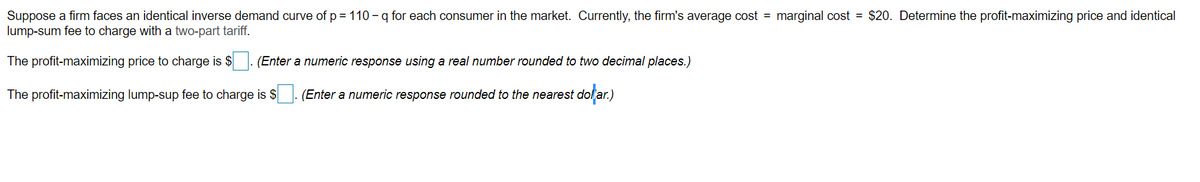

Suppose a firm faces an identical inverse demand curve of p = 110- q for each consumer in the market. Currently, the firm's average cost = marginal cost = $20. Determine the profit-maximizing price and identical lump-sum fee to charge with a two-part tariff. The profit-maximizing price to charge is $. (Enter a numeric response using a real number rounded to two decimal places.) The profit-maximizing lump-sup fee to charge is $. (Enter a numeric response rounded to the nearest dol ar.)

Q: Let P(g) = { 34 +1, 0 2, be the demand function for a manufacturer's product, where q is the number…

A: In the production process, the conditions and fluctuations that happen between demand and also the…

Q: Which of the following if true would make it harder for a firm to practice price discrimination?…

A: Three factors that has got to be met for price discrimination to occur: the firm must have market…

Q: Suppose you are the manager of a theatre company. You have identified two groups of customers. Group…

A: Option 4 is correct answer

Q: You are the manager of a firm that charges customers $16 per unit for the first unit purchased, and…

A: Given, First purchase price- $16 Additional Purchase price- $12

Q: Hershey Park sells tickets at the gate and at local municipal offices to two groups of people.…

A: The demand function shows the relationship between the quantity demanded for a commodity and its…

Q: Suppose the total monthly demand for golf services is Q = 20 − P. The marginal cost to the firm of…

A: The demand function is given as Q=20-P and the MC (marginal cost) is $1. By equating MC=P; Thus, in…

Q: Consider a single country and a single good. The demand curve for this good is given by QD = 144 -…

A: We know that the consumer surplus is the difference between the actual pay for a particular product…

Q: Suppose you can separate consumers into two groups: Group 1 has a price elasticity of demand = -3…

A: Price elasticity of demand refers to the ratio between the percentage change in quantity demanded to…

Q: There is only one firm that produces NICE sneakers, and its product has no substitutes.…

A: A demand curve is a curve that shows the relation between the quantity demanded and price. A demand…

Q: Joe has just moved to a small town with only one golf course, the Northlands Golf Club. His inverse…

A: The practice of charging different prices for the same good or service from different customers is…

Q: Dunder Mifflin sells specialty paper to commercial clients in the Scranton area. Some of Dunder…

A: A monopoly is a single seller in the market which sets the price of its good and thus, is a price…

Q: For a price searcher utilizing a simple (uniform) pricing scheme, which statement best expresses the…

A: Marginal cost is the additional cost incurred in order to produce an additional unit of output.

Q: [Suppose] A Cmpany is the sole provider of electricity in the various districts of Dubai. To meet…

A: Given P = 1,200 − 4Q, C1(Q1) = 8,000 + 6Q1 C2(Q2) = 6,000 + 3Q2 + 5Q22

Q: Identify and describe at least 2 direct price discrimination and 2 indirect price discrimination…

A: Meaning of Price Discrimination: The term price discrimination refers to the situation under which…

Q: price discrimination advantages ? 2. overall opinion

A: 1) Some of the major advantages of price discrimination is that They help reduce the income…

Q: Assume a firm faces two customers in the market. Customer 1 has an inverse demand of p= 120 - 91.…

A: Given; Customer 1 has a inverse demand function; p=120-q1 or q1=120-p Customer21 has a inverse…

Q: Which of these statements is most CORRECT about real world pricing strategies? Select one: a. Two…

A: Pricing strategies are important to decide on the revenue of the firm. Strategies are important as…

Q: A coffee addict’s demand function for coffee may be very inelastic, but the market demand function…

A: 1. An addicts demand function for a drug may be very inelastic because it is broadly defined in the…

Q: Suppose] A Cmpany is the sole provider of electricity in the various districts of Dubai. To meet the…

A: 1.P=1200-4Q Q=Q1+Q2 P=1200-4(Q1+Q2) For firm1: Total Revenue:PQ1 TR1=1200Q1-4Q1^2-4Q1Q2…

Q: For each of the following scenarios, begin by assuming that all demand factors are set to their…

A: The law of supply and demand is a theory that explains how suppliers and customers interact.…

Q: As discussed in class, when a single firm sells two complementary goods, they should lower their…

A: Substitute goods are two items that may be swapped for one another, such as tea and coffee. When the…

Q: Q48' Assume that Cresco Labs is a monopolist that can sell 15 ounces of marijuana per day at $12.50…

A:

Q: Price discrimination is the practice of selling the same good at more than one price when the price…

A: Price discrimination is based on three factors: 1-Charging consumer maximum willingness to pay…

Q: If your marketing department estimates that the semiannual demand for the highlander is q=150,000. -…

A: To maximize revenue, one must charge the price that can make it's demand unit elastic.Thus, applying…

Q: As economic consultant to the dominant firm in a particular market, you have discovered that, at the…

A: In a market, firms generally hire economic consultant to analyze the market that helps them to make…

Q: To join the Quiet Reading Society, members pay a fixed annual fee of F, and then they can read any…

A: Price discrimination refers to when a firm with market power charges different firms differently to…

Q: If the demand function of a product is p - 0.5x + 90 where p denotes unit pric and x shows quantity,…

A: Demand function: p = -0.5x +90 Total revenue = Price* Quantity Here, Price = p and Quantity = x So…

Q: Suppose] A Cmpany is the sole provider of electricity in the various districts of Dubai. To meet the…

A: Profit for facility 1 = MR1 = MC1 MR1 = d(TR)/dQ1 TR1 = (1200 -4(Q1+Q2))Q1 TR1 = 1200Q1 - 4Q12 -…

Q: 1. A firm has the possibility of charging different prices in its domestic and foreign markets. The…

A:

Q: Each consumer has the following demand for annual visits to Planet Fitness: Q = 200 - P (or P = 200…

A: *Answer: Step 1 Given:Q=200−P MC=$10 In optimal two−part tariff, P=MC P=$200 Now, Q = 200−P…

Q: The information in the table below shows the total demand for premium-channel digital cable TV…

A: The ideal conclusion of a game occurs where there is no incentive to depart from the beginning…

Q: A large firm has two divisions: an upstream division that is a monopoly supplier of an input whose…

A: Monopoly Market:A monopoly market is a market where a single firm enjoys the whole market share and…

Q: Suppose the inverse demand for a particular good is given by P = 1200 – 12Q. Furthermore, th are…

A: Stackelberg duopoly model is the competition between two firm such that one of them is a…

Q: You've estimated the market demand curve for the spice market as P=184 - 2Q. What is elasticity of…

A: Elasticity of demand depicts how much consumer responds with the change in the price level.

Q: Suppose Joe and Sarah each have a patent on their respective product: no other supplier can provide…

A: Given, Consumer Demand of Joe and Sarah :Qjoe=300-15Pjoe+10PsarahQsarah=300-15Psarah+10PjoeCosts…

Q: Consider a single country and a single good. The demand curve for this good is given by QD = 144 -…

A: Hi! Thank you for the question, as per the honor code, we are allowed to answer three sub-parts at a…

Q: The second largest public utility in the nation is the sole provider of electricity in 32 counties…

A: Inverse demand function, P=1200-4QTC of firm 1, C1(Q1)=8000+6Q12TC of firm 2, C2(Q2)=6000+3Q22

Q: Consider a single country and a single good. The demand curve for this good is given by QD = 144 -…

A: A monopolist is a firm that sells a heterogeneous product in the market. He sells the less quantity…

Q: Suppose the monthly demand for golf services at a golf club is given by the inverse demand function,…

A: Given: The inverse demand function is P = 20 - Q The marginal cost is = €2 The fixed cost is = €500…

Q: The average consumer at a firm with market power has an inverse demand function of P 10 - Q. The…

A: A firm engages in two-part pricing charges two prices, i.e., per unit price and fixed fee. Per…

Q: Suppose] A Cmpany is the sole provider of electricity in the various districts of Dubai. To meet the…

A: We are going to find the revenue function, marginal revenue function to answer this question. .

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- Bluth’s Bananas is considering expanding its retail operations for its one-of-a-kind frozen banana stands on Jones Beach, which is 10 kilometers long. Bluth’s Bananas estimates that the typical day has 2,000 visitors to the beach, spread uniformly, and that each will demand a single frozen banana provided the price plus any disutility of traveling to a stand does not exceed $6. To visit a stand a beach goer incurs a disutility of $0.50 for each 1/4 kilometer they have to walk to reach a stand. Each Bluth Banana costs $0.75 to make and each stand requires an operating fee to be paid to the city of $50 per day. Determine the equilibrium number of stands Bluth’s Bananas should operate on the beach given it is not in competition with any other firm. Determine the profit maximizing price for the bananas and calculate the profit realized by BB in equilibrium.You are a pricing analyst for QuantCrunch Corporation, a company that sells a statistical software package. To date, you only have one client. A recent internal study reveals that this client’s inverse demand for your software is P=1500-5Q and that it would cost you $1,000 per unit to install and maintain software at this client’s site. What is the profit that results from two-part pricing? (Hint: set the per-unit price for each unit of the software installed and maintained equal to marginal cost; and charge a fixed “licensing fee” that extracts all consumer surplus from the client)Each year a new group of high school seniors chooses where they want to attend college. The college faces two identifiably different categories of customers, in-state and out-of-state students. The (inverse) demand equation for in-state students is given by PI=$9000- QI, while demand by out-of-state students is given by PO= $21,000 -9QO. P represents the annual tuition charged by the college and Q represents the number of students who enter as freshmen. The marginal cost of educating an additional student is constant and equal to $3000. Suppose that the Board of Trustees wants to act as a profit-maximizing monopolist in setting price and output. What tuition should they charge for in-state and out-of-state students, and how many of each would enroll each year?

- Consider a single country and a single good. The demand curve for this good is given by QD = 144 - 4P. Thereare two firms serving the market: Firm A and Firm B, where Firm A has a marginal cost of $20 and Firm B hasa marginal cost of $16. There are no fixed costs incurred by either firm. Assume that these firms compete in Bertrand fashion. Part I. What is the equilibrium price in the market? Explain your reasoning. Part II. How many units of output each firm produces? Show your work. Part III. How much profit each firm makes? Show your work. Part IV. What is the consumer surplus? Show your work.The information in the table below shows the total demand for premium-channel digital cable TV subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per year) to provide premium digital channels in the market area and that the marginal cost of providing the premium channel service to a household is zero. 1. Assume there are two profit-maximizing digital cable TV companies operating in this market. Further assume that they are not able to collude on the price and quantity of premium digital channel subscriptions to sell, how many premium digital channel cable TV subscriptions will be sold altogether and what price will be charged when this market reaches a Nash equilibrium? 2. Under the conditions given in Question #3 of this problem, how much profit will each firm earn when this market reaches a Nash equilibrium? 3. What is the socially efficient level of digital premium channel subscriptions for this market and at what…You are the manager of a golf course. For simplicity assume that you only have two potential customers – a high demand customer whose inverse demand for golf services is given by P = 10 – 0.5Q and a low demand customer whose inverse demand for golf services is given by P = 8 – 0.5Q. Suppose the marginal cost to the golf course of each round of golf is zero.Suppose you have to charge both players the same two-part pricing strategy. Which of the following pricing strategies will yield the highest profit for you? A. Charge a fixed fee of €100 and a per unit fee of zero B. Charge a fixed fee of €64 and a per unit fee of zero C. Charge a fixed fee of €64 and a per unit fee of €4 D. Charge a fixed fee of €128 and a fixed fee of zero.

- A manager of a nightclub realizes that demand for drinks is more elastic among students and is trying to determine the optimal pricing schedule. Specifically, he estimates the following average demand for his customer types: Under 25: qr =18-5p Over 25: q=10-2p The two age groups visit the nightclub in equal numbers on average. Assume that drinks cost the club $2 to make. If the manager can charge a separate entry fee and a price per drink for each group, what two-part price will the manager set for reach group. Now suppose that once again it is impossible to identify which group the customers belong. Suppose the manager lowers the price of drinks to equal to marginal cost and still wanted to attract both customers, what entry fee would the manager set? Compare the profits earned in parts a) to d). Which scheme would you choose if you could not identify customer type and which would you choose if you could identify customer type.You are the manager of a firm that charges customers $16 per unit for the first unit purchased, and $12 per unit for each additional unit purchased in excess of one unit. The accompanying graph summarizes your relevant demand and costs. a. What is the economic term for your firm’s pricing strategy? multiple choice Third degree price discrimination Fourth degree price discrimination First degree price discrimination Second degree price discrimination b. Determine the profits you earn from this strategy. $ c. How much additional profit would you earn if you were able to perfectly price discriminate?Instructions: In solving this problem, assume the firm cannot sell fractions of a unit. $There are two types of consumers in Melbourne: students and non-students. The student population is 10, and each student’s demand of printing paper is Q=1−P, for P<1.The non-student population is 40, and each non-student’s demand of printing paper is Q=3−P, for P<3. Suppose OfficeMax is the only seller of printing paper in Melbourne. Assume zero production cost. Suppose OfficeMax cannot offer student discounts, and every customer has to pay the same price P. Derive the aggregate demand curve (for both students and non-students), and illustrate it in a diagram.

- According to International Data Corporation (IDC), the number of worldwide smartphone owners will soon exceed 1.5 billion. That number is expected to grow at nearly 10 percent per year for the next five years. While the actual cost of a smartphone is about $300, wireless carriers in some countries offer their customers a “free” smartphone with a two-year wireless service agreement. Is this pricing strategy rational? ExplainYou are a medical group manager. Some market research has suggested that the price elasticity of demand for the services of your physicians is −4.1. The marginal cost for the average unit of physician service in your group is approximately $536. A. Using the economic pricing model formula, calculate your profit-maximizing price for each unit of physician services. B. Suppose that your medical group is considering new contracts with two particular businesses to provide physician services to their employees. If the marginal cost for each service unit is the same as with the rest of your customers, but the price elasticity of demand from the first new business customers is −0.9, and the second group of business customers is −4.4, how would that change your profit-maximizing price for each of the new groups? Would you recommend that your medical group obtain contracts with both new groups, just one of them or none? Explain your reasoning. C. In order to maximize your profits, what specific…You are an executive for Super Computer, Inc. (SC), which rents out super computers. SC receives a fixed rental payment per time period in exchange for the right to unlimited computing at a rate of P cents per second. SC has two types of potential customers of equal number—10 businesses and 10 academic institutions. Each business customer has the demand function: Q=14−P, where Q is in millions of seconds per month; each academic institution has the demand: Q=10−P. The marginal cost to SC of additional computing is 2 cents per second, regardless of volume. a. Suppose that you could separate business and academic customers. What rental fee and usage fee would you charge each group? What would be your profits? (Round all answers to the nearest integer) For business users, the rental fee would be$720,000per month and the usage fee is 2 cents per second. For academic institutions, the rental fee would be $320,000 per month and the usage fee is 2 cents per second.…