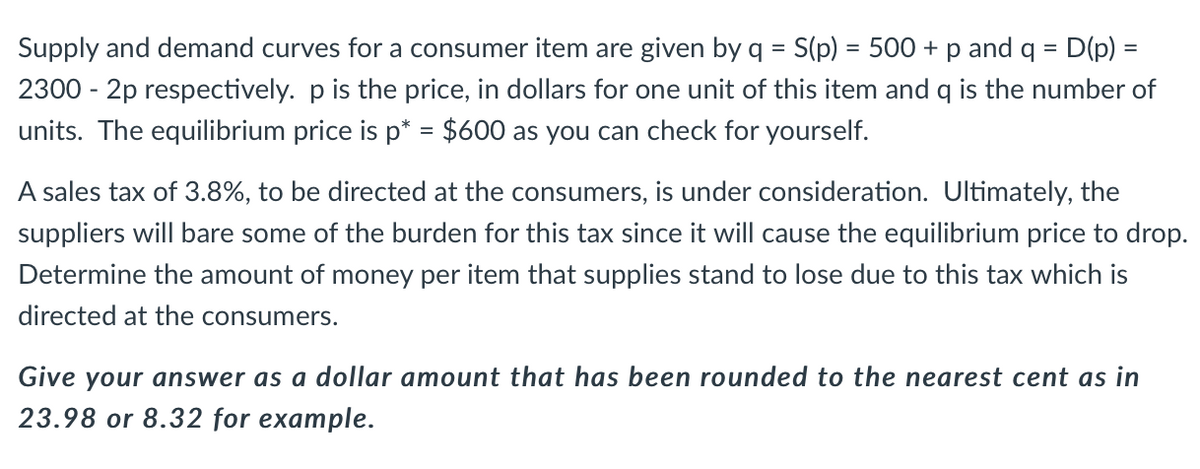

Supply and demand curves for a consumer item are given by q = S(p) = 500 +p and q = D(p) = %3D 2300 - 2p respectively. p is the price, in dollars for one unit of this item and q is the number of units. The equilibrium price is p* = $600 as you can check for yourself. A sales tax of 3.8%, to be directed at the consumers, is under consideration. Ultimately, the suppliers will bare some of the burden for this tax since it will cause the equilibrium price to drop. Determine the amount of money per item that supplies stand to lose due to this tax which is directed at the consumers. Give your answer as a dollar amount that has been rounded to the nearest cent as in 23.98 or 8.32 for example.

Supply and demand curves for a consumer item are given by q = S(p) = 500 +p and q = D(p) = %3D 2300 - 2p respectively. p is the price, in dollars for one unit of this item and q is the number of units. The equilibrium price is p* = $600 as you can check for yourself. A sales tax of 3.8%, to be directed at the consumers, is under consideration. Ultimately, the suppliers will bare some of the burden for this tax since it will cause the equilibrium price to drop. Determine the amount of money per item that supplies stand to lose due to this tax which is directed at the consumers. Give your answer as a dollar amount that has been rounded to the nearest cent as in 23.98 or 8.32 for example.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 9E

Related questions

Question

Transcribed Image Text:Supply and demand curves for a consumer item are given by q = S(p) = 500 + p and q = D(p) =

%3D

2300 - 2p respectively. p is the price, in dollars for one unit of this item and q is the number of

units. The equilibrium price is p* = $600 as you can check for yourself.

A sales tax of 3.8%, to be directed at the consumers, is under consideration. Ultimately, the

suppliers will bare some of the burden for this tax since it will cause the equilibrium price to drop.

Determine the amount of money per item that supplies stand to lose due to this tax which is

directed at the consumers.

Give your answer as a dollar amount that has been rounded to the nearest cent as in

23.98 or 8.32 for example.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning