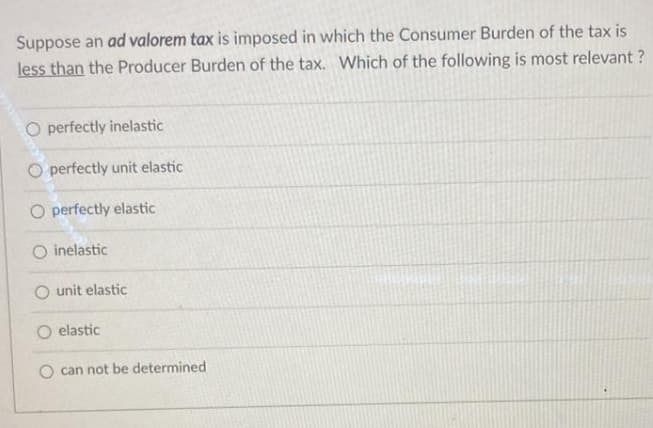

Suppose an ad valorem tax is imposed in which the Consumer Burden of the tax is less than the Producer Burden of the tax. Which of the following is most relevant O perfectly inelastic O perfectly unit elastic O perfectly elastic inelastic O unit elastic O elastic can not be determined

Q: d. Holding Donald's income and Pd constant at $120 and $1 respectively, what is Donald's demand…

A: Part d ) We have been given the budget line as : 120=Pc×Qc+Pd×Qd 120=Pc×Qc+1×Qd ( equation 1)…

Q: (Pairs of jeans) (Dollars per pair) (Dollars per pair) Before Tax After Tax Using the data you…

A:

Q: Time left U:36:11 When the price elasticity of demand is low and the price elasticity of supply is…

A: Share of burden of tax depends on relative elasticities of demand and supply. Higher the elasticity,…

Q: Suppose that in Australia the price elasticity of steel demand of -1.5 and the price elasticity of…

A: "Price elasticity of demand measures the responsiveness of quantity demanded of a commodity with…

Q: Eggs have a supply curve that is linear and upwardslopingand a demand curve that is linear…

A: Supply and demand is an economic model of value determination in a very market in economic science.…

Q: order to reduce sales volume. This strategy may successfully increase sales revenue if the luxury…

A: Macroeconomics is important for a country and equally microeconomics is also important. Aggregate…

Q: Consider the competitive market for with the usual assumptions. Demand is downward sloping and…

A: Elasticity of demand and supply curve depicts how much consumer and producer responds with the…

Q: Let demand and supply be given by, Qa = 100 - 1P, Qs = -50+6P. A tax of $10 is levied on the good.…

A:

Q: he demand and supply functions for product M are P = 83.6 - 0.037 Q P = 15.7 + 0.056 Q. A P10 tax…

A: Demand refers to the consumer's willingness to buy products and services at given prices within a…

Q: The price elasticity of demand for lychee fruit is 1.3, while the price elasticity of supply is 0.7.…

A: Here, price elasticity of demand is given as 1.3 and price elasticity of supply is given as 0.7.…

Q: Assuming that the price of a pack of cigarettes is $5 before the tax and if the actual price…

A: Price elasticity of demand is defined as the measure of change in the quantity bought of a commodity…

Q: 32. Suppose the frice elasticity of demand for commodity M is less than one. When a tax is imposed…

A: When the price elasticity of demand is less than one, then the demand for the good is inelastic.

Q: Calculate the percentage of the tax borne by the demander and supplier in each of the following…

A: The fraction of tax borne by the demanded = ES/(ED+ES) Similarly, for supplier = ED/(ED+ES) A) ED =…

Q: In the state of Santa Lucia cigarettes were selling for $8.03 per pack before a $0.25 per pack…

A: Price elasticity of demand refers to the percentage change in quantity due to a percentage change in…

Q: Suppose the current price of gasoline is $1.50/L. If a government places a $0.25/L tax on gasoline,…

A: The degree of sensitivity of demand for a commodity to changes in its price is referred to as price…

Q: The demand function for beer is given below, where p is the retail price and D(p) is the demand in…

A: The elasticity of demand (Ed) is an economics term that represents the responsiveness (sensitivity)…

Q: Find the consumer and producer tax burden. e) Calculate the tax revenue that the government…

A: The tax Shifts the supply curve to the left and decreases supply which decreases the quantity and…

Q: The government has increased VAT on some commodities in order to raise revenue. The market for…

A: The term "equilibrium" describes a state of no more change. Both Clearly, all sellers and buyers…

Q: The demand for pastries slopes downward and the supply of pastries slopes upward. Suppose that the…

A: Elasticity measures how responsive is quantity to changes in price level.

Q: The Health Ministry is evaluating the data of the soft beverages market. Demand function: Qp = 310 –…

A: The total surplus in a market is a measure of the overall happiness of all market participants. It's…

Q: Suppose the demand for grape jelly is perfectlyelastic (because strawberry jelly is a…

A: Elasticity mentions the responsiveness of one economic variable like quantity demanded to a change…

Q: Suppose an economist estimates that the price elasticity of supply for red wine is 2.4 while its…

A: The burden of Elasticity is totally demanded upon the elasticities.

Q: Market demand for soda is given by QD = 4000 120P and market supply is given by = 200P. Solve for…

A: QD = 4000 - 120P Qs = 200P For equilibrium, QD = Qs 4000 - 120P = 200P - 120P - 200P = - 4000 320P =…

Q: Given Qd = 10000 - 4p Qs = -400 + p Find tax incidence and the dead weight loss of a $10 tax.…

A: The incidence of tax depends on the elasticities of demand and supply. More burden of tax will be…

Q: The consumers' burden associated with an excise tax will be largest when demand is OA. vertical. B.…

A: The consumer's burden associated with an excise tax will be the largest when demand is vertical.

Q: For a given elasticity of demand, the less elastic the supply, the A) greater is the excess burden…

A: Elasticity measures the responsiveness of quantity to changes in the price level.

Q: When a firm dumps a product in another country, it sells it at O a lower price in the foreign…

A: Since you have asked multiple questions, we could solve only one question for you. If you want any…

Q: Determine the point elasticity η of the demand equation 3p^2q = 5000 + 2000p^2, when p = 50. ?

A: Point price elasticity (PE) can be calculated by using the following formula. From the equation the…

Q: If the demand for private planes is elastic compared to the supply, then the burden of a luxury tax…

A: In an economy, various taxes are imposed on different products to reduce income inequality or get…

Q: Suppose a tax is imposed on sellers. The more inelastic the demand for the taxed item, the اختر أحد…

A: Tax refers to the compulsory charges levied by the government on its citizen and the citizen. The…

Q: Consider the market for rubber bands.a. If this market has very elastic supply and veryinelastic…

A: The tax incidence analysis consists of deciding who is the economic entity that bears the expense of…

Q: The US Dept of Agriculture estimates that the elasticity of demand for cigarettes is 0.3 for adult…

A: Price elasticity of demand is the degree of responsiveness of demand for a commodity to a change in…

Q: The Australian government have suggested that they might need to increase GST to help fund the…

A: Elastic is an economic term that refers to a shift in customer and seller behavior in reaction to a…

Q: Assuming a unitary elastic demand and supply, a tax on the sellers of coffee will cause the price…

A: Equilibrium is at a point to demand come into six the supply curve. When the tax is imposed on the…

Q: Assume the ZRA decides to impose a new tax on imported vehicles priced above K200, 0 00. The new tax…

A: Given P1 = K200000 Tax rate = 15% P2 = 15% of K200000 + K200000 = K30000+K200000 = K230000 D1 = 1000…

Q: The inverse supply function for coal is PS = 2 + QS, The inverse demand function for coal is PD = 20…

A: PS=2+QS PD=20-2QD

Q: The demand (D) and supply (S) function for a commodity are P=100 - 20 and P= 10 + Q, respectively.…

A: Given Demand : P = 100-2Q Supply : P = 10+Q Equilibrium QUANTITY = 100-2Q = 10+Q…

Q: Consider a country which taxes two goods, diamonds and bread. Each good has a supply elasticity of…

A: Given information Two products Bread and Diamond Elasticity of supply for both goods=1 Elasticity…

Q: Suppose you are an aid to the Odododiodo Member of Parliament who is concerned about the impact of a…

A: The equilibrium is established where the demand and supply forces are equal.

Q: Using the data you entered in the previous table, calculate the tax burden that falls on buyers and…

A: We can see these values directly from the graph and fill the table to be: QUANTITY PRICE BUYERS…

Q: B The demand and supply functions for a product are: Q=50-3P and Q, =-6+4P, respectively (1) Graph…

A: Given: Demand function: Qd = 50 - 3P Supply function: Qs = -6 + 4P

Q: When an excise tax is imposed on sellers, the of the tax. curve shifts by the amount supply;…

A: Correct answer "supply; upward".

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- The demand for mineral water is P=10 – (2/3) Q and supply function for mineral water isP=1+(1/3)Q What is the burden of the tax on producers and consumers and explain how the tax burden isrelated to elasticities? thanks in advance!Calculate the percentage of the tax borne by the demander and supplier in each of the following cases:Instructions: Enter your responses rounded to the nearest whole number. Elasticityof demand Elasticityof supply Percent borne by demander Percent borne by supplier a. ED = 0.1 ES = 0.5 % % b. ED = 1.0 ES = 2.0 % % c. ED = 1.3 ES = 0.9 % % d. ED = 1.9 ES = 0.7 % % e. Summarize your findings regarding relative elasticity and tax burden. Consumers bear a greater portion of the tax burden because consumers choose to buy the good. Whichever group (producers or consumers) has the lower elasticity bears the greater portion of the tax burden. Whichever group (producers or consumers) has the higher elasticity bears the greater portion of the tax burden. Producers usually bear a greater portion of the tax burden because the government generally levies more taxes on producers.very urgent!!! the demand for mineral water is P=10 – (2/3) Q and supply function for mineral water isP=1+(1/3)Qa) Find the equilibrium price and quantity and Price elasticities of demand and supply.b) Suppose a unit tax (t) is imposed on suppliers (t= 3TL). Find the new equilibrium.c) Find the price that consumers pay and the price that producers get after the tax.d) What is the burden of the tax on producers and consumers and explain how the tax burden isrelated to elasticities? thank you in advance.

- d. Holding Donald's income and Pd constant at $120 and $1 respectively, what is Donald's demand curve for carrots? e. Suppose that a tax of $1 per unit is levied on donuts. How will this alter Donald's utility maximizing market basket of goods? f. Suppose that, instead of the per unit tax in (e), a lump sum tax of the same dollar amount is levied on Donald. What is Donald's utility maximizing market basket? g. The taxes in (e) and (f) both collect exactly the same amount of revenue for the government, which of the two taxes would Donald prefer? Show your answer numerically and explain why Donald prefers the per unit tax over the lump sum tax, or vice versa, or why he is indifferent between the two taxes.The demand for mineral water is P=10 – (2/3) Q and supply function for mineral water isP=1+(1/3)Qa) Find the equilibrium price and quantity and Price elasticities of demand and supply.b) Suppose a unit tax (t) is imposed on suppliers (t= 3TL). Find the new equilibrium.c) Find the price that consumers pay and the price that producers get after the tax.d) What is the burden of the tax on producers and consumers and explain how the tax burden isrelated to elasticities? thank you in advance.Suppose you are an aid to the Odododiodo Member of Parliament who is concerned about the impact of a new tax on the welfare on his constituents. You have explained to him that one of the ways he can determine the impact is to calculate the price elasticity as well as the consumer surplus. Conduct a formal analysis by undertaking the following exercises when the demand and supply functions for the goods in question are given as Qd=500-5p and Qs=2p-60 a. Sketch the supply and the demand curves.b. Calculate the equilibrium price and quantity.c. If government imposes a tax of ¢2 on this commodity, calculate the new price and quantity afterthe imposition of the taxd. Calculate the consumer surplus before the taxe. Calculate the own price elasticity of demand before the imposition of the tax.

- If the government imposes a tax on a product: O the MC will rise causing the level of output to rise. the MC will rise causing the level of output to fall. O the MC will rise causing the level of output to rise. O None of these answers are correct. Note:- Please avoid using ChatGPT and refrain from providing handwritten solutions; otherwise, I will definitely give a downvote. Also, be mindful of plagiarism.Answer completely and accurate answer.Rest assured, you will receive an upvote if the answer is accurate.Q2: Suppose the demand function isp = 50 - 2q………………1and the supply function isp = 10 + 3q…………….2a) Find the market clearing price and quantity (equilibrium point)b) Sketch a graphc) Suppose the government imposes a per unit tax of $5 on producers, what would be the effect of this tax on market clearing price and quantity? ( show your answers)d) Find the consumer and producer tax burden.e) Calculate the tax revenue that the government received.Suppose the demand for grape jelly is perfectlyelastic (because strawberry jelly is a goodsubstitute), while the supply is unit elastic. A tax ongrape jelly would have _________ deadweight losses,and the burden of the tax would fall entirely on the_________ of grape jelly.a. sizable; consumersb. sizable; producersc. no; consumersd. no; producers

- a)Use the following demand and supply functions to calculate the elasticity of demand at market equilibrium QD=-53P+355 Qs=32P+65 Round your answer to the nearest hundredthb)Jack is looking to determine the difference in the cost of capital of debt between two debt issuers: Issuer One is selling the bond at par, with a face value of $1000, and semi-annual coupon payments of $60 Issuer Two is selling his bond at par, with a face value of $1100 and coupon payments of $50 every six months. However, Issuer Two must pay issuing expenses of $40 per bond, and a discount of $20. Both bonds term to maturities are expected to be 10 years. Help Jack to determine the difference in the cost of capital between these two bonds? Assume a tax rate of 40% A 2.34% B 0.02% C 6.34% D 7.37% E 1.31%(Answer the f) Its is known that the demand function for a product is P = 24 - 1/2Q and the supply function Q = 4 + 2P. If the government then increases the seller's tax on the product amount of IDR 20/ unit of goods, what is the price and quantity of goods new balance Calculate the tax burden borne by consumers & manufacturers, as well governement tax revenue F. Calculate the amount of subsidy received by consumers and manufacturers , as well subsidies issued by the governmentOnly typed answer Green et al. (2005) estimate that the demand elasticity is minus−0.47 and the long-run supply elasticity is 12.0 for almonds. The corresponding elasticities are minus−0.68 and 0.73 for cotton and minus−0.26 and 0.64 for processing tomatoes. If the government were to apply a specific tax to each of these commodities, what incidence would fall on consumers? The incidence of a specific almond tax that would fall on consumers is nothing___percent. (Enter numeric responses using real numbers rounded to one decimal place.)