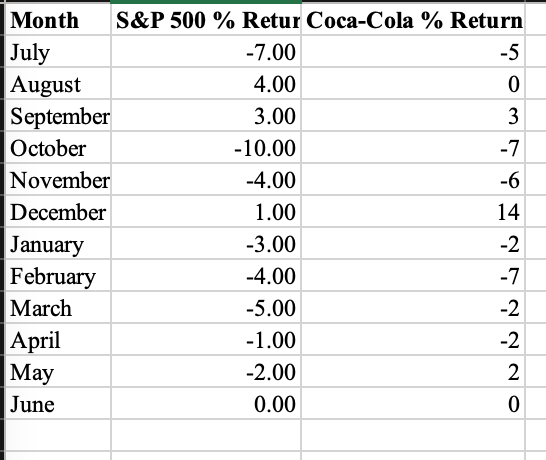

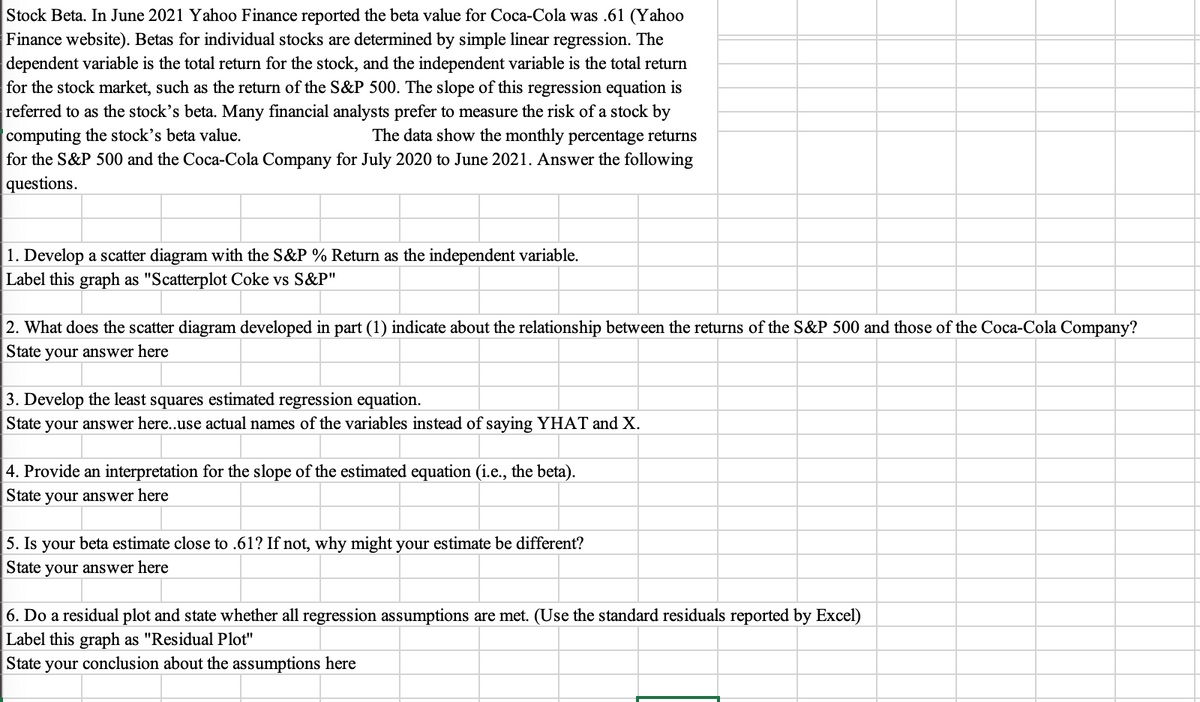

Stock Beta. In June 2021 Yahoo Finance reported the beta value for Coca-Cola was .61 (Yahoo Finance website). Betas for individual stocks are determined by simple linear regression. The dependent variable is the total return for the stock, and the independent variable is the total return for the stock market, such as the return of the S&P 500. The slope of this regression equation is referred to as the stock's beta. Many financial analysts prefer to measure the risk of a stock by computing the stock's beta value. The data show the monthly percentage returns for the S&P 500 and the Coca-Cola Company for July 2020 to June 2021. Answer the following questions. 1. Develop a scatter diagram with the S&P % Return as the independent variable. Label this graph as "Scatterplot Coke vs S&P" 2. What does the scatter diagram developed in part (1) indicate about the relationship between the returns of the S&P 500 and those of the Coca-Cola Company? State your answer here 3. Develop the least squares estimated regression equation. State your answer here..use actual names of the variables instead of saying YHAT and X. 4. Provide an interpretation for the slope of the estimated equation (i.e., the beta). State your answer here 5. Is your beta estimate close to .61? If not, why might your estimate be different? State your answer here

Stock Beta. In June 2021 Yahoo Finance reported the beta value for Coca-Cola was .61 (Yahoo Finance website). Betas for individual stocks are determined by simple linear regression. The dependent variable is the total return for the stock, and the independent variable is the total return for the stock market, such as the return of the S&P 500. The slope of this regression equation is referred to as the stock's beta. Many financial analysts prefer to measure the risk of a stock by computing the stock's beta value. The data show the monthly percentage returns for the S&P 500 and the Coca-Cola Company for July 2020 to June 2021. Answer the following questions. 1. Develop a scatter diagram with the S&P % Return as the independent variable. Label this graph as "Scatterplot Coke vs S&P" 2. What does the scatter diagram developed in part (1) indicate about the relationship between the returns of the S&P 500 and those of the Coca-Cola Company? State your answer here 3. Develop the least squares estimated regression equation. State your answer here..use actual names of the variables instead of saying YHAT and X. 4. Provide an interpretation for the slope of the estimated equation (i.e., the beta). State your answer here 5. Is your beta estimate close to .61? If not, why might your estimate be different? State your answer here

Algebra and Trigonometry (MindTap Course List)

4th Edition

ISBN:9781305071742

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter1: Equations And Graphs

Section1.FOM: Focus On Modeling: Fitting Lines To Data

Problem 6P

Related questions

Question

Transcribed Image Text:Month

July

August

September

October

November

December

January

February

March

April

May

June

S&P 500 % Retur Coca-Cola % Return

-7.00

4.00

3.00

-10.00

-4.00

1.00

-3.00

-4.00

-5.00

-1.00

-2.00

0.00

-5

0

3

-7

-6

14

-2

-7

222

-2

-2

0

Transcribed Image Text:Stock Beta. In June 2021 Yahoo Finance reported the beta value for Coca-Cola was .61 (Yahoo

Finance website). Betas for individual stocks are determined by simple linear regression. The

dependent variable is the total return for the stock, and the independent variable is the total return

for the stock market, such as the return of the S&P 500. The slope of this regression equation is

referred to as the stock's beta. Many financial analysts prefer to measure the risk of a stock by

computing the stock's beta value.

The data show the monthly percentage returns

for the S&P 500 and the Coca-Cola Company for July 2020 to June 2021. Answer the following

questions.

1. Develop a scatter diagram with the S&P % Return as the independent variable.

Label this graph as "Scatterplot Coke vs S&P"

2. What does the scatter diagram developed in part (1) indicate about the relationship between the returns of the S&P 500 and those of the Coca-Cola Company?

State your answer here

3. Develop the least squares estimated regression equation.

State your answer here..use actual names of the variables instead of saying YHAT and X.

4. Provide an interpretation for the slope of the estimated equation (i.e., the beta).

State your answer here

5. Is your beta estimate close to .61? If not, why might your estimate be different?

State your answer here

6. Do a residual plot and state whether all regression assumptions are met. (Use the standard residuals reported by Excel)

Label this graph as "Residual Plot"

State your conclusion about the assumptions here

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill