Zoe Company reported net income of P3,400,000 for the current year. The net income included depreciation o P840,000 and a gain on sale of equipment of P170,000. The equipment had an original cost of P4,000,000 and accumulated depreciation of P2,400,000. All of the following accounts increased during the current year. 450,000 680,000 Patent Prepaid rent Financial asset at fair value through other comprehensive income (FVOCI) Bonds payable 100,000 500,000 What amount should be reported as net cash flow from investing activities? a. 1,720,000 provided 6. 1,220,000 provided 540,000 provided d. c. 380,000 used

Zoe Company reported net income of P3,400,000 for the current year. The net income included depreciation o P840,000 and a gain on sale of equipment of P170,000. The equipment had an original cost of P4,000,000 and accumulated depreciation of P2,400,000. All of the following accounts increased during the current year. 450,000 680,000 Patent Prepaid rent Financial asset at fair value through other comprehensive income (FVOCI) Bonds payable 100,000 500,000 What amount should be reported as net cash flow from investing activities? a. 1,720,000 provided 6. 1,220,000 provided 540,000 provided d. c. 380,000 used

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 7MCQ

Related questions

Question

Please refer to the picture.

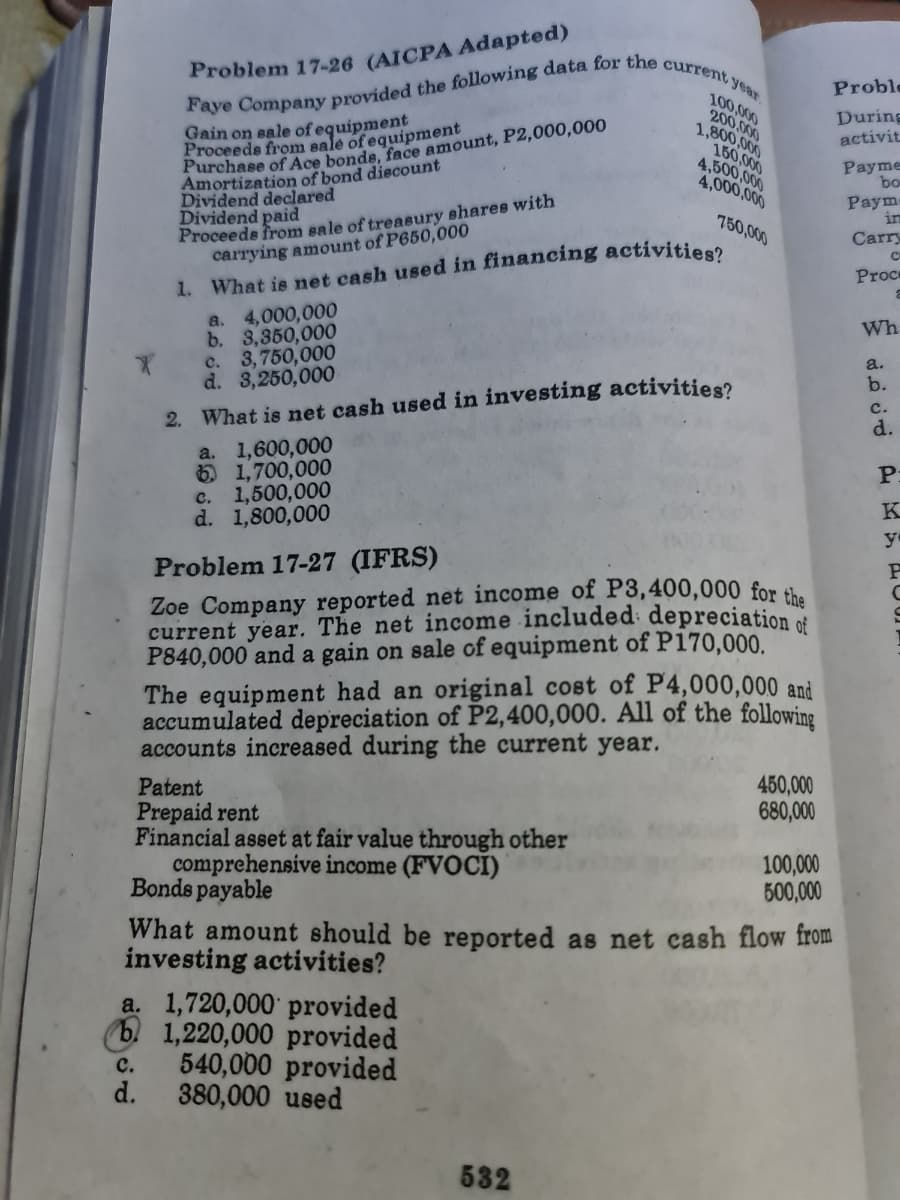

Transcribed Image Text:Faye Company provided the following data for the current year.

Problem 17-26 (AICPA Adapted)

Proble

Gain on eale ofequipment

Proceeds from sale of equipment

During

activit

Furchase of Ace bonde, face amount, P2,000,000

Amortization of bond diecount

Dividend declared

Dividend paid

Payme

bo

Paym

in

Carry

Proceeds from sale of treasury shares with

carrying amount of P650,000

750,000

1. What is net cash used in financing activities

Proce

a. 4,000,000

b. 3,350,000

c. 3,750,000

d. 3,250,000

Wh

a.

b.

c.

d.

2. What is net cash used in investing activities?

a. 1,600,000

O 1,700,000

c. 1,500,000

d. 1,800,000

P

K

y

Problem 17-27 (IFRS)

Zoe Company reported net income of P3,400,000 for .

current year. The net income included depreciation o

P840,000 and a gain on sale of equipment of P170,000.

The equipment had an original cost of P4,000,000 and

accumulated depreciation of P2,400,000. All of the following

accounts increased during the current year.

Patent

Prepaid rent

Financial asset at fair value through other

comprehensive income (FVOCI)

Bonds payable

450,000

680,000

100,000

500,000

What amount should be reported as net cash flow from

investing activities?

a. 1,720,000 provided

b. 1,220,000 provided

540,000 provided

d.

c.

380,000 used

532

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning