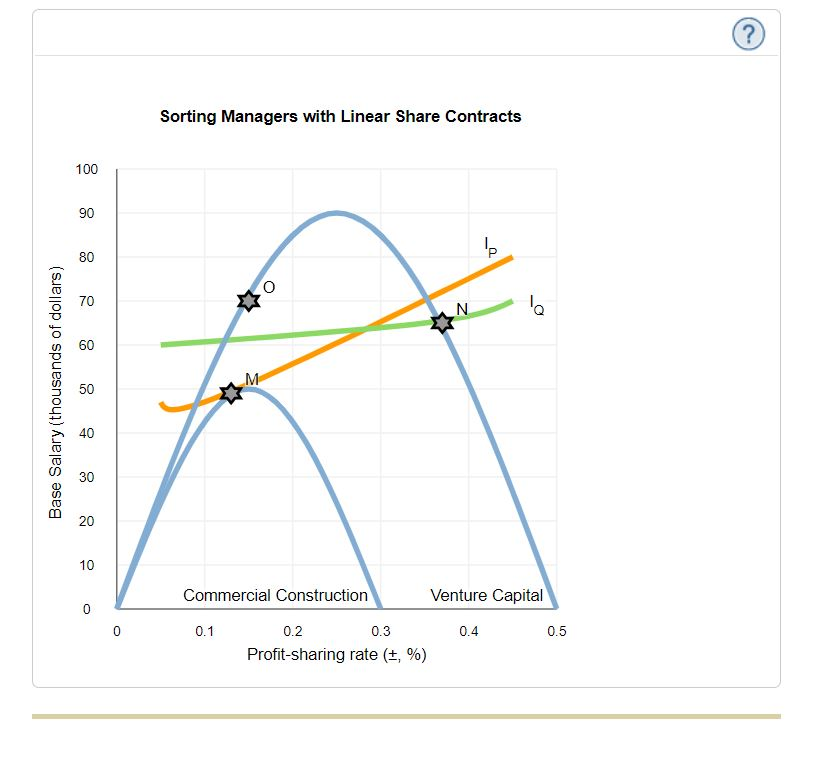

Suppose a large bank has two openings for which it desires managers of different risk aversion. One position is the assistant vice president for commercial construction loans, for which the bank seeks a more risk averse manager. The other position is an assistant vice president to manage the venture capital loan portfolio, for which the bank seeks a manager who is more willing to take risks. The vertical scale of the following graph displays the guaranteed base salary, and the horizontal scale displays the profit-sharing rate—a percentage that represents what additions to or subtractions from one’s pay occur as a result of the profit-sharing agreement. The two hill-shaped curves represent expected profit-sharing payouts that would allow the firm to just break even on its incentive payments to the two managers. The graph also shows the indifference curves (IP and IQ) for two applicants. Which is the indifference curve of the more risk-neutral applicant? A. IQ B. IP Suppose the bank offers its applicants a choice between two contracts, M and O. The more risk-averse applicant would choose _______ (Contract M or Contract O) and the more risk-neutral applicant would choose _________ (Contract M or Contract O). Suppose the bank withdraws Contract O and asks its applicants to choose between contracts M and N instead. The more risk-averse applicant would choose _________ (Contract M or Contract N) and the more risk-neutral applicant would choose _______________ (Contract M or Contract N).

Suppose a large bank has two openings for which it desires managers of different risk aversion. One position is the assistant vice president for commercial construction loans, for which the bank seeks a more risk averse manager. The other position is an assistant vice president to manage the venture capital loan portfolio, for which the bank seeks a manager who is more willing to take risks.

The vertical scale of the following graph displays the guaranteed base salary, and the horizontal scale displays the profit-sharing rate—a percentage that represents what additions to or subtractions from one’s pay occur as a result of the profit-sharing agreement. The two hill-shaped curves represent expected profit-sharing payouts that would allow the firm to just break even on its incentive payments to the two managers.

The graph also shows the indifference curves (IP and IQ) for two applicants.

Which is the indifference curve of the more risk-neutral applicant?

A. IQ

B. IP

Suppose the bank offers its applicants a choice between two contracts, M and O. The more risk-averse applicant would choose _______ (Contract M or Contract O) and the more risk-neutral applicant would choose _________ (Contract M or Contract O).

Suppose the bank withdraws Contract O and asks its applicants to choose between contracts M and N instead. The more risk-averse applicant would choose _________ (Contract M or Contract N) and the more risk-neutral applicant would choose _______________ (Contract M or Contract N).

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images