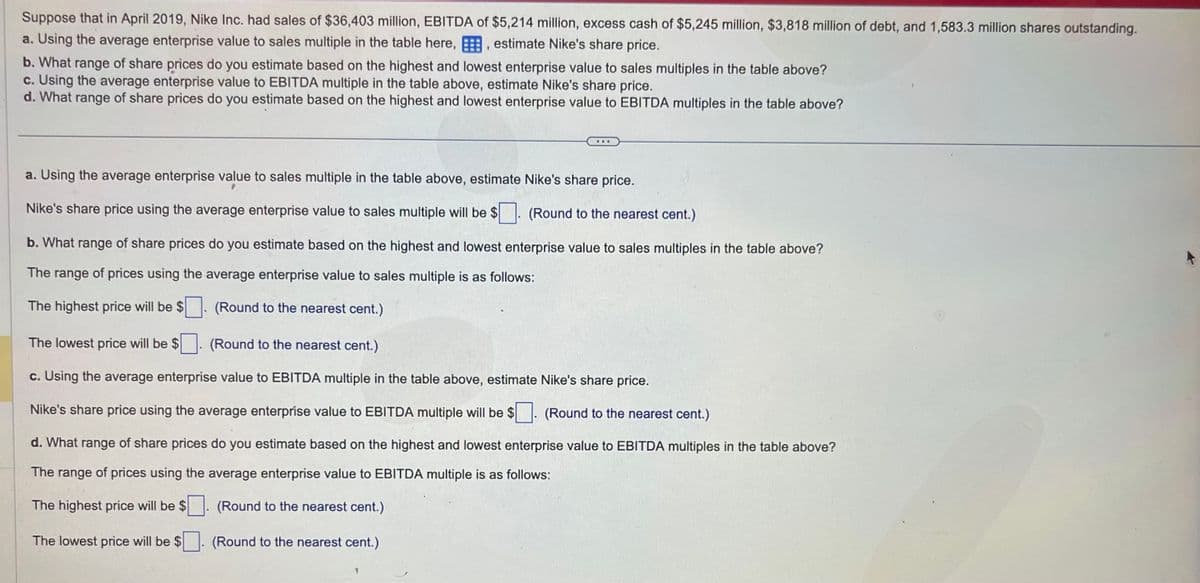

Suppose that in April 2019, Nike Inc. had sales of $36,403 million, EBITDA of $5,214 million, excess cash of $5,245 million, $3,818 million of debt, and 1,583.3 million shares outstanding. a. Using the average enterprise value to sales multiple in the table here,, estimate Nike's share price. b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above? c. Using the average enterprise value to EBITDA multiple in the table above, estimate Nike's share price. d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above? a. Using the average enterprise value to sales multiple in the table above, estimate Nike's share price. Nike's share price using the average enterprise value to sales multiple will be $. (Round to the nearest cent.) b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above? The range of prices using the average enterprise value to sales multiple is as follows: The highest price will be $ (Round to the nearest cent.) The lowest price will be $ (Round to the nearest cent.) c. Using the average enterprise value to EBITDA multiple in the table above, estimate Nike's share price. Nike's share price using the average enterprise value to EBITDA multiple l be $ (Round to the nearest cent.) d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above? The range of prices using the average enterprise value to EBITDA multiple is as follows: The highest price will be $. (Round to the nearest cent.) The lowest price will be $. (Round to the nearest cent.)

Suppose that in April 2019, Nike Inc. had sales of $36,403 million, EBITDA of $5,214 million, excess cash of $5,245 million, $3,818 million of debt, and 1,583.3 million shares outstanding. a. Using the average enterprise value to sales multiple in the table here,, estimate Nike's share price. b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above? c. Using the average enterprise value to EBITDA multiple in the table above, estimate Nike's share price. d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above? a. Using the average enterprise value to sales multiple in the table above, estimate Nike's share price. Nike's share price using the average enterprise value to sales multiple will be $. (Round to the nearest cent.) b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above? The range of prices using the average enterprise value to sales multiple is as follows: The highest price will be $ (Round to the nearest cent.) The lowest price will be $ (Round to the nearest cent.) c. Using the average enterprise value to EBITDA multiple in the table above, estimate Nike's share price. Nike's share price using the average enterprise value to EBITDA multiple l be $ (Round to the nearest cent.) d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above? The range of prices using the average enterprise value to EBITDA multiple is as follows: The highest price will be $. (Round to the nearest cent.) The lowest price will be $. (Round to the nearest cent.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 9P

Related questions

Concept explainers

Financial Ratios

A Ratio refers to a figure calculated as a reference to the relationship of two or more numbers and can be expressed as a fraction, proportion, percentage, or the number of times. When the number is determined by taking two accounting numbers derived from the financial statements, it is termed as the accounting ratio.

Return on Equity

The Return on Equity (RoE) is a measure of the profitability of a business concerning the funds by its stockholders/shareholders. ROE is a metric used generally to determine how well the company utilizes its funds provided by the equity shareholders.

Topic Video

Question

Transcribed Image Text:Suppose that in April 2019, Nike Inc. had sales of $36,403 million, EBITDA of $5,214 million, excess cash of $5,245 million, $3,818 million of debt, and 1,583.3 million shares outstanding.

a. Using the average enterprise value to sales multiple in the table here,, estimate Nike's share price.

b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above?

c. Using the average enterprise value to EBITDA multiple in the table above, estimate Nike's share price.

d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above?

a. Using the average enterprise value to sales multiple in the table above, estimate Nike's share price.

Nike's share price using the average enterprise value to sales multiple will be $

(Round to the nearest cent.)

b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above?

The range of prices using the average enterprise value to sales multiple is as follows:

The highest price will be $

(Round to the nearest cent.)

The lowest price will be $

(Round to the nearest cent.)

c. Using the average enterprise value to EBITDA multiple in the table above, estimate Nike's share price.

Nike's share price using the average enterprise value to EBITDA multiple will be $

(Round to the nearest cent.)

d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above?

The range of prices using the average enterprise value to EBITDA multiple is as follows:

The highest price will be $

(Round to the nearest cent.)

The lowest price will be $

(Round to the nearest cent.)

Transcribed Image Text:Suppose that in

a. Using the average enterprise value to sales multiple in the table here,, estimate Nike's share price.

5. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above?

c. Using the average enterprise value to EBITDA multiple in the table above, estimate Nike's share price.

d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above?

a. Us

Nike'

b. W

The r

The H

The I

c. Us

Nike'

d. WI

The r

The H

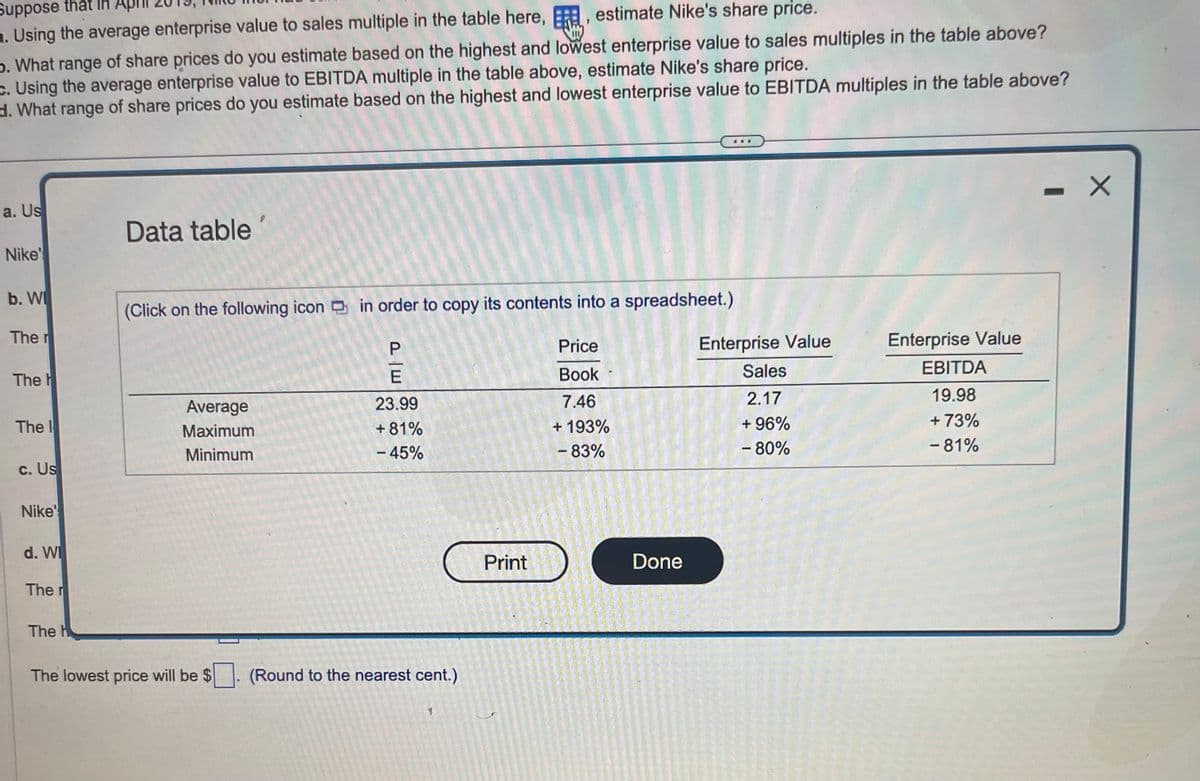

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Average

Maximum

Minimum

The lowest price will be $

PE

23.99

+81%

-45%

(Round to the nearest cent.)

Y

Print

Price

Book

7.46

+ 193%

- 83%

Done

Enterprise Value

Sales

2.17

+ 96%

- 80%

--------------ZA

Enterprise Value

EBITDA

19.98

+ 73%

- 81%

- X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning