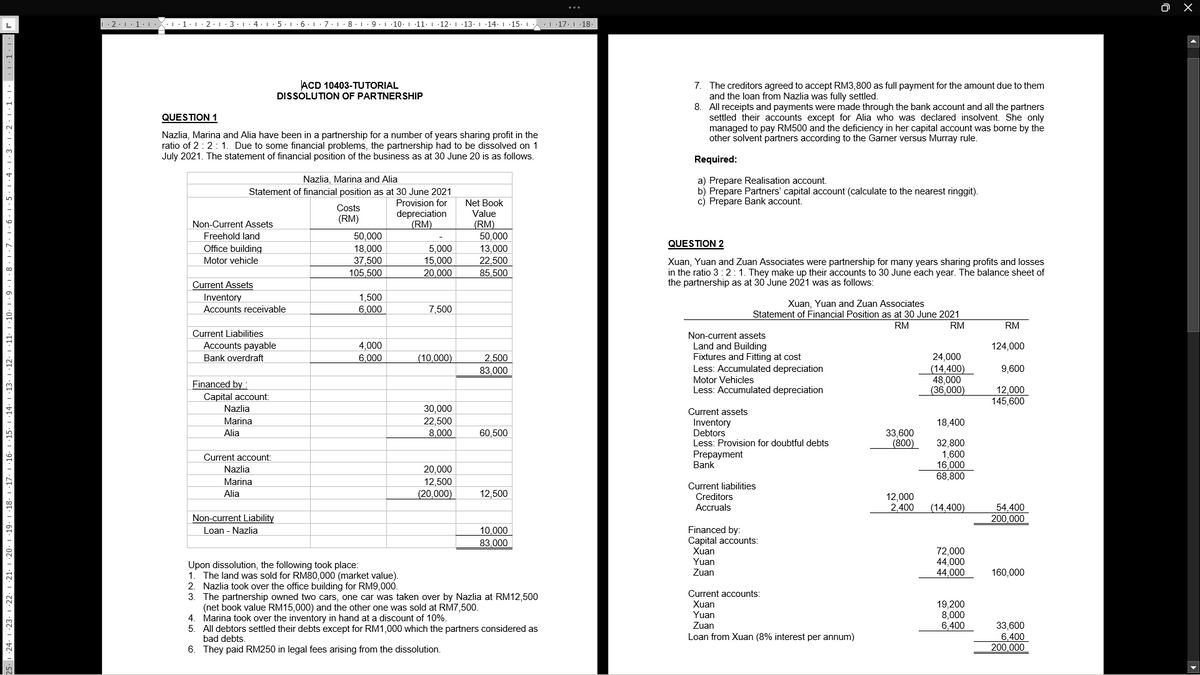

Statement of financial position as at 30 June 2021 Provision for depreciation Costs (RM) Net Book Value (RM) Non-Current Assets Freehold land (RM) 50,000 50,000 18,000 37,500 105,500 Office building 5,000 15,000 20,000 13,000 22,500 85 500 Motor vehicle Current Assets Inventory Accounts receivable 1,500 6,000 7,500 Current Liabilities Accounts payable Bank overdraft 4,000 6,000 2.500 83.000 (10,000) Financed by: Capital account: Nazlia Marina Alia 30,000 22,500 8,000 60,500 Current account: Nazlia 20,000 12,500 (20.000) Marina Alia 12,500 Non-current Liability Loan - Nazlia 10,000 83 000 Upon dissolution, the following took place: 1. The land was sold for RMB0,000 (market value). 2. Nazlia took over the office building for RM9,000. 3. The partnership owned two cars, one car was taken over by Nazlia at RM12,500 (net book value RM15,000) and the other one was sold at RM7,500. 4. Marina took over the inventory in hand at a discount of 10%. 5. All debtors settled their debts except for RM1,000 which the partners considered as bad debts. 6. They paid RM250 in legal fees arising from the dissolution.

Statement of financial position as at 30 June 2021 Provision for depreciation Costs (RM) Net Book Value (RM) Non-Current Assets Freehold land (RM) 50,000 50,000 18,000 37,500 105,500 Office building 5,000 15,000 20,000 13,000 22,500 85 500 Motor vehicle Current Assets Inventory Accounts receivable 1,500 6,000 7,500 Current Liabilities Accounts payable Bank overdraft 4,000 6,000 2.500 83.000 (10,000) Financed by: Capital account: Nazlia Marina Alia 30,000 22,500 8,000 60,500 Current account: Nazlia 20,000 12,500 (20.000) Marina Alia 12,500 Non-current Liability Loan - Nazlia 10,000 83 000 Upon dissolution, the following took place: 1. The land was sold for RMB0,000 (market value). 2. Nazlia took over the office building for RM9,000. 3. The partnership owned two cars, one car was taken over by Nazlia at RM12,500 (net book value RM15,000) and the other one was sold at RM7,500. 4. Marina took over the inventory in hand at a discount of 10%. 5. All debtors settled their debts except for RM1,000 which the partners considered as bad debts. 6. They paid RM250 in legal fees arising from the dissolution.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:· 2· 1· 1• I· X:1:1· 2· |· 3· 1 · 4· 1: 5· 1·6·1· 7:1·8· 1· 9 . 1 ·10. 1 11. | ·12: 1 ·13. 1 14. 1 15. 1 .1 17. 1 18.

ACD 10403-TUTORIAL

7. The creditors agreed to accept RM3,800 as full payment for the amount due to them

and the loan from Nazlia was fully settled.

8. All receipts and payments were made through the bank account and all the partners

settled their accounts except for Alia who was declared insolvent. She only

managed to pay RM500 and the deficiency in her capital account was borne by the

other solvent partners according to the Garner versus Murray rule.

DISSOLUTION OF PARTNERSHIP

QUESTION 1

Nazlia, Marina and Alia have been in a partnership for a number of years sharing profit in the

ratio of 2 :2:1. Due to some financial problems, the partnership had to be dissolved on 1

July 2021. The statement of financial position of the business as at 30 June 20 is as follows.

Required:

Nazlia, Marina and Alia

a) Prepare Realisation account.

b) Prepare Partners' capital account (calculate to the nearest ringgit).

c) Prepare Bank account.

Statement of financial position as at 30 June 2021

Provision for

Net Book

Costs

(RM)

depreciation

(RM)

Value

(RM)

50,000

Non-Current Assets

50,000

18,000

37,500

105,500

Freehold land

QUESTION 2

Office building

5,000

15,000

13,000

Motor vehicle

22,500

85,500

Xuan, Yuan and Zuan Associates were partnership for many years sharing profits and losses

in the ratio 3:2:1. They make up their accounts to 30 June each year. The balance sheet of

the partnership as at 30 June 2021 was as follows:

20,000

Current Assets

Inventory

Accounts receivable

1,500

Xuan, Yuan and Zuan Associates

Statement of Financial Position as at 30 June 2021

6,000

7,500

RM

RM

RM

Current Liabilities

Non-current assets

Accounts payable

Bank overdraft

4,000

6,000

Land and Building

Fixtures and Fitting at cost

Less: Accumulated depreciation

Motor Vehicles

Less: Accumulated depreciation

124,000

(10,000)

2,500

24,000

(14,400)

48,000

(36,000)

83,000

9,600

Financed by :

Capital account:

Nazlia

12,000

145,600

30,000

Current assets

Marina

22,500

Inventory

Debtors

Less: Provision for doubtful debts

18,400

Alia

8.000

60,500

33,600

(800)

32,800

1,600

16,000

68,800

Prepayment

Bank

Current account:

Nazlia

20,000

12,500

(20,000)

Marina

Current liabilities

Alia

12,500

Creditors

Accruals

12,000

2,400

54,400

200,000

(14,400)

Non-current Liability

Financed by:

Capital accounts:

Xuan

Yuan

Loan - Nazlia

10,000

83.000

72,000

44,000

44,000

Upon dissolution, the following took place:

1. The land was sold for RM80,000 (market value).

2. Nazlia took over the office building for RM9,000.

3. The partnership owned two cars, one car was taken over by Nazlia at RM12,500

(net book value RM15,000) and the other one was sold at RM7,500.

4. Marina took over the inventory in hand at a discount of 10%.

5. All debtors settled their debts except for RM1,000 which the partners considered as

bad debts.

6. They paid RM250 in legal fees arising from the dissolution.

Zuan

160,000

Current accounts:

Xuan

19,200

8,000

6,400

Yuan

Zuan

Loan from Xuan (8% interest per annum)

33,600

6,400

200,000

| 24. 1 23. 1 22. 1 21. I

Transcribed Image Text:AutoSave ● Off

ACD 10403-TUTORIAL DISSOLUTION OF PARTNERSHIP Q1 Q2

Protected View • Saved to this PC -

O Search (Alt+Q)

Nurul Iffah

困

NI

File

Home

Insert

Draw

Design

Layout

References

Mailings

Review

View

Help

O Comments v

A Share

PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View.

Enable Editing

|: 2:1. 1:

1.1

2.1.3. I

4. 1: 5. 1: 6. 1:7. L·8. 1. 9. 10. I

11. 1· 12. 1 13. 1

14. 1 15. 1 L 17. 1 · 18.

On 30 September 2021, Xuan, Yuan and Zuan decided to dissolve their partnership. In the

period from July to 30 September 2021, the following transactions related to the dissolution

resulted:

1.

Land and Building were sold for RM160,000.

Fixtures and Fitting was disposed at RM4,000.

Xuan agreed to take over one of the motor vehicles at the value of RM3,200

the remaining motor vehicles being sold at RM8,000.

Half of the inventory were sold for RM8,000 and another half were taken over

by Yuan at RM6,400.

The debtors, except for debts of RM1,600, were settled their debts in full.

Refund of RM1,200 from the prepayments were received.

After some negotiation with the creditors, the partnership only paid 95% of the

creditors to full settlement of its debts.

2.

3.

4.

5.

6.

7.

8.

Professional charges relating to the dissolution of RM800 was paid.

The partnership settled all of the accrued expenses.

It was agreed that loan from Xuan of RM6,400 should be paid to him plus the

interest accrued to him since 30 June 2021.

The partner's current accounts were to be closed and any balances on them

as at 30 September 2021 to be transferred to the respective capital accounts.

9.

10.

11.

Required:

Prepare the following accounts showing the dissolution of the partnership:

a) Realisation accounts;

b) Partners' capital accounts;

c) Bank account

13

16

Page 3 of 3

712 words

D'Focus

90%

10:15 PM

O Type here to search

O G 4) ENG

IMI

20/4/2022

2·1 ·11· I ·:

11:3· 1·2· 1 ·1· 1 · 1·1:2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education