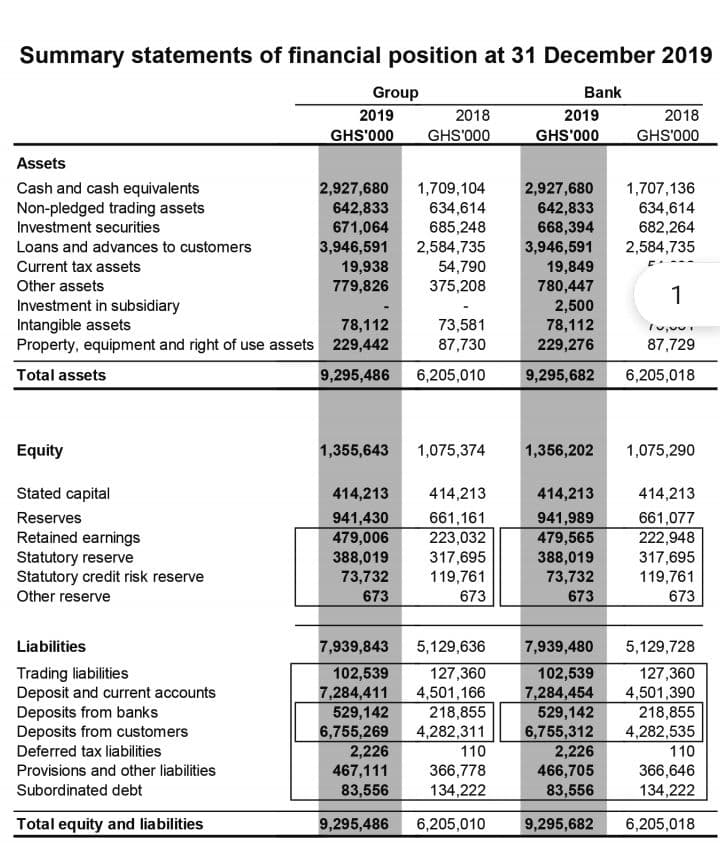

Summary statements of financial position at 31 December 2019 Bank Assets Cash and cash equivalents Non-pledged trading assets Investment securities Loans and advances to customers Current tax assets Other assets Equity Stated capital Reserves Retained earnings Statutory reserve Statutory credit risk reserve Other reserve Group Liabilities Trading liabilities Deposit and current accounts Deposits from banks Deposits from customers Deferred tax liabilities Provisions and other liabilities Subordinated debt Total equity and liabilities 2019 2018 GHS'000 GHS'000 2,927,680 1,709,104 642,833 634,614 671,064 685,248 3,946,591 2,584,735 Investment in subsidiary Intangible assets 78,112 Property, equipment and right of use assets 229,442 Total assets 19,938 779,826 9,295,486 6,205,010 54,790 375,208 1,355,643 1,075,374 941,430 479,006 388,019 73,732 673 73,581 87,730 414,213 414,213 661,161 223,032 317,695 119,761 673 529,142 6,755,269 7,939,843 5,129,636 102,539 127,360 7,284,411 4,501,166 218,855 4,282,311 2,226 467,111 83,556 9,295,486 110 366,778 134,222 6,205,010 2019 GHS'000 2,927,680 642,833 668,394 3,946,591 19,849 780,447 2,500 78,112 70₁501 229,276 87,729 9,295,682 6,205,018 414,213 941,989 479,565 388,019 73,732 673 2018 GHS'000 7,939,480 102,539 7,284,454 529,142 6,755,312 1,707,136 634,614 682,264 2,584,735 1,356,202 1,075,290 2,226 466,705 83,556 9,295,682 1 414,213 661,077 222,948 317,695 119,761 673 5,129,728 127,360 4,501,390 218,855 4,282,535 110 366,646 134,222 6,205,018

Reporting Cash Flows

Reporting of cash flows means a statement of cash flow which is a financial statement. A cash flow statement is prepared by gathering all the data regarding inflows and outflows of a company. The cash flow statement includes cash inflows and outflows from various activities such as operating, financing, and investment. Reporting this statement is important because it is the main financial statement of the company.

Balance Sheet

A balance sheet is an integral part of the set of financial statements of an organization that reports the assets, liabilities, equity (shareholding) capital, other short and long-term debts, along with other related items. A balance sheet is one of the most critical measures of the financial performance and position of the company, and as the name suggests, the statement must balance the assets against the liabilities and equity. The assets are what the company owns, and the liabilities represent what the company owes. Equity represents the amount invested in the business, either by the promoters of the company or by external shareholders. The total assets must match total liabilities plus equity.

Financial Statements

Financial statements are written records of an organization which provide a true and real picture of business activities. It shows the financial position and the operating performance of the company. It is prepared at the end of every financial cycle. It includes three main components that are balance sheet, income statement and cash flow statement.

Owner's Capital

Before we begin to understand what Owner’s capital is and what Equity financing is to an organization, it is important to understand some basic accounting terminologies. A double-entry bookkeeping system Normal account balances are those which are expected to have either a debit balance or a credit balance, depending on the nature of the account. An asset account will have a debit balance as normal balance because an asset is a debit account. Similarly, a liability account will have the normal balance as a credit balance because it is amount owed, representing a credit account. Equity is also said to have a credit balance as its normal balance. However, sometimes the normal balances may be reversed, often due to incorrect journal or posting entries or other accounting/ clerical errors.

What is the amount of total assets?

Step by step

Solved in 2 steps