Straight-L Depreciat $205,00 205,00

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 5MC: During 2019, White Company determined that machinery previously depreciated over a 7-year life had a...

Related questions

Question

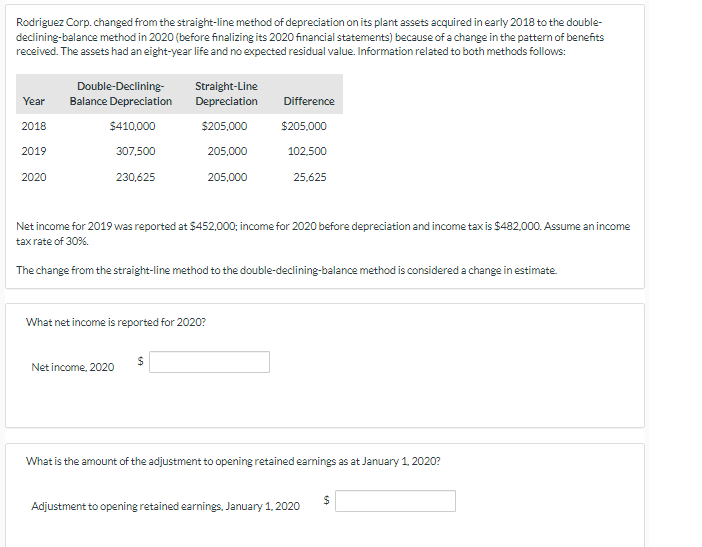

Transcribed Image Text:Rodriguez Corp. changed from the straight-line method of depreciation on its plant assets acquired in early 2018 to the double-

declining-balance method in 2020 (before finalizing its 2020 financial statements) because of a change in the pattern of benefits

received. The assets had an eight-year life and no expected residual value. Information related to both methods follows:

Double-Declining-

Balance Depreciation

Straight-Line

Depreciation

Year

Difference

2018

$410,000

$205,000

$205,000

2019

307,500

205.000

102.500

2020

230,625

205,000

25,625

Net income for 2019 was reported at $452,000; income for 2020 before depreciation and income tax is $482.000. Assume an income

tax rate of 30%.

The change from the straight-line method to the double-declining-balance method is considered a change in estimate.

What net income is reported for 2020?

Net income, 2020

What is the amount of the adjustment to opening retained earnings as at January 1, 2020?

Adjustment to opening retained earnings, January 1, 2020

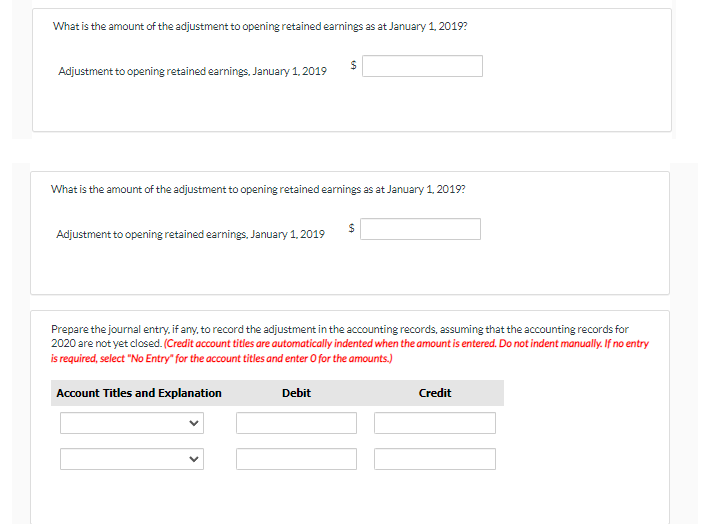

Transcribed Image Text:What is the amount of the adjustment to opening retained earnings as at January 1, 2019?

Adjustment to opening retained earnings. January 1, 2019

What is the amount of the adjustment to opening retained earnings as at January 1, 2019?

Adjustment to opening retained earnings, January 1, 2019

Prepare the journal entry, if any, to record the adjustment in the accounting records, assuming that the accounting records for

2020 are not yet closed. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry

is required, select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT