Suppose that the Shapiro administration is considering two possible policies meant to discourage production (and related air pollution) of steel in Pittsburgh, where the market for a metric ton of steel produced in Pittsburgh is characterized by the following equations for demand and supply: ?? = 1200 − ? ?? = 2? Use this information and a graphical analysis to answer the following. a) What welfare effects would result from the Shapiro administration instituting a $180 per unit tax that sellers are required to pay to PA? Be sure to calculate the after-tax prices and quantity. Use a well labeled graph to clearly illustrate the welfa

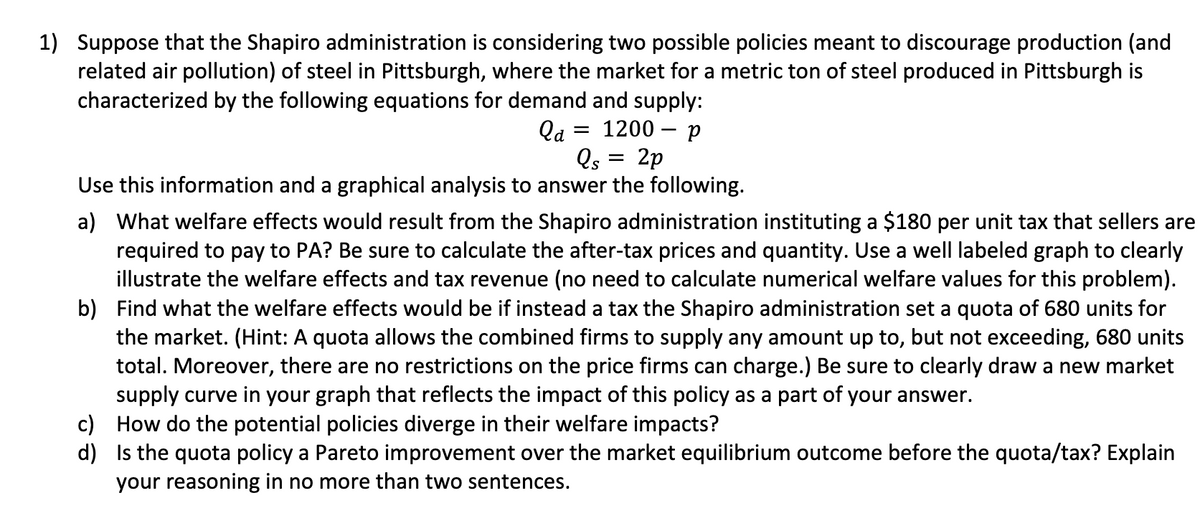

Suppose that the Shapiro administration is considering two possible policies meant to discourage production (and

related air pollution) of steel in Pittsburgh, where the market for a metric ton of steel produced in Pittsburgh is

characterized by the following equations for demand and supply:

?? = 1200 − ?

?? = 2?

Use this information and a graphical analysis to answer the following.

a) What welfare effects would result from the Shapiro administration instituting a $180 per unit tax that sellers are

required to pay to PA? Be sure to calculate the after-tax prices and quantity. Use a well labeled graph to clearly

illustrate the welfare effects and tax revenue (no need to calculate numerical welfare values for this problem).

b) Find what the welfare effects would be if instead a tax the Shapiro administration set a quota of 680 units for

the market. (Hint: A quota allows the combined firms to supply any amount up to, but not exceeding, 680 units

total. Moreover, there are no restrictions on the price firms can charge.) Be sure to clearly draw a new market

supply curve in your graph that reflects the impact of this policy as a part of your answer.

c) How do the potential policies diverge in their welfare impacts?

d) Is the quota policy a Pareto improvement over the

your reasoning in no more than two sentences

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images