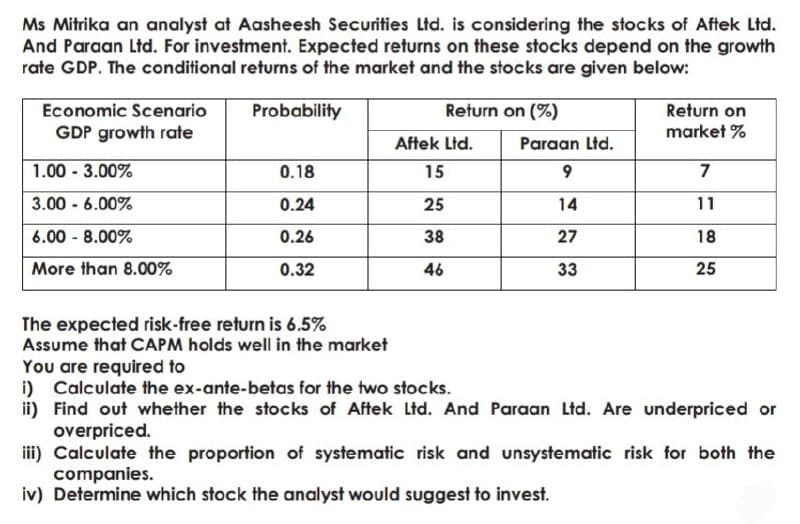

Ms Mitrika an analyst at Aasheesh Securities Ltd. is considering the stocks of Aftek Ltd. And Paraan Ltd. For investment. Expected returns on these stocks depend on the growth rate GDP. The conditional returns of the market and the stocks are given below: Economic Scenario Probability Return on (%) Return on GDP growth rate market % Aftek Ltd. Paraan Ltd. 1.00 - 3.00% 0.18 15 9 3.00 - 6.00% 0.24 25 14 11 6.00 - 8.00% 0.26 38 27 18 More than 8.00% 0.32 46 33 25 The expected risk-free return is 6.5% Assume that CAPM holds well in the market You are required to i) Calculate the ex-ante-betas for the two stocks. ii) Find out whether the stocks of Aftek Ltd. And Paraan Ltd. Are underpriced or overpriced. iii) Calculate the proportion of systematic risk and unsystematic risk for both the companies. iv) Determine which stock the analyst would suggest to invest.

Ms Mitrika an analyst at Aasheesh Securities Ltd. is considering the stocks of Aftek Ltd. And Paraan Ltd. For investment. Expected returns on these stocks depend on the growth rate GDP. The conditional returns of the market and the stocks are given below: Economic Scenario Probability Return on (%) Return on GDP growth rate market % Aftek Ltd. Paraan Ltd. 1.00 - 3.00% 0.18 15 9 3.00 - 6.00% 0.24 25 14 11 6.00 - 8.00% 0.26 38 27 18 More than 8.00% 0.32 46 33 25 The expected risk-free return is 6.5% Assume that CAPM holds well in the market You are required to i) Calculate the ex-ante-betas for the two stocks. ii) Find out whether the stocks of Aftek Ltd. And Paraan Ltd. Are underpriced or overpriced. iii) Calculate the proportion of systematic risk and unsystematic risk for both the companies. iv) Determine which stock the analyst would suggest to invest.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter5: Business And Economic Forecasting

Section: Chapter Questions

Problem 8E: Bell Greenhouses has estimated its monthly demand for potting soil to be the following: N=400+4X...

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:Ms Mitrika an analyst at Aasheesh Securities Ltd. is considering the stocks of Aftek Ltd.

And Paraan Ltd. For investment. Expected returns on these stocks depend on the growth

rate GDP. The conditional returns of the market and the stocks are given below:

Economic Scenario

GDP growth rate

Probability

Return on (%)

Return on

market %

Aftek Ltd.

Paraan Ltd.

1.00 - 3.00%

0.18

15

7

3.00 - 6.00%

0.24

25

14

11

6.00 - 8.00%

0.26

38

27

18

More than 8.00%

0.32

46

33

25

The expected risk-free return is 6.5%

Assume that CAPM holds well in the market

You are required to

i) Calculate the ex-ante-betas for the two stocks.

ii) Find out whether the stocks of Aftek Ltd. And Paraan Ltd. Are underpriced or

overpriced.

iii) Calculate the proportion of systematic risk and unsystematic risk for both the

companies.

iv) Determine which stock the analyst would suggest to invest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax