Suppose that National Bank of Guerneville has $31 million in checkable deposits, Commonwealth Bank has $43 million in checkable deposits, and the required reserve ratio for checkable deposits is 10%. If National Bank of Guerneville has $4 million in reserves and Commonwealth has $5 million in reserves, how much in excess reserves does each bank have? (Enter your answers rounded to one decimal place.) National Bank of Guerneville has $ 0.9 million in excess reserves. Commonwealth Bank has $ 0.7 million in excess reserves. Now suppose that a customer of National Bank of Guerneville writes a check for $1 million to a real estate broker who deposits the check at Commonwealth. After the check clears, how much in excess reserves does each bank have? National Bank of Guerneville has $0 million in excess reserves. Commonwealth Bank has $ million in excess reserves.

Suppose that National Bank of Guerneville has $31 million in checkable deposits, Commonwealth Bank has $43 million in checkable deposits, and the required reserve ratio for checkable deposits is 10%. If National Bank of Guerneville has $4 million in reserves and Commonwealth has $5 million in reserves, how much in excess reserves does each bank have? (Enter your answers rounded to one decimal place.) National Bank of Guerneville has $ 0.9 million in excess reserves. Commonwealth Bank has $ 0.7 million in excess reserves. Now suppose that a customer of National Bank of Guerneville writes a check for $1 million to a real estate broker who deposits the check at Commonwealth. After the check clears, how much in excess reserves does each bank have? National Bank of Guerneville has $0 million in excess reserves. Commonwealth Bank has $ million in excess reserves.

Chapter13: Monetary Policy

Section: Chapter Questions

Problem 8E

Related questions

Question

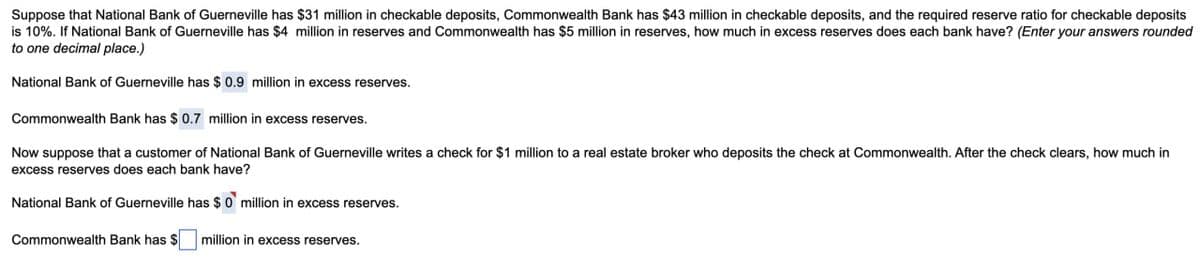

Transcribed Image Text:Suppose that National Bank of Guerneville has $31 million in checkable deposits, Commonwealth Bank has $43 million in checkable deposits, and the required reserve ratio for checkable deposits

is 10%. If National Bank of Guerneville has $4 million in reserves and Commonwealth has $5 million in reserves, how much in excess reserves does each bank have? (Enter your answers rounded

to one decimal place.)

National Bank of Guerneville has $ 0.9 million in excess reserves.

Commonwealth Bank has $ 0.7 million in excess reserves.

Now suppose that a customer of National Bank of Guerneville writes a check for $1 million to a real estate broker who deposits the check at Commonwealth. After the check clears, how much in

excess reserves does each bank have?

National Bank of Guerneville has $0 million in excess reserves.

Commonwealth Bank has $ million in excess reserves.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc