Study the statement of cash flows of Mustang Limited given below and answer the following questions: 1.1 Calculate the cash balance as at the beginning of the year and state whether the balance is favourable or unfavourable. 1.2 Calculate the amount of interest paid for the year ended 31 December 2020. 1.3 Identify one item from the statement of cash flows below that increases cash flow but not profit.

Study the statement of cash flows of Mustang Limited given below and answer the following questions: 1.1 Calculate the cash balance as at the beginning of the year and state whether the balance is favourable or unfavourable. 1.2 Calculate the amount of interest paid for the year ended 31 December 2020. 1.3 Identify one item from the statement of cash flows below that increases cash flow but not profit.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 27BE

Related questions

Question

Good day

Please refer to attachments for question and information

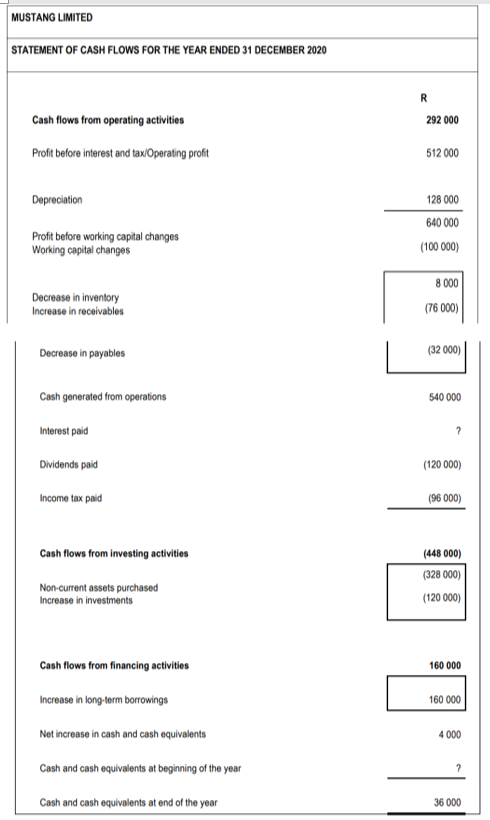

Transcribed Image Text:MUSTANG LIMITED

STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER 2020

R

Cash flows from operating activities

292 000

Profit before interest and tax/Oparating profit

512 000

Depreciation

128 000

640 000

Profit before working capital changes

Working capital changes

(100 000)

8 000

Decrease in inventory

Increase in receivables

(76 000)

Decrease in payables

(32 000)

Cash generated from operations

540 000

Interest paid

Dividends paid

(120 000)

Income tax paid

(96 000)

Cash flows from investing activities

(448 000)

(328 000)

Non-current assets purchased

Increase in investments

(120 000)

Cash flows from financing activities

160 000

Increase in long-term borrowings

160 000

Net increase in cash and cash equivalents

4 000

Cash and cash equivalents at beginning of the year

Cash and cash equivalents at end of the year

36 000

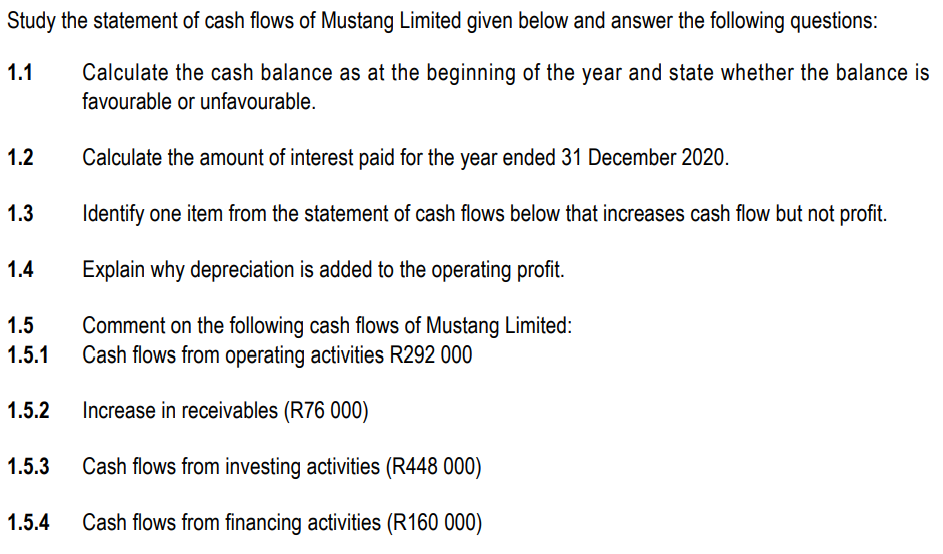

Transcribed Image Text:Study the statement of cash flows of Mustang Limited given below and answer the following questions:

1.1

Calculate the cash balance as at the beginning of the year and state whether the balance is

favourable or unfavourable.

1.2

Calculate the amount of interest paid for the year ended 31 December 2020.

1.3

Identify one item from the statement of cash flows below that increases cash flow but not profit.

1.4

Explain why depreciation is added to the operating profit.

1.5

Comment on the following cash flows of Mustang Limited:

Cash flows from operating activities R292 000

1.5.1

1.5.2

Increase in receivables (R76 000)

1.5.3

Cash flows from investing activities (R448 000)

1.5.4

Cash flows from financing activities (R160 000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning