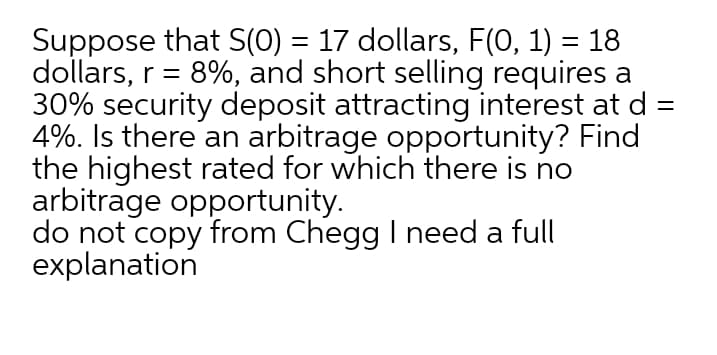

Suppose that S(0) = 17 dollars, F(0, 1) = 18 dollars, r = 8%, and short selling requires a 30% security deposit attracting interest at d = 4%. Is there an arbitrage opportunity? Find the highest rated for which there is no arbitrage opportunity. do not copy from Chegg I need a full explanation %3D

Q: You observe the following quotes for the USD/AUD in the spot market from two banks: Bank of Sydney…

A: Locational arbitrage is a trading strategy in which a person earns a profit by buying and selling…

Q: Assume that the risk-free rate of interest is 4% and the expected rate of return on the market is…

A: As per CAPM Ri = Rf + B (Rm - Rf) Where Ri = Return on equity Rf = Risk free rate of return B =…

Q: Related to Solved Problem 3.3] For each of the following situations, choose the equation needed to…

A: Cost of debt (yield to maturity) refers to the total return generated by a bond until it matures.…

Q: Suppose the gold price is $300/oz., the 1-year forward price is 310.686, and the continuously…

A: a)Lease rate- refers to the dollar amount paid for a specified time for which an asset is taken on…

Q: For an interest rate of 10%, find the compounding factor from the table below that will be used to…

A: GIVEN, A=$1000 N= 6 R=10%

Q: I asked this question yesterday: Suppose that, in each period, the cost of a security either goes up…

A: At the outset, we regret the approach that was provided to you in the earlier solution. We also…

Q: Suppose that the borrowing rate that your client faces is 9%. Assume that the equity market index…

A: Computation:

Q: 3. Answer the following questions based on the information below Proposed credit policy (net 30)…

A: Hey, since there are multiple subpart questions posted, we will answer the first three subpart…

Q: which one is correct please confirm? Q20: Which investment would show the highest rate of return:…

A: There are two ways of investing one interest on principles and discount on principal

Q: What is the projected probability of default for the borrower? What is the projected probability of…

A: The probability of default of a loan can be defined as the probability of a loan applicant not…

Q: An investment shows a positive net present value at an 8% discount rate and a negative net present…

A: Capital budgeting indicates the evaluation of the profitability of possible investment and projects…

Q: Complete the following table by identifying the appropriate corresponding variables used in the…

A:

Q: Mr. Mohammed is specialized in cross-rate arbitrage and noticed the below quotes: OMR 0.250/ USD,…

A: Rates OMR/USD = 0.250 INR/USD = 75 INR/OMR = 325 Given, Cross Rate Between OMR and USD based on…

Q: 2. Given the following data, is there an Arbitrage? What is the Profit when St > K and St < K for…

A: A put option is a type of option that gives the right but not the obligation to holders to sell the…

Q: Assume that you have $10,000 to invest in a term deposit. In this situation, explain which of the…

A: Annualized return on investment: It is the total amount of money earned on investment each year over…

Q: (1) A single payment security matures in 100 days and has a maturity value of $50,000. What would be…

A: The question is related to the Present Value and time value of Money. The Present Value is…

Q: The following table shows the option of a Business in which the value at time zero means the…

A: Internal Rate of Return (IRR) is the rate at which the net present value of the cash flows is zero.…

Q: If the return on U.S. Treasury bills is 7.02%, the risk premium is 2.32%, and the inflation rate is…

A: U.S. Treasury bills return is 7.02%. This is nominal rate of return on U.S. Treasury bills. Hence,…

Q: Quantitative Problem: You own a security with the cash flows shown below. 2 3 620 365 240 290 If you…

A: Present value = Cash flows*Discounting factor Discounting factor…

Q: 2. Denote by Cn and P calls and puts with strike price K = 240 and exercise date N = 1. Let the bank…

A: The Above Question is related to Put Call Parity Equation for the Same = = > P0 + S0 = C0…

Q: Suppose that -7% (n=1), and that future short term (1 year) interest rates are expected to be 5% and…

A: The liquidity premium theory of interest rates: The liquidity premium theory of interest rates…

Q: In a bank, rate sensitive asset is Rs 5000 with yield of 7.5% per annum (PA), fixed rate asset is Rs…

A: Interest earned on assets 5000 * 7.5% = 375 3500 * 8% = 280 Total 655

Q: The difference in returns between Treasury bills and the FTSE Bursa Malaysia (FBM) KLCI is 5.50%.…

A: Risk free return = 3% Difference in returns between Treasury bills and the FTSE Bursa Malaysia (FBM)…

Q: Assume the current price of copper is $1675 per tonne, the term structure of interest rate is flat…

A: Arbitrage: If the cost of entering into a strategy is lower than the proceeds from the strategy, a…

Q: Find the profitability index for Shanfari Company if the initial investment is 7900 OMR and the cash…

A: Profitability index can be calculated by dividing the present worth of future cash flows and the…

Q: On the basis of these data, the real risk-free rate of return is 3% 2% 0% 1%

A: Real risk-free rate refers to the rate of interest that is expected by the investors on the…

Q: Consider 1-factor model and assume that the price of a certain fixed income security P(y) for y=9%…

A: To Find: DVO1 Duration Convexity

Q: Suppose Mr. Juice needs a $1,660 loan and the bank, Wonderland Banking, has decided that this guy…

A: Answer:- Loan meaning:- A loan can be defined as the amount of payment of money to another party in…

Q: You own a security with the cash flows shown below. 0 1 2 3 4 0 690 395 230…

A: Present value of cash flow will be calculated by cash flow multiply with present value factor.

Q: Suppose you borrow $38499.71M when financing a gym with a cost of $87624.83M. You expect to generate…

A: Cost of capital- From the investor's perspective, cost of capital is the minimum return that the…

Q: money supply M is 2,000, and the price level P is 2. If the price level is fixed an money is raised…

A: With change in money supply there will be change in interest rate and there may be increase in…

Q: Suppose you are given S100 in period I (today), $200 in period 2, and $300 in period 3. Given an…

A: "In the context of multiple questions guidelines we need to solve the first question if no question…

Q: 1. In a spiderplot, the most sensitive factor is the one with: a. the highest Y-intercept value b.…

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: If the loan interest rate is 4 % mark-up on the 6 month treasury bill and the deposit interest rate…

A: There are different types of risk faced by the investor such as Repricing risk,yield -curve risk ,…

Q: wants to borrow funds from B. The risk-free rate is 6% and current inflation is 2%. It is expected…

A: We need to compute different rates as per the requirement of the question

Q: ted, with ercentage points lower than short-tem rates If long-term financing is perfectly matched…

A: Earnings after Taxes: It is a measure of net profitability for the company. Higher the earnings…

Q: You read in the Wall Street Journal that 30-day treasury bills are currently yielding 8%. You are…

A: An interest rate that is modified to eliminate the impacts of inflation in order to reflect the…

Q: a) You observe the following quotes for the USD/AUD in the spot market from two banks: Bank of…

A: There are 3 different questions, solution of first answer will provided. If you want answer for…

Q: a. Find the present values of the following cash flow streams at a 6% discount rate. Do not round…

A:

Q: lefault (PD) find the expected loss (EL) and unexpected loss (UL) of the Bank if exposure at given…

A: According to Islamic banking governed by Sharia laws, charging of interest (Riba) for loans is…

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

- Assume that an officer of ZED Bank wants to execute a transaction with the following characteristics using the risk-adjusted return on capital (RAROC) model:▪ Probability of default (PD) = 45 basis points▪ Loss given default (LGD) = 50%▪ Exposure at default (EAD) = US$ 2.0 million▪ The risk-free rate of return is 6%This is a loan to an agricultural company and the bank’s economic capital (EC) model delivers the following charge for the firm: EC of exposure = 5% of EAD, which is US$ 100,000. Assume that the bank has set a RAROC hurdle rate of 15% and this transaction has a net profit of US$ 12,000 before other adjustments.REQUIRED:1. Compute the bank’s risk-adjusted rate of return on the loan to an agricultural company? 2. Now assume that the bank could also have made a loan for the same amount and net profit of US$ 12,000 before other adjustments to a chemical manufacturing firm, and that the EC = 2.5% in this case. 3. Which loan between the two should the bank grant and why?Assume that an officer of ZED Bank wants to execute a transaction with the following characteristics using the risk-adjusted return on capital (RAROC) model:▪ Probability of default (PD) = 45 basis points▪ Loss given default (LGD) = 50%▪ Exposure at default (EAD) = US$ 2.0 million▪ The risk-free rate of return is 6%This is a loan to an agricultural company and the bank’s economic capital (EC) model delivers the following charge for the firm: EC of exposure = 5% of EAD, which is US$ 100,000. Assume that the bank has set a RAROC hurdle rate of 15% and this transaction has a net profit of US$ 12,000 before other adjustments.REQUIRED:Compute the bank’s risk-adjusted rate of return on the loan to an agricultural company? Now assume that the bank could also have made a loan for the same amount and net profit of US$ 12,000 before other adjustments to a chemical manufacturing firm, and that the EC = 2.5% in this case. Which loan between the two should the bank grant and why?You observe the following quotes for the USD/AUD in the spot market from two banks:Bank of Sydney /Bank of New YorkBid Ask/ Bid Ask0.71711 0.71715 /0.71708 0.71715Do these quotes imply the possibility of earning a profit by using locational arbitrage? If so, calculatethe potential profit if you are able to use AUD 25,000. If not, explain why arbitrage is not possible?(b) You observe the following quotes for the GBP /AUD in the spot market from two banks:Bank of Melbourne/ Bank of LondonBid Ask/ Bid Ask0.5458 0.5459 /0.5514 0.5515Do these quotes imply the possibility of earning a profit by using locational arbitrage? If so, calculatethe potential profit if you are able to use GBP 50,000. If not, explain why arbitrage is not possible?c) You observe the following quotes for the EUR / USD in the spot market from two banks:Deutsche Bank/ Bank of AmericaBid Ask /Bid Ask1.18102 1.18102 /1.18094 1.18100Do these quotes imply the possibility of earning a profit by using locational arbitrage? If…

- You are given the following information for Wine and Cork Enterprises (WCE): rRF = 5%; rM = 7%; RPM = 2%, and beta = 1.3 What is WCE's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. If inflation increases by 2% but there is no change in investors' risk aversion, what is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places. Assume now that there is no change in inflation, but risk aversion increases by 1%. What is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places. If inflation increases by 2% and risk aversion increases by 1%, what is WCE's required rate of return now? Do not round intermediate calculations. Round your answer to two decimal places.a) You observe the following quotes for the USD/AUD in the spot market from two banks: Bank of Sydney Bank of New York Bid Ask Bid Ask 0.71711 0.71715 0.71708 0.71715 Do these quotes imply the possibility of earning a profit by using locational arbitrage? If so, calculate the potential profit if you are able to use AUD 25,000. If not, explain why arbitrage is not possible? (b) You observe the following quotes for the GBP /AUD in the spot market from two banks: Bank of Melbourne Bank of London Bid Ask Bid Ask 0.5458 0.5459 0.5514 0.5515 Do these quotes imply the possibility of earning a profit by using locational arbitrage? If so, calculate the potential profit if you are able to use GBP 50,000. If not, explain why arbitrage is not possible? c) You observe the following quotes for the EUR / USD in the spot market from two banks: Deutsche Bank Bank of America Bid Ask Bid Ask 1.18102 1.18102 1.18094 1.18100 Do these quotes imply the…which one is correct please confirm? Q20: Which investment would show the highest rate of return: 1) a six month (180/360 days) deposit at a rate of 4.75% or 2) a six month straight discount bill at a discount rate of 4.60% (180/360) "A six month deposit is a true yield instrument, therefore the yield will be 4.75%" a six month straight discount bill at a discount rate of 4.60% cannot be determined both are same

- compute the convexity of this bound b. Bound A has the following information: face value=RM1, 000 coupon rate=8% potential change in interst rate:0.004% Time to maturity:15 the yield to maturity in 5% using Compounding interst ratA Treasury bill has a bid yield of 3.46 and an ask yield of 3.4. The bill matures in 123 days. Assume a face value of $1,000. a. At what price could you sell the Treasury bill? (Do not round intermediate calculations. Round your answer to 3 decimal places.) b. What is the dollar spread for this bill? (Do not round intermediate calculations. Round your answer to 3 decimal places.)Here are data on two companies. The T-bill rate is 4% and the market risk premium is 6%. Company $1 Discount Store Everything $5 Actual return 12% 11% Standard deviation of returns 8% 10% Beta 1.5 1.0 What would be the required return for $1 Discount Store according to the capital asset pricing model (CAPM)? Enter your answer as a decimal.

- Here are data on two companies. The T-bill rate is 4% and the market risk premium is 6%. Company $1 Discount Store Everything $5 Forecast return 12% 11% Standard deviation of returns 8% 10% Beta 1.5 1.0 What would be the fair return for $1 Discount Store according to the capital asset pricing model (CAPM)? Enter your answer as a decimal.32-Mr. Mohammed is specialized in cross-rate arbitrage and noticed the below quotes: OMR 0.250/ USD, INR 75/USD, INR 325/OMR. Which one of the following statements represent the above? O a. None of the options O b. The quoted cross-rate is higher at INR/OMR hence the triangular arbitrage is not possible O c. The quoted cross-rate is higher at OMR/INR hence the triangular arbitrage is not possible O d. The quoted cross-rate is higher at INR/OMR hence the triangular arbitrage is possibleA commercial bill with a face value of $50 000 has a current price of $49,291. This bill is trading at a yield of 7.5% which necessarily implies a time to maturity of how many days? Can you please give a solution in a good accounting form? I need to know what should I call the result of each computations for reference. Thank you so much!