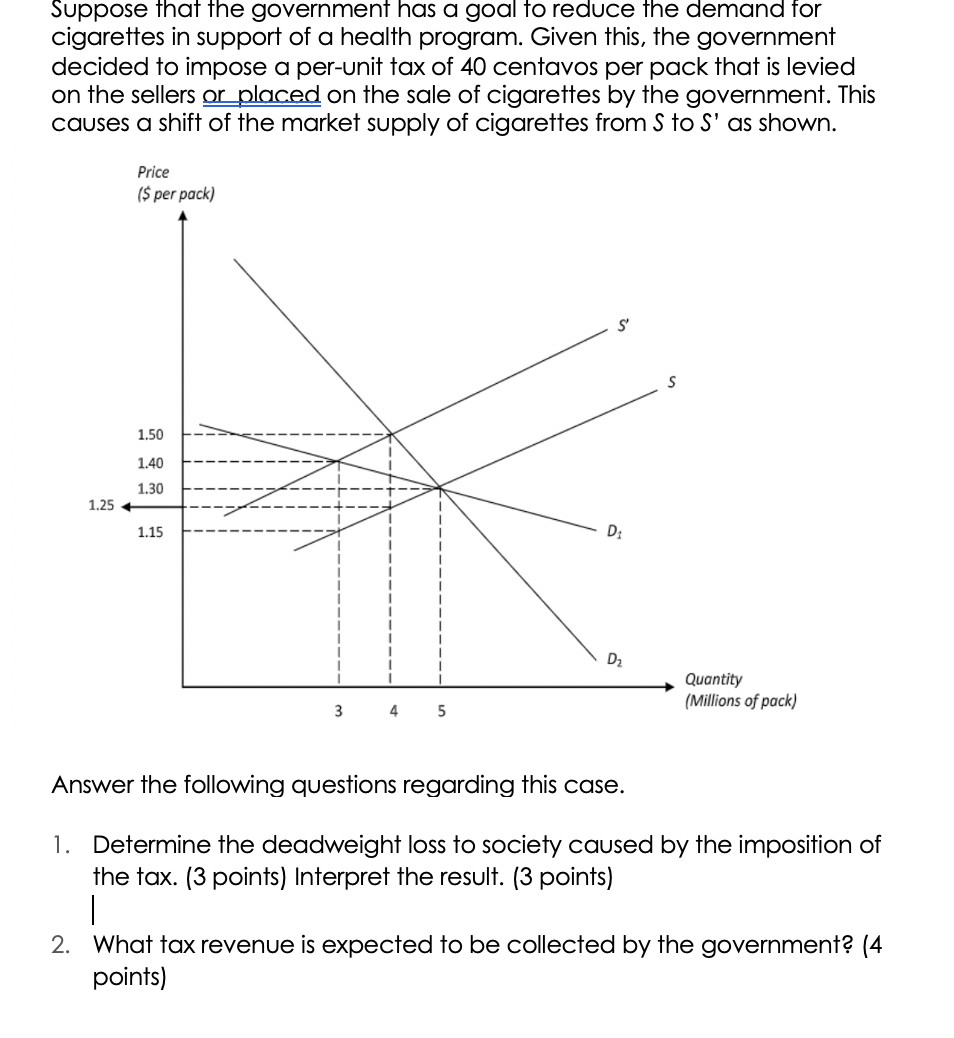

Suppose that the government has a goal to reduce the demand for cigarettes in support of a health program. Given this, the government decided to impose a per-unit tax of 40 centavos per pack that is levied on the sellers or placed on the sale of cigarettes by the government. This causes a shift of the market supply of cigarettes from S to S' as shown. Price ($ per pack) S 1.50 1.40 1.30 1.15 D₂ Quantity 3 4 5 (Millions of pack) Answer the following questions regarding this case. 1. Determine the deadweight loss to society caused by the imposition of the tax. (3 points) Interpret the result. (3 points) | 2. What tax revenue is expected to be collected by the government? (4 points) 1.25 D₁

Suppose that the government has a goal to reduce the demand for cigarettes in support of a health program. Given this, the government decided to impose a per-unit tax of 40 centavos per pack that is levied on the sellers or placed on the sale of cigarettes by the government. This causes a shift of the market supply of cigarettes from S to S' as shown. Price ($ per pack) S 1.50 1.40 1.30 1.15 D₂ Quantity 3 4 5 (Millions of pack) Answer the following questions regarding this case. 1. Determine the deadweight loss to society caused by the imposition of the tax. (3 points) Interpret the result. (3 points) | 2. What tax revenue is expected to be collected by the government? (4 points) 1.25 D₁

Chapter12: The Partial Equilibrium Competitive Model

Section: Chapter Questions

Problem 12.10P

Related questions

Question

Transcribed Image Text:Suppose that the government has a goal to reduce the demand for

cigarettes in support of a health program. Given this, the government

decided to impose a per-unit tax of 40 centavos per pack that is levied

on the sellers or placed on the sale of cigarettes by the government. This

causes a shift of the market supply of cigarettes from S to S' as shown.

Price

($ per pack)

S

1.50

1.40

1.30

1.15

D₂

Quantity

(Millions of pack)

3

4

5

Answer the following questions regarding this case.

1. Determine the deadweight loss to society caused by the imposition of

the tax. (3 points) Interpret the result. (3 points)

1

2. What tax revenue is expected to be collected by the government? (4

points)

1.25 +

1

1

D₁

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax