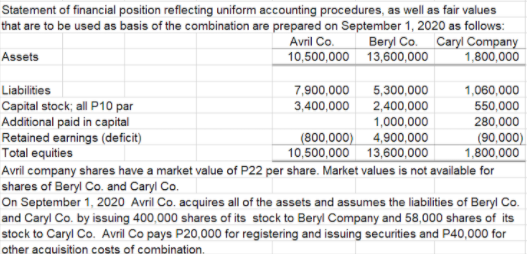

Statement of financial position reflecting uniform accounting procedures, as well as fair values that are to be used as basis of the combination are prepared on September 1, 2020 as follows: Beryl Co. Caryl Company 1,800,000 Avril Co. 10,500,000 13,600,000 Assets Liabilities Capital stock; all P10 par Additional paid in capital Retained earnings (deficit) Total equities Avril company shares have a market value of P22 per share. Market values is not available for shares of Beryl Co. and Caryl Co. On September 1, 2020 Avril Co. acquires all of the assets and assumes the liabilities of Beryl Co. and Caryl Co. by issuing 400,000 shares of its stock to Beryl Company and 58,000 shares of its stock to Caryl Co. Avril Co pays P20,000 for registering and issuing securities and P40,000 for 7,900,000 1,060,000 5,300,000 2,400,000 3,400,000 550,000 280,000 1,000,000 (800,000) 4,900,000 10,500,000 13,600,000 (90,000 1,800,000 other acquisition costs of combination.

Statement of financial position reflecting uniform accounting procedures, as well as fair values that are to be used as basis of the combination are prepared on September 1, 2020 as follows: Beryl Co. Caryl Company 1,800,000 Avril Co. 10,500,000 13,600,000 Assets Liabilities Capital stock; all P10 par Additional paid in capital Retained earnings (deficit) Total equities Avril company shares have a market value of P22 per share. Market values is not available for shares of Beryl Co. and Caryl Co. On September 1, 2020 Avril Co. acquires all of the assets and assumes the liabilities of Beryl Co. and Caryl Co. by issuing 400,000 shares of its stock to Beryl Company and 58,000 shares of its stock to Caryl Co. Avril Co pays P20,000 for registering and issuing securities and P40,000 for 7,900,000 1,060,000 5,300,000 2,400,000 3,400,000 550,000 280,000 1,000,000 (800,000) 4,900,000 10,500,000 13,600,000 (90,000 1,800,000 other acquisition costs of combination.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 7E: Multiple-Step and Single-Step Income Statements, and Statement of Comprehensive Income On December...

Related questions

Question

100%

Hello, I can't seem to get this sample problem that is given in our textbook(reading the book in advance). The needed answer is:

I feel like my answer is off from the real answer.

Transcribed Image Text:Statement of financial position reflecting uniform accounting procedures, as well as fair values

that are to be used as basis of the combination are prepared on September 1, 2020 as follows:

Beryl Co. Caryl Company

1,800,000

Avril Co.

10,500,000 13,600,000

Assets

5,300,000

2,400,000

1,000,000

(800,000) 4,900,000

10,500,000 13,600,000

7,900,000

3,400,000

1,060,000

550,000

Liabilities

Capital stock; all P10 par

Additional paid in capital

Retained earnings (deficit)

Total equities

280,000

(90,000)

1,800,000

Avril company shares have a market value of P22 per share. Market values is not available for

shares of Beryl Co. and Caryl Co.

On September 1, 2020 Avril Co. acquires all of the assets and assumes the liabilities of Beryl Co.

and Caryl Co. by issuing 400,000 shares of its stock to Beryl Company and 58,000 shares of its

stock to Caryl Co. Avril Co pays P20,000 for registering and issuing securities and P40,000 for

other acquisition costs of combination.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning