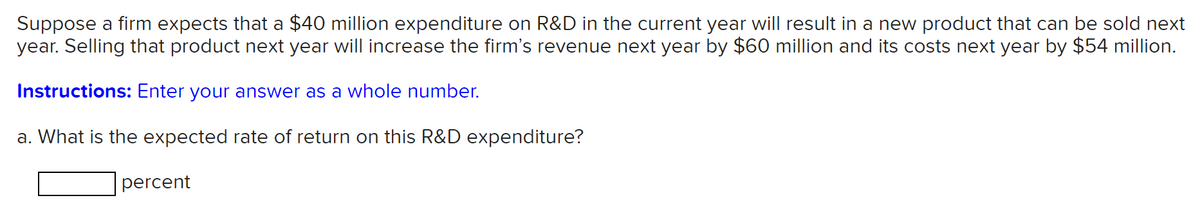

Suppose a firm expects that a $40 million expenditure on R&D in the current year will result in a new product that can be sold next year. Selling that product next year will increase the firm's revenue next year by $60 million and its costs next year by $54 million. Instructions: Enter your answer as a whole number. a. What is the expected rate of return on this R&D expenditure? percent

Suppose a firm expects that a $40 million expenditure on R&D in the current year will result in a new product that can be sold next year. Selling that product next year will increase the firm's revenue next year by $60 million and its costs next year by $54 million. Instructions: Enter your answer as a whole number. a. What is the expected rate of return on this R&D expenditure? percent

Chapter17: Capital And Time

Section: Chapter Questions

Problem 17.2P

Related questions

Question

Transcribed Image Text:Suppose a firm expects that a $40 million expenditure on R&D in the current year will result in a new product that can be sold next

year. Selling that product next year will increase the firm's revenue next year by $60 million and its costs next year by $54 million.

Instructions: Enter your answer as a whole number.

a. What is the expected rate of return on this R&D expenditure?

percent

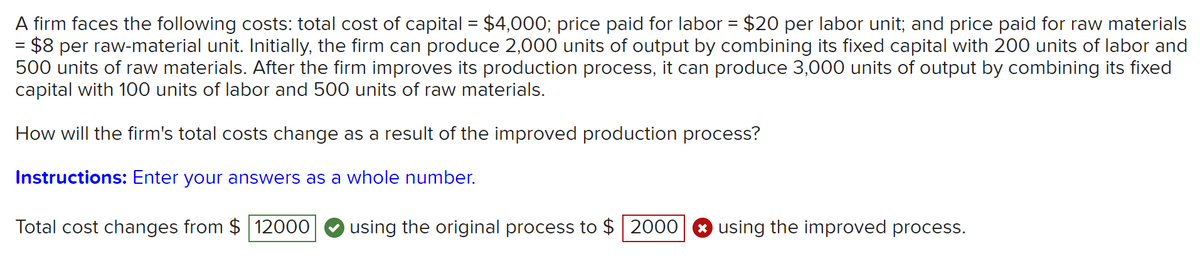

Transcribed Image Text:A firm faces the following costs: total cost of capital = $4,000; price paid for labor = $20 per labor unit; and price paid for raw materials

$8 per raw-material unit. Initially, the firm can produce 2,000 units of output by combining its fixed capital with 200 units of labor and

500 units of raw materials. After the firm improves its production process, it can produce 3,000 units of output by combining its fixed

capital with 100 units of labor and 500 units of raw materials.

%D

How will the firm's total costs change as a result of the improved production process?

Instructions: Enter your answers as a whole number.

Total cost changes from $ 12000

using the original process to $ 2000

O using the improved process.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Suppose the firm can get a bank loan at 16% interest to finance is 40 million are in the project will the firundertake the project

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning