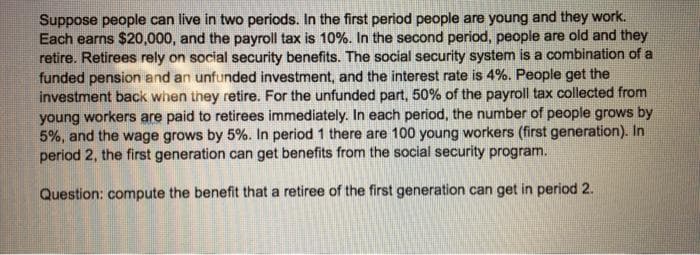

Suppose people can live in two periods. In the first period people are young and they Work. Each earns $20,000, and the payroll tax is 10%. In the second period, people are old and they retire. Retirees rely on social security benefits. The social security system is a combination of a unded pension and an unfunded investment, and the interest rate is 4%. People get the nvestment back when they retire. For the unfunded part, 50% of the payroll tax collected from young workers are paid to retirees immediately. In each period, the number of people grows by 5%, and the wage grows by 5%. In period 1 there are 100 young workers (first generation). In period 2, the first generation can get benefits from the social security program. Question: compute the benefit that a retiree of the first generation can get in period 2.

Suppose people can live in two periods. In the first period people are young and they Work. Each earns $20,000, and the payroll tax is 10%. In the second period, people are old and they retire. Retirees rely on social security benefits. The social security system is a combination of a unded pension and an unfunded investment, and the interest rate is 4%. People get the nvestment back when they retire. For the unfunded part, 50% of the payroll tax collected from young workers are paid to retirees immediately. In each period, the number of people grows by 5%, and the wage grows by 5%. In period 1 there are 100 young workers (first generation). In period 2, the first generation can get benefits from the social security program. Question: compute the benefit that a retiree of the first generation can get in period 2.

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 2FPE

Related questions

Question

Transcribed Image Text:Suppose people can live in two periods. In the first period people are young and they work.

Each earns $20,000, and the payroll tax is 10%. In the second period, people are old and they

retire. Retirees rely on social security benefits. The social security system is a combination of a

funded pension and an unfunded investment, and the interest rate is 4%. People get the

investment back when they retire. For the unfunded part, 50% of the payroll tax collected from

young workers are paid to retirees immediately. In each period, the number of people grows by

5%, and the wage grows by 5%. In period 1 there are 100 young workers (first generation). In

period 2, the first generation can get benefits from the social security program.

Question: compute the benefit that a retiree of the first generation can get in period 2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning