Strassel Investors buys real estate, develops it, and resells it for a profit. A new property is available, and Bud Strassel, the president and owner of Strassel Investors, believes if he purchases and develops this property it can then be sold for $165000. The current property owner has asked for bids and stated that the property will be sold for the highest bid in excess of $100000. Two competitors will be submitting bids for the property. Strassel does not know what the competitors will bid, but he assumes for planning purposes that the amount bid by each competitor will be uniformly distributed between $100000 and $150000. a. Develop a worksheet that can be used to simulate the bids made by the two competitors. Strassel is considering a bid of $130000 for the property. Using simulation of 1000 trials, what is the estimate of the probability Strassel will be able to obtain the property using a bid of $130000? Round your answer to 1 decimal place. Enter your answer as a percent. % b. How much does Strassel need to bid to be assured of obtaining the property? What is the profit associated with this bid? 24

Strassel Investors buys real estate, develops it, and resells it for a profit. A new property is available, and Bud Strassel, the president and owner of Strassel Investors, believes if he purchases and develops this property it can then be sold for $165000. The current property owner has asked for bids and stated that the property will be sold for the highest bid in excess of $100000. Two competitors will be submitting bids for the property. Strassel does not know what the competitors will bid, but he assumes for planning purposes that the amount bid by each competitor will be uniformly distributed between $100000 and $150000. a. Develop a worksheet that can be used to simulate the bids made by the two competitors. Strassel is considering a bid of $130000 for the property. Using simulation of 1000 trials, what is the estimate of the probability Strassel will be able to obtain the property using a bid of $130000? Round your answer to 1 decimal place. Enter your answer as a percent. % b. How much does Strassel need to bid to be assured of obtaining the property? What is the profit associated with this bid? 24

Chapter21: Partnerships

Section: Chapter Questions

Problem 32P

Related questions

Question

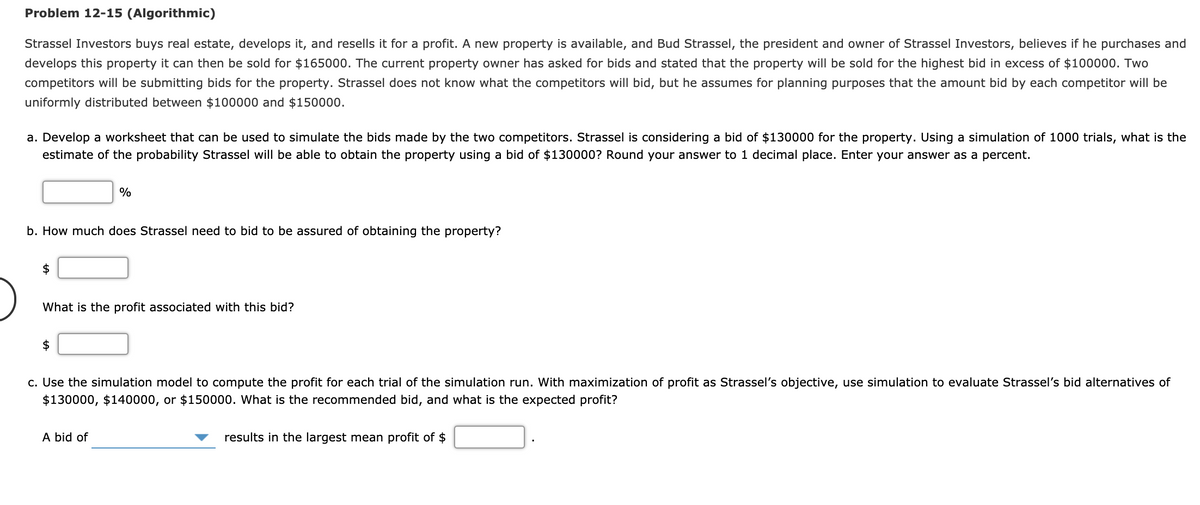

Transcribed Image Text:Problem 12-15 (Algorithmic)

Strassel Investors buys real estate, develops it, and resells it for a profit. A new property is available, and Bud Strassel, the president and owner of Strassel Investors, believes if he purchases and

develops this property it can then be sold for $165000. The current property owner has asked for bids and stated that the property will be sold for the highest bid in excess of $100000. Two

competitors will be submitting bids for the property. Strassel does not know what the competitors will bid, but he assumes for planning purposes that the amount bid by each competitor will be

uniformly distributed between $100000 and $150000.

a. Develop a worksheet that can be used to simulate the bids made by the two competitors. Strassel is considering a bid of $130000 for the property. Using a simulation of 1000 trials, what is the

estimate of the probability Strassel will be able to obtain the property using a bid of $130000? Round your answer to 1 decimal place. Enter your answer as a percent.

%

b. How much does Strassel need to bid to be assured of obtaining the property?

$

What is the profit associated with this bid?

$

c. Use the simulation model to compute the profit for each trial of the simulation run. With maximization of profit as Strassel's objective, use simulation to evaluate Strassel's bid alternatives of

$130000, $140000, or $150000. What is the recommended bid, and what is the expected profit?

A bid of

results in the largest mean profit of $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you