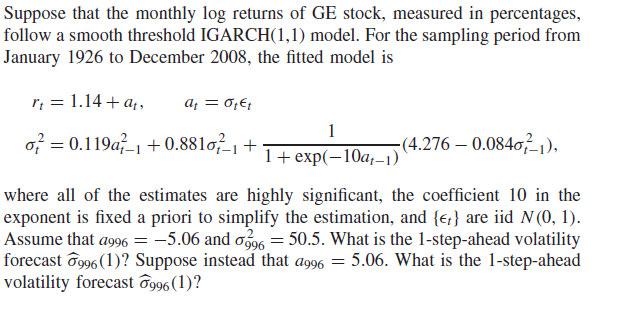

Suppose that the monthly log returns of GE stock, measured in percentages, follow a smooth threshold IGARCH(1,1) model. For the sampling period from January 1926 to December 2008, the fitted model is r; = 1.14 + a;, a; = 0;€; 1 of = 0.119a-1 + 0.881o1+ -(4.276 – 0.08401), 1+ exp(-10a,-1) where all of the estimates are highly significant, the coefficient 10 in the exponent is fixed a priori to simplify the estimation, and {e;} are iid N(0, 1). Assume that a996 = -5.06 and o6 = 50.5. What is the 1-step-ahead volatility forecast ô996 (1)? Suppose instead that a996 = 5.06. What is the 1-step-ahead volatility forecast ô996(1)?

Suppose that the monthly log returns of GE stock, measured in percentages, follow a smooth threshold IGARCH(1,1) model. For the sampling period from January 1926 to December 2008, the fitted model is r; = 1.14 + a;, a; = 0;€; 1 of = 0.119a-1 + 0.881o1+ -(4.276 – 0.08401), 1+ exp(-10a,-1) where all of the estimates are highly significant, the coefficient 10 in the exponent is fixed a priori to simplify the estimation, and {e;} are iid N(0, 1). Assume that a996 = -5.06 and o6 = 50.5. What is the 1-step-ahead volatility forecast ô996 (1)? Suppose instead that a996 = 5.06. What is the 1-step-ahead volatility forecast ô996(1)?

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter4: Eigenvalues And Eigenvectors

Section4.6: Applications And The Perron-frobenius Theorem

Problem 25EQ

Related questions

Question

I need help with solution of this problem.Subject is Time Series and question is based on IGARCH.

Transcribed Image Text:Suppose that the monthly log returns of GE stock, measured in percentages,

follow a smooth threshold IGARCH(1,1) model. For the sampling period from

January 1926 to December 2008, the fitted model is

r; = 1.14 + a,,

af = 0;E;

1

of = 0.119a-1 + 0.881o, +

(4.276 – 0.0840²1),

1+ exp(—10а,-1)

where all of the estimates are highly significant, the coefficient 10 in the

exponent is fixed a priori to simplify the estimation, and {;} are iid N (0, 1).

Assume that ag96 = -5.06 and o96 = 50.5. What is the 1-step-ahead volatility

forecast ô996 (1)? Suppose instead that ag96 = 5.06. What is the 1-step-ahead

volatility forecast og96(1)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill