Suppose that in the early part of a new book's life, sales drop by 15% to 20% each term, as the pool of used books on the market grows. This is because after being on the market, the latest edition of a given textbook will have made its way into the used textbook market, giving many students the opportunity to move from new textbooks toward used ones. As the supply of used textbooks increases, the price of used textbooks decreases, and thus the expected resale value for new textbooks declines. Suppose the publisher still plans to charge the same price of $140 per new copy of the textbook between editions. Adjust the previous graph to show the effect of the market for used textbooks on the demand for new economics textbooks in 2019. (Note: Select and drag the curve to the desired position. The curve will snap into position, so if you try to move a curve and it snaps back to its original position, just drag it a little farther.) Next, use the purple rectangle (diamond symbols) to shade the area representing the revenue the publisher should expect in 2019. (Note: Select and drag the shaded region from the palette to the graph. To resize the shaded region, select one of the points and move to the desired position. To see the area of the rectangle, select the shaded region.) Then answer the question that follows. In 2019, at $140, copies of textbook will be demanded, and the publisher's expected revenue is $ Suppose now that the publisher realizes the damaging effect of the market for used textbooks on its revenue. Market research suggests that on average, between editions, the price of an economics textbook declines by approximately 50%. To offset the potential damage to revenue, the publisher decides to sell both the printed textbook at $140 and an electronic version of the textbook at a competitive price of $40, which is approximately 75% less than the price of a new textbook. By design, e-books offer the same content along with a Type here to search a 35 P 59°F 4) 10:48 PM 9/25/2023 ☐

Suppose that in the early part of a new book's life, sales drop by 15% to 20% each term, as the pool of used books on the market grows. This is because after being on the market, the latest edition of a given textbook will have made its way into the used textbook market, giving many students the opportunity to move from new textbooks toward used ones. As the supply of used textbooks increases, the price of used textbooks decreases, and thus the expected resale value for new textbooks declines. Suppose the publisher still plans to charge the same price of $140 per new copy of the textbook between editions. Adjust the previous graph to show the effect of the market for used textbooks on the demand for new economics textbooks in 2019. (Note: Select and drag the curve to the desired position. The curve will snap into position, so if you try to move a curve and it snaps back to its original position, just drag it a little farther.) Next, use the purple rectangle (diamond symbols) to shade the area representing the revenue the publisher should expect in 2019. (Note: Select and drag the shaded region from the palette to the graph. To resize the shaded region, select one of the points and move to the desired position. To see the area of the rectangle, select the shaded region.) Then answer the question that follows. In 2019, at $140, copies of textbook will be demanded, and the publisher's expected revenue is $ Suppose now that the publisher realizes the damaging effect of the market for used textbooks on its revenue. Market research suggests that on average, between editions, the price of an economics textbook declines by approximately 50%. To offset the potential damage to revenue, the publisher decides to sell both the printed textbook at $140 and an electronic version of the textbook at a competitive price of $40, which is approximately 75% less than the price of a new textbook. By design, e-books offer the same content along with a Type here to search a 35 P 59°F 4) 10:48 PM 9/25/2023 ☐

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter27: Investment, The Capital Market, And The Wealth Of Nations

Section: Chapter Questions

Problem 13CQ

Related questions

Question

I need help with this question please. I also showed the graph as well for context.

Transcribed Image Text:☐

MindTap - Cengage Learning X

Dashboard

✰ng.cengage.com/static/nb/ui/evo/index.html?elSBN=9780357133606&id=1834966587&snapshotld=3545333&

X +

Suppose that in the early part of a new book's life, sales drop by 15% to 20% each term, as the pool of used books on the market

grows. This is because after being on the market, the latest edition of a given textbook will have made its way into the used textbook

market, giving many students the opportunity to move from new textbooks toward used ones. As the supply of used textbooks

increases, the price of used textbooks decreases, and thus the expected resale value for new textbooks declines. Suppose the publisher

still plans to charge the same price of $140 per new copy of the textbook between editions.

In 2019, at $140,

Adjust the previous graph to show the effect of the market for used textbooks on the demand for new economics textbooks in 2019. (Note: Select

and drag the curve to the desired position. The curve will snap into position, so if you try to move a curve and it snaps back to its original position,

just drag it a little farther.) Next, use the purple rectangle (diamond symbols) to shade the area representing the revenue the publisher should expect

in 2019. (Note: Select and drag the shaded region from the palette to the graph. To resize the shaded region, select one of the points and move to

the desired position. To see the area of the rectangle, select the shaded region.) Then answer the question that follows.

copies of textbook will be demanded, and the publisher's expected revenue is $

Suppose now that the publisher realizes the damaging effect of the market for used textbooks on its revenue. Market research suggests

that on average, between editions, the price of an economics textbook declines by approximately 50%. To offset the potential damage

to revenue, the publisher decides to sell both the printed textbook at $140 and an electronic version of the textbook at a competitive

price of $40, which is approximately 75% less than the price of a new textbook. By design, e-books offer the same content along with a

Type here to search

발

Р

a

H

35

59°F

e

I

10:48 PM

9/25/2023

⠀

Transcribed Image Text:LO

obl

B

LI

MindTap - Cengage Learning X ★Dashboard

Marvin

My Home

Courses

Help

✰ng.cengage.com/static/nb/ui/evo/index.html?elSBN=9780357133606&id=1834966587&snapshotld=3545333&

Catalog and Study Tools

Rental Options

College Success Tips

Career Success Tips

«

Give Feedback

Type here to search

CENGAGE MINDTAP

News Analysis: When It Comes To Textbooks, Students and Publishers Do Their Homework

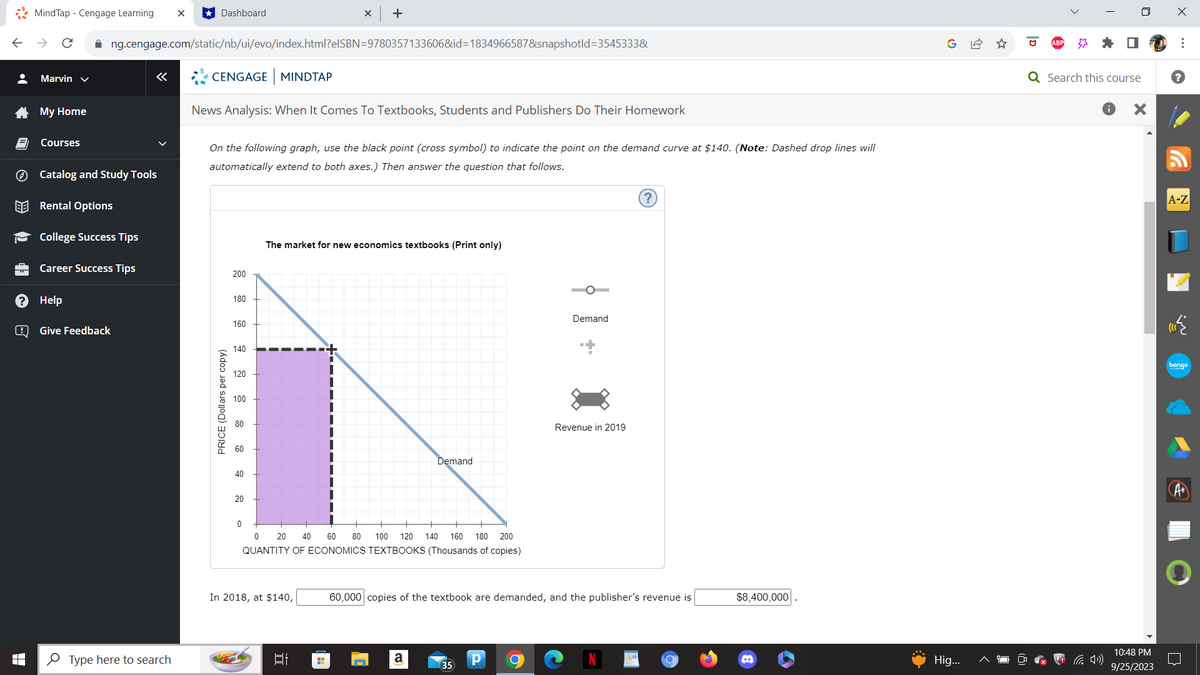

On the following graph, use the black point (cross symbol) to indicate the point on the demand curve at $140. (Note: Dashed drop lines will

automatically extend to both axes.) Then answer the question that follows.

PRICE (Dollars per copy)

200

180

160

140

120

100

80

60

40

20

0

X +

The market for new economics textbooks (Print only)

In 2018, at $140,

80 100 120 140 160 180 200

0 20 40 60

QUANTITY OF ECONOMICS TEXTBOOKS (Thousands of copies)

발

H

Demand

a

35

Demand

60,000 copies of the textbook are demanded, and the publisher's revenue is

Р

Revenue in 2019

?

$8,400,000

Hig...

I

Q Search this course

X

10:48 PM

9/25/2023

X

⠀

?

A-Z

bongo

A+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning