Suppose Barefeet is a monopolist that produces and sells Ooh boots, an amazingly trendy brand with no close substitutes. The following graph shows the market demand and marginal revenue (MR) curves Barefeet faces, as well as its marginal cost (MC), which is constant at $30 per pair of Ooh boots. For simplicity, assume that fixed costs are equal to zero; this, combined with the fact that Barefeet's marginal cost is constant, means that its marginal cost curve is also equal to the average total cost (ATC) curve. First, suppose that Barefeet cannot price discriminate. That is, it must charge each consumer the same price for Ooh boots regardless of the consumer's willingness and ability to pay. On the following graph, use the black point (plus symbol) to indicate the profit-maximizing price and quantity. Next, use the purple points (diamond symbol) to shade the profit, the green points (triangle symbol) to shade the consumer surplus, and the black points (plus symbol) to shade the deadweight loss in this market without price discrimination. (Note: If you decide that consumer surplus, profit, or deadweight loss equals zero, indicate this by leaving that element in its original position on the palette.) 100 90 Monopoly Outcome 80 70 60 Consumer Surplus 50 40 Profit MC = ATC 30 20 Deadweight Loss 10 MR Demand 40 80 120 160 200 240 280 320 360 400 QUANTITY (Pairs of Ooh boots) PRICE (Dollars per pair of Ooh boots)

Suppose Barefeet is a monopolist that produces and sells Ooh boots, an amazingly trendy brand with no close substitutes. The following graph shows the market demand and marginal revenue (MR) curves Barefeet faces, as well as its marginal cost (MC), which is constant at $30 per pair of Ooh boots. For simplicity, assume that fixed costs are equal to zero; this, combined with the fact that Barefeet's marginal cost is constant, means that its marginal cost curve is also equal to the average total cost (ATC) curve. First, suppose that Barefeet cannot price discriminate. That is, it must charge each consumer the same price for Ooh boots regardless of the consumer's willingness and ability to pay. On the following graph, use the black point (plus symbol) to indicate the profit-maximizing price and quantity. Next, use the purple points (diamond symbol) to shade the profit, the green points (triangle symbol) to shade the consumer surplus, and the black points (plus symbol) to shade the deadweight loss in this market without price discrimination. (Note: If you decide that consumer surplus, profit, or deadweight loss equals zero, indicate this by leaving that element in its original position on the palette.) 100 90 Monopoly Outcome 80 70 60 Consumer Surplus 50 40 Profit MC = ATC 30 20 Deadweight Loss 10 MR Demand 40 80 120 160 200 240 280 320 360 400 QUANTITY (Pairs of Ooh boots) PRICE (Dollars per pair of Ooh boots)

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter13: best-practice Tactics: Game Theory

Section: Chapter Questions

Problem 1E

Related questions

Question

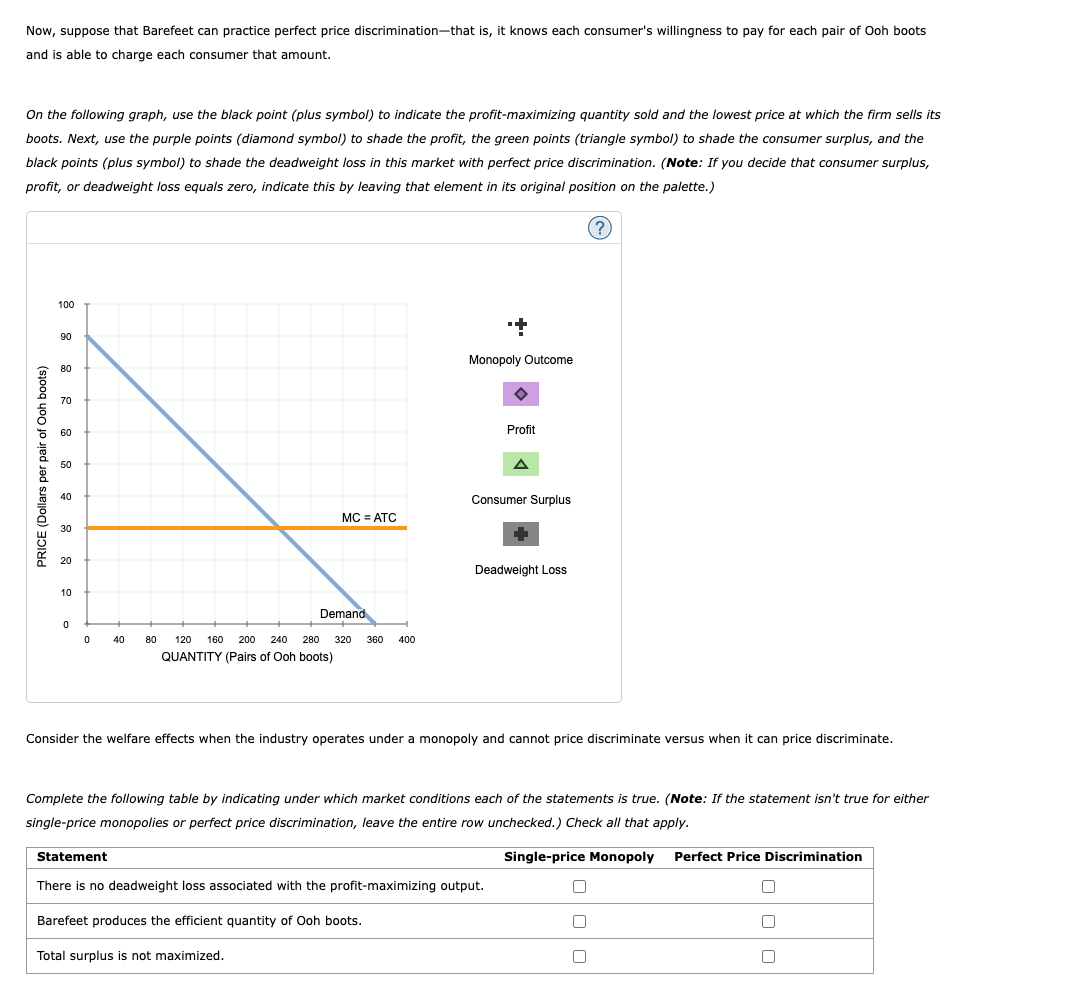

Transcribed Image Text:Now, suppose that Barefeet can practice perfect price discrimination-that is, it knows each consumer's willingness to pay for each pair of Ooh boots

and is able to charge each consumer that amount.

On the following graph, use the black point (plus symbol) to indicate the profit-maximizing quantity sold and the lowest price at which the firm sells its

boots. Next, use the purple points (diamond symbol) to shade the profit, the green points (triangle symbol) to shade the consumer surplus, and the

black points (plus symbol) to shade the deadweight loss in this market with perfect price discrimination. (Note: If you decide that consumer surplus,

profit, or deadweight loss equals zero, indicate this by leaving that element in its original position on the palette.)

100

90

Monopoly Outcome

80

70

60

Profit

50

40

Consumer Surplus

MC = ATC

30

20

Deadweight Loss

10

Demand

40

80

120

160

200

240

280

320

360

400

QUANTITY (Pairs of Ooh boots)

Consider the welfare effects when the industry operates under a monopoly and cannot price discriminate versus when it can price discriminate.

Complete the following table by indicating under which market conditions each of the statements is true. (Note: If the statement isn't true for either

single-price monopolies or perfect price discrimination, leave the entire row unchecked.) Check all that apply.

Statement

Single-price Monopoly

Perfect Price Discrimination

There is no deadweight loss associated with the profit-maximizing output.

Barefeet produces the efficient quantity of Ooh boots.

Total surplus is not maximized.

(si0og uoo JO JIed jad sJeIog) a0INe

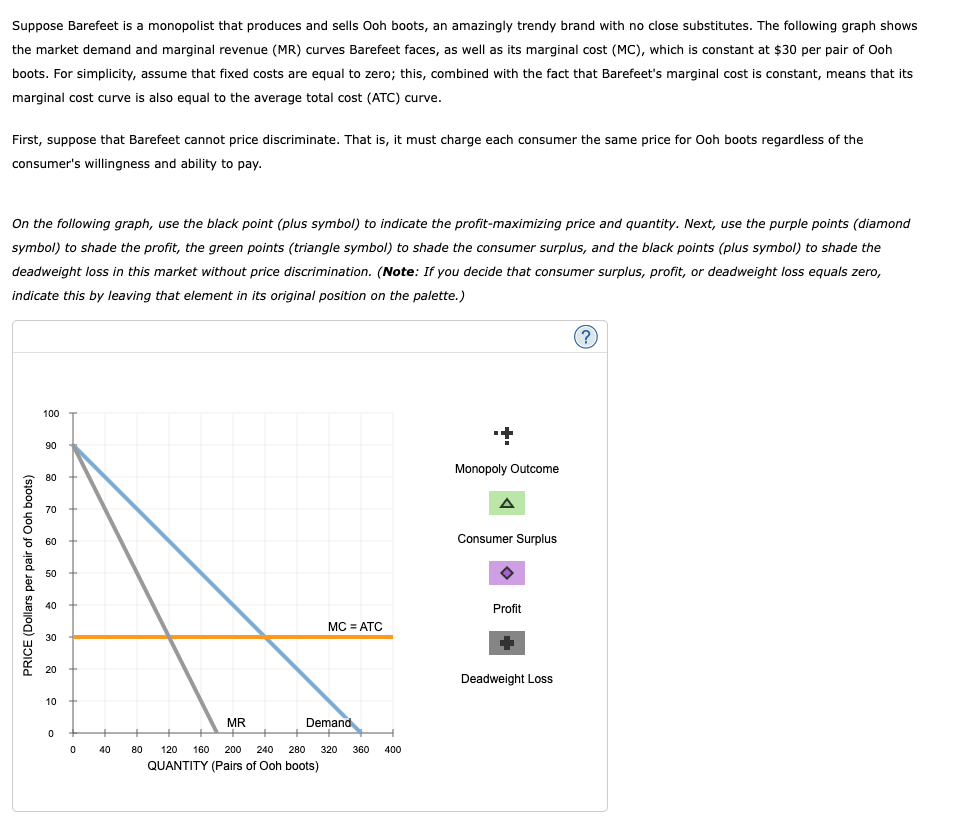

Transcribed Image Text:Suppose Barefeet is a monopolist that produces and sells Ooh boots, an amazingly trendy brand with no close substitutes. The following graph shows

the market demand and marginal revenue (MR) curves Barefeet faces, as well as its marginal cost (MC), which is constant at $30 per pair of Ooh

boots. For simplicity, assume that fixed costs are equal to zero; this, combined with the fact that Barefeet's marginal cost is constant, means that its

marginal cost curve is also equal to the average total cost (ATC) curve.

First, suppose that Barefeet cannot price discriminate. That is, it must charge each consumer the same price for Ooh boots regardless of the

consumer's willingness and ability to pay.

On the following graph, use the black point (plus symbol) to indicate the profit-maximizing price and quantity. Next, use the purple points (diamond

symbol) to shade the profit, the green points (triangle symbol) to shade the consumer surplus, and the black points (plus symbol) to shade the

deadweight loss in this market without price discrimination. (Note: If you decide that consumer surplus, profit, or deadweight loss equals zero,

indicate this by leaving that element in its original position on the palette.)

100

90

Monopoly Outcome

80

70

60

Consumer Surplus

50

40

Profit

MC = ATC

30

20

Deadweight Loss

10

MR

Demand

40

80

120

160

200

240

280

320

360

400

QUANTITY (Pairs of Ooh boots)

PRICE (Dollars per pair of Ooh boots)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning