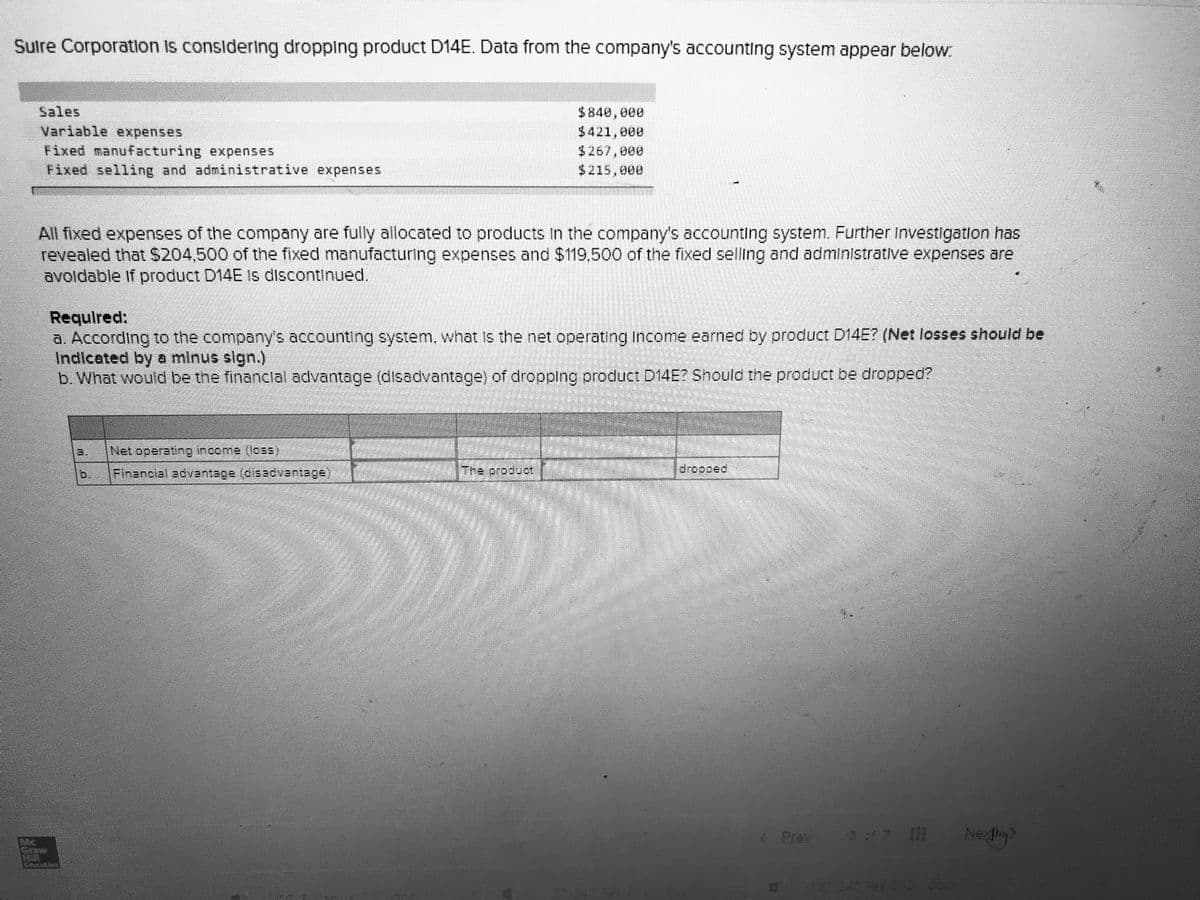

Sulre Corporation is considering dropping product D14E. Data from the company's accounting system appear below: Sales $840, 000 Variable expenses Fixed manufacturing expenses Fixed selling and administrative expenses $421,000 $267,000 $215, 000 All fixed expenses of the company are fully allocated to products In the company's accounting system. Further Investigatlon has revealed that $204,500 of the fixed manufacturing expenses and $119,500 of the fixed selling and administrative expenses are avoldable If product D14E Is discontinued. Required: a. According to the company's accounting system, what Is the net operating Income earned by product D14E? (Net losses should be Indicated by a minus sign.) b. What would be the financlal advantage (disadvantage) of dropping product D14E? Should the product be dropped? a. Net operating income (loss) b. Financial advantage (disadvantage) The product dropped

Sulre Corporation is considering dropping product D14E. Data from the company's accounting system appear below: Sales $840, 000 Variable expenses Fixed manufacturing expenses Fixed selling and administrative expenses $421,000 $267,000 $215, 000 All fixed expenses of the company are fully allocated to products In the company's accounting system. Further Investigatlon has revealed that $204,500 of the fixed manufacturing expenses and $119,500 of the fixed selling and administrative expenses are avoldable If product D14E Is discontinued. Required: a. According to the company's accounting system, what Is the net operating Income earned by product D14E? (Net losses should be Indicated by a minus sign.) b. What would be the financlal advantage (disadvantage) of dropping product D14E? Should the product be dropped? a. Net operating income (loss) b. Financial advantage (disadvantage) The product dropped

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

ChapterE: Departmental Accounting

Section: Chapter Questions

Problem 3P

Related questions

Question

Need help with a practice question from the last unit

Transcribed Image Text:Sulre Corporation is considering dropping product D14E. Data from the company's accounting system appear below:

$840,000

$421,000

$267,000

Sales

Variable expenses

Fixed manufacturing expenses

Fixed selling and administrative expenses

$215,000

All fixed expenses of the company are fully allocated to products in the company's accounting system. Further Investigation has

revealed that S204,500 of the fixed manufacturing expenses and $119,500 of the fixed selling and administrative expenses are

avoldable if product D14E Is discontinued.

Requlred:

a. According to the company's accounting system, what Is the net operating Income earned by product D14E? (Net losses should be

Indicated by a minus sign.)

b. What would be the financlal advantage (disadvantage) of dropplng product D14E? Should the product be dropped?

3.

Net operating income (loss)

b.

Financial advantage (disadvantage)

dropped

( Prev

40 Fa

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub