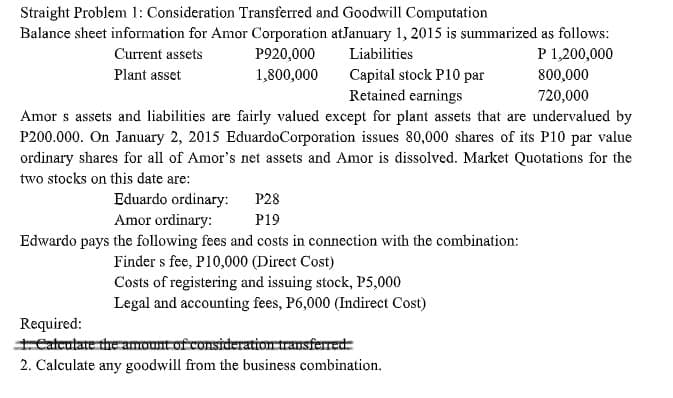

Straight Problem 1: Consideration Transferred and Goodwill Computation Balance sheet information for Amor Corporation atJanuary 1, 2015 is summarized as follows: P920,000 1,800,000 Current assets Liabilities P 1,200,000 Plant asset Capital stock P10 par Retained earnings 800,000 720,000 Amor s assets and liabilities are fairly valued except for plant assets that are undervalued by P200.000. On January 2, 2015 EduardoCorporation issues 80,000 shares of its P10 par value ordinary shares for all of Amor's net assets and Amor is dissolved. Market Quotations for the two stocks on this date are: Eduardo ordinary: P28 Amor ordinary: P19 Edwardo pays the following fees and costs in connection with the combination: Finder s fee, P10,000 (Direct Cost) Costs of registering and issuing stock, P5,000 Legal and accounting fees, P6,000 (Indirect Cost) Required: teateutate the amount ofconsideration transferred 2. Calculate any goodwill from the business combination.

Straight Problem 1: Consideration Transferred and Goodwill Computation Balance sheet information for Amor Corporation atJanuary 1, 2015 is summarized as follows: P920,000 1,800,000 Current assets Liabilities P 1,200,000 Plant asset Capital stock P10 par Retained earnings 800,000 720,000 Amor s assets and liabilities are fairly valued except for plant assets that are undervalued by P200.000. On January 2, 2015 EduardoCorporation issues 80,000 shares of its P10 par value ordinary shares for all of Amor's net assets and Amor is dissolved. Market Quotations for the two stocks on this date are: Eduardo ordinary: P28 Amor ordinary: P19 Edwardo pays the following fees and costs in connection with the combination: Finder s fee, P10,000 (Direct Cost) Costs of registering and issuing stock, P5,000 Legal and accounting fees, P6,000 (Indirect Cost) Required: teateutate the amount ofconsideration transferred 2. Calculate any goodwill from the business combination.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 11PB: On May 1, 2015, Zoe Inc. purchased Branta Corp. for $15,000,000 in cash. They only received...

Related questions

Question

s.p.1-2

Transcribed Image Text:Straight Problem 1: Consideration Transferred and Goodwill Computation

Balance sheet information for Amor Corporation atJanuary 1, 2015 is summarized as follows:

P 1,200,000

800,000

720,000

Current assets

P920,000

Liabilities

Plant asset

1,800,000

Capital stock P10 par

Retained earnings

Amor s assets and liabilities are fairly valued except for plant assets that are undervalued by

P200.000. On January 2, 2015 EduardoCorporation issues 80,000 shares of its P10 par value

ordinary shares for all of Amor's net assets and Amor is dissolved. Market Quotations for the

two stocks on this date are:

Eduardo ordinary:

Amor ordinary:

P28

P19

Edwardo pays the following fees and costs in connection with the combination:

Finder s fee, P10,000 (Direct Cost)

Costs of registering and issuing stock, P5,000

Legal and accounting fees, P6,000 (Indirect Cost)

Required:

teatcutate the amount ofconsideration transferred:

2. Calculate any goodwill from the business combination.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College