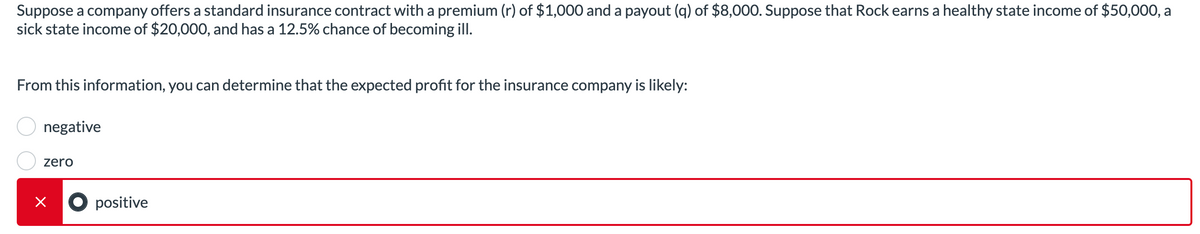

Suppose a company offers a standard insurance contract with a premium (r) of $1,000 and a payout (q) of $8,000. Suppose that Rock earns a healthy state income of $50,000, a sick state income of $20,000, and has a 12.5% chance of becoming ill. From this information, you can determine that the expected profit for the insurance company is likely: negative zero

Q: Which of the following is omitted from GDP calculations? O sales of used goods certain nonmarket…

A: Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and…

Q: From 1970 to 2017, the real price of a college education increased, and total enrollment increased.…

A: The demand is defined as the desire of an individual to buy a product. The individual must have…

Q: Problem 1: A firm has the following production function: f(L, M) = min{L, 3M) where L is the number…

A: Returns to scale is an economic concept that explains how the scale of production or the size of a…

Q: Your student group is setting up an internship fair. You invite companies looking for interns and…

A: The distribution of this subsidy could significantly sway the dynamics of the internship market,…

Q: What is the deadweight loss (DWL) from the monopoly below? P 16 15 14 13 12 11 4321 0 0 0 0 0 50 30…

A: Dead weight loss is defined as the loss of total welfare (or the total surplus = consumer surplus +…

Q: The diagram to the right shows a hypothetical demand curve for apples. The slope of this curve is…

A: The slope of a demand curve represents the relationship between the price of a good or service and…

Q: At a price of $1.20, a local coffee shop is willing to supply 100 cinnamon rolls per day. At a price…

A: Point elasticity of demand measures the elasticity at a point on the demand curve. Mainly it's the…

Q: In the market for off-campus apartments in San Diego, the market supply curve is QS = 300 + 1/8p The…

A: The demand curve is the downward-sloping curve. The supply curve is the upward-sloping curve. The…

Q: Chris receives a portion of his income from his holdings of interest-bearing U.S. government bonds.…

A: The nominal interest rate refers to the interest rate stated on a loan or investment without…

Q: 4. (Nominal GDP) Which of the following is a necessary condition-something that must occur-for…

A: Nominal GDP is the product of current price and output level in a year.

Q: The percentage of an increase in income that is taxed is: O a regressive tax. the marginal tax rate.…

A: The percentage of an increase in income that is taxed is the tax rate that applies to the last…

Q: The market produces too much of a good with O adverse selection negative externalities positive…

A: Efficiency means when allocation of goods is utilized in best way and it means no social welfare…

Q: What happens to a competitive firm whose cost function exhibits decreasing marginal cost everywhere?…

A: A competitive firm in a market is typically characterized as a price taker, meaning it accepts the…

Q: Equation for consumption is C=40/(0.8Y) where Y= yearly income = $400. The marginal propensity to…

A: An individual experiences a rise in their income level, they tend to consume more and the additional…

Q: If the purpose of a tax is to decrease the amount of a harmful activity, then the tax would be most…

A: Supply and demand both are affected by the imposition of tax. The imposition of tax changes the…

Q: Figure 3. The graph depicts the market for fertilizer. Price 500 450- 400 350- 300 250 200- g 150-…

A: There are various products that are sold in high quantity but yield a huge amount of negative…

Q: offee grown in Guatemala is priced at 17 Guatemalan quetzal per pound (Guatemalan quetzal, or GTQ,…

A: The nominal exchange rate—the price of a dollar in the US, for instance—and the ratio of prices in…

Q: According to the short-run Phillips curve, when actual output is unemployment rate rises. above;…

A: Phillips curve refers to a curve that shows an inverse relationship between inflation rate and…

Q: Suppose a closed economy with no government spending or taxing initially. Suppose also that intended…

A: Aggregate demand is the sum of consumption, investment, government spending and net export. This…

Q: Sellers expect the price of houses will be lower in 2024 due to high interest rates. The price of…

A: The supply curve represents the quantity supplied by producers at different price levels. A movement…

Q: Two students, Ryan Wattenberg and Emma Bennett, are discussing the idea of convergence over coffee.…

A: Convergence: Convergence refers to the idea that poorer or less developed countries will, over time,…

Q: 16) A significant difference between monopoly and perfect competition is that A. free entry and exit…

A: Monopoly refers to a a market situation at which there is only single sellers selling a product that…

Q: The graph shows the demand curve for cars in 2017. Suppose that the least-possible cost of producing…

A: Average total Cost (ATC) :- It is the ratio of total cost to the total units produced. Efficiency of…

Q: Which of the following goods would be considered a pure public good? Select one: O O O a. National…

A: A pure public good is characterized by two main features: non-excludability and…

Q: A decrease in both the equilibrium price and the equilibrium quantity of pasta is best explained by…

A: An equilibrium is defined as the balance of market forces such as demand and supply. If the demand…

Q: An apartment building needs a new elevator, which costs $10,000. 10 residents need to decide…

A: A Nash equilibrium is a concept in game theory that represents a situation in which each player in a…

Q: H G O B 50 100 150 200 250 Quantity (units) Look at Figure 4.5.3. If If quantity is 200, deadweight…

A: In economics deadweight loss is associated with the market inefficiency that arises when supply and…

Q: Which of the following statements is correct? A) The demand for Starbucks coffee is more elastic…

A: The elasticity measures the degree of responsiveness of demand to change in its determinants. The…

Q: PQ7.2(a) Case: Average Revenue Demand Curve (AR): P=120 -0.02Q Weekly Production (Q) Price (P)…

A: The demand curve represents the quantity demanded by consumers at different price levels. Total…

Q: 6. Effects of a tariff in a large nation The following graph shows the domestic market for steel in…

A: A tariff is a duty charged on imports of goods. A country imports a large proportion of goods from…

Q: Give an example that would explain scarcity and economic decision making in the context of the…

A: Scarcity refers to the basic economic problem - the gap between limited resources and theoretically…

Q: Assume that the Vietnam places a strict quota on goods imported from Chile and that Chile does not…

A: Market Prices:The prices of products and services in a free market depend on the supply and demand…

Q: -. In microeconomics the two fundamental assumptions that resources are finite, but conomic wants…

A: PPC:Graphical representation of the combination of two goods that can be produced in the economy in…

Q: Using the information displayed on the table below (numbers are in thousands), calculate the…

A: The total number of employed persons is 14,108 thousand.The participation rate is 67% and employment…

Q: An engineer calculated the AW values shown for retaining a presently owned machine additional years.…

A: Economic service life, often referred to as the economic life or service life, is a concept in…

Q: Find the supply curve associated with the marginal cost function shown below Mc 9 8 7 6 5 4 3 2 1 2…

A: In this case, we have to discuss the term marginal cost and supply curve of a firm. The marginal…

Q: A cloth manufacturing firm is deciding whether or not to invest in new machinery. The machinery…

A: The present value of a cash flow refers to the current value of expected inflows and outflows of…

Q: What may be a consequence of laws on labor unions and employment in Western Europe that make it…

A: The management team and the human resources team are in charge of terminating employees. The last…

Q: Short-run monetary policy changes should Multiple Choice Oignore any fiscal policy change that a…

A: Monetary Policy:Monetary policy refers to the set of actions, decisions, and measures taken by a…

Q: If a good is an "inferior good", then people feel inferior when they buy it people buy less of this…

A: Inferior goods refer to those goods which demand decreases due to rise in individual income and…

Q: What does it mean when recyclers gather containers until their marginal costs are equal to the…

A: Marginal cost-benefit analysis examines the additional benefits of an activity with respect to the…

Q: Inflation: O cannot occur when prices are decreasing. O is an increase in the price of a good or…

A: Inflation refers to persistent rise in prices of general goods and services over a period of…

Q: Question 6 This figure reflects the market for outdoor concerts in a public park surrounded by…

A: The externality is defined as the cost or benefit that is unrelated to the third party involved. It…

Q: Tuition has risen every year since 1980 and at the same time enrollment has steadily increased.…

A: The demand curve is the downward-sloping curve. The supply curve is the upward-sloping curve. The…

Q: Suppose the inverse market demand is given by P-500-5Q. If the incumbent continues to produce 25…

A: A residual demand curve is present for each individual firm. This is the market need that other…

Q: True or False? A tax of $1 on buyers always decreases the equilibrium price by $1.

A: The only price at which consumer and producer desires coincide is equilibrium, or when the quantity…

Q: what is the relationship between the financial well-being of the industry and availability of…

A: Healthcare is a wide term that envelops a scope of services and practices pointed toward keeping up…

Q: A risk-neutral monopoly must set output before it knows the market price. There is a 50 percent…

A: In a monopoly market there will only one seller of a good or service. The monopolist is a price…

Q: 7. An externality occurs when the benefits or costs of an economic activity are external and not…

A: The externality is defined as the cost or benefit that is unrelated to the third party involved. It…

Q: here p is the price (in dollars) of a chair. (a) According to the model, at what price will…

A: Demand schedule represents negative relationship between the price and the quantity demand. It…

Step by step

Solved in 3 steps with 1 images

- Suppose the equilibrium price for good quality used cars is $20,000. And the equilibrium price for poor quality used cars is $10,000. Assume a potential used car buyer has imperfect information as to the condition of any given used car. Assume this potential buyer believes the probability a given used car is good quality is .60 and the probability a given used car is low quality is .40. Assume the seller has perfect information on all cars in inventory. If the seller sells the buyer a poor quality car, what is the net-benefit to the seller? a. A net gain of $6,000. b. A net loss of $20,000. c. A net loss of $6,000. d. A net gain of $10,000.Priyanka has an income of £90,000 and is a von Neumann-Morgenstern expected utility maximiser with von Neumann-Morgenstern utility index . There is a 1 % probability that there is flooding damage at her house. The repair of the damage would cost £80,000 which would reduce the income to £10,000. Priyanka has an income of £90,000 and is a von Neumann-Morgenstern expected utility maximiser with von Neumann-Morgenstern utility index . There is a 1 % probability that there is flooding damage at her house. The repair of the damage would cost £80,000 which would reduce the income to £10,000. What would be the highest price (premium) that she would be willing to pay for an insurance policy that fully insures her against the flooding damage?Dr. Gambles has a utility function given as U(w)=In(w). Due to the pandemic affecting his consulting business, Dr Gambles faces the prospect of having his wealth reduced to £2 or £75,000 or £100,000 with probabilities of 0.15, 0.25, and 0.60, respectively. Suppose insurance is available that will protect his wealth from this risk. How much would he be willing to pay for such insurance?

- John wants to buy a used car. He knows that there are two types of car in the market, plums and lemons. Lemons are worse quality cars and are more likely to break down than plums. John is willing to pay £10, 000 for a plum and £2, 000 for a lemon. Unfortunately, however, he cannot distinguish between the two types. Sellers can offer a warranty that would cover the full cost of any repair needed by the car for y ∗ years. Considering the type and likelihood of problems their cars can have, owners of plums estimate that y years of guarantee would cost them 1000y, owners of lemons estimate that the cost would be 2000y. John knows these estimates and decides to offer £10, 000 if a car comes with y ∗ years of warranty, £2, 000 if a car comes without warranty. For which values of y ∗ is there a separating equilibrium where only owners of plums are willing to offer the y ∗ -years warranty? Clearly explain your reasoning.You need to hire some new employees to staff your startup venture. You know that potential employees are distributed throughout the population as follows, but you can't distinguish among them: Employee Value Probability $65,000 0.1 $78,000 0.1 $91,000 0.1 $104,000 0.1 $117,000 0.1 $130,000 0.1 $143,000 0.1 $156,000 0.1 $169,000 0.1 $182,000 0.1 The expected value of hiring one employee is. Suppose you set the salary of the position equal to the expected value of an employee. Assume that employees will not work for a salary below their employee value. The expected value of an employee who would apply for the position, at this salary, is. Given this adverse selection, your most reasonable salary offer (that ensures you do not lose money) is (A. 65,000, B. 91,000, C. 78,000, D. 104,000)You need to hire some new employees to staff your startup venture. You know that potential employees are distributed throughout the population as follows, but you can't distinguish among them: Employee Value Probability $65,000 0.25 $82,000 0.25 $99,000 0.25 $116,000 0.25 The expected value of hiring one employee is . Suppose you set the salary of the position equal to the expected value of an employee. Assume that employees will not work for a salary below their employee value. The expected value of an employee who would apply for the position, at this salary, is . Given this adverse selection, your most reasonable salary offer (that ensures you do not lose money) is .

- Solve the following problem using an excel spreadsheet. A tobacco company isinterested in hiring a salesperson to promote smoking cigarettes in nightclubs. The position pays a flat salary of $50,000, regardless of sales levels. The firm has two applicants, Predictable Patty and Risky Ricky. Predictable Patty can produce with 100% certainty $100,000 a year in sales. Risky Ricky, on the other hand, can produce $300,000 with probability of 50%. But if he turns out to spend his time drinking and dancing in the nightclubs instead of making sales, he could actually cost the firm -$100,000 per year.a) During their first year on the job, what are the expected sales of Patty and Ricky? What are the firm’s expected profits on each worker?b) Now assume both workers are currently 25, and they will work until the retirement age of 65. The firm has the option to fire its new employee after one year based on sales, but can only hire one employee. Assume that it takes only one year to discover whether…Tess and Lex earn $40,000 per year and all earnings are spent on consumption (c). Tess and Lex both have the utility function c. Both could experience an adverse event that results in earnings of $0 per year. Tess has a 1% chance of experiencing an adverse event and Lex has a 12% chance of experiencing an adverse event. Tess and Lex are both aware of their risk of an adverse event. 1. Suppose the actuarially fair premium charge is 2600, Calculate Tess’ expected utility with full insurance if she is charged the premium. Round to two decimal places. 2. What is the premium that private insurance companies will charge for full insurance? Round to two decimal places. 3.Assume the social welfare function is the sum of the Tess’ and Lex’s utility functions. Select the correct statement regarding the explanation for what has happened in the private market and the role of social insurance. a.Adverse section has lead to market failure. The government could improve social welfare by…Leo owns one share of Anteras, a semiconductor chip company which may have to recall millions of chips. The stock currently trades at $100/share. Leo believes the probability that they have to recall the chips is 50%. If the chips have to be recalled, the stock price will be cut in half, but otherwise it will remain $100. The expected value of Leo's share is ______ Assume Leo has the utility function, U(X)=√X. The minimum price Leo would accept to sell his share is _______ Leo's risk premium is ________

- Priyanka has an income of £90,000 and is a von Neumann-Morgenstern expected utility maximiser with von Neumann-Morgenstern utility index u(x) = square root x . There is a 1 % probability that there is flooding damage at her house. The repair of the damage would cost £80,000 which would reduce the income to £10,000. a) Would Priyanka be willing to spend £500 to purchase an insurance policy that would fully insure her against this loss? ExplainSuppose that the probability of breaking a collar bone is p = .05 and the cost of breaking a collar bone is $1,000. What is the actuarially fair price for insurance against breaking your collarbone?A consumer has the following utility function u(x)= root x where x is the consumer’s total wealth. The consumer's total wealth is the consumer’s cash plus the value of her house. The consumer has $400 in cash (risk free) plus a house. The house is currently worth $756. With probability 70% nothing happens, and the value of the house stays the same. With probability 30%, high winds will cause $580 in damages to the house (in which case, the house value becomes $176). An insurance company offers to fully insure the house at an insurance premium p. What is the maximum insurance premium that the consumer is willing to pay? The consumer is willing to pay at most p=. The fair insurance premium is . In this example, the associated risk premium is .