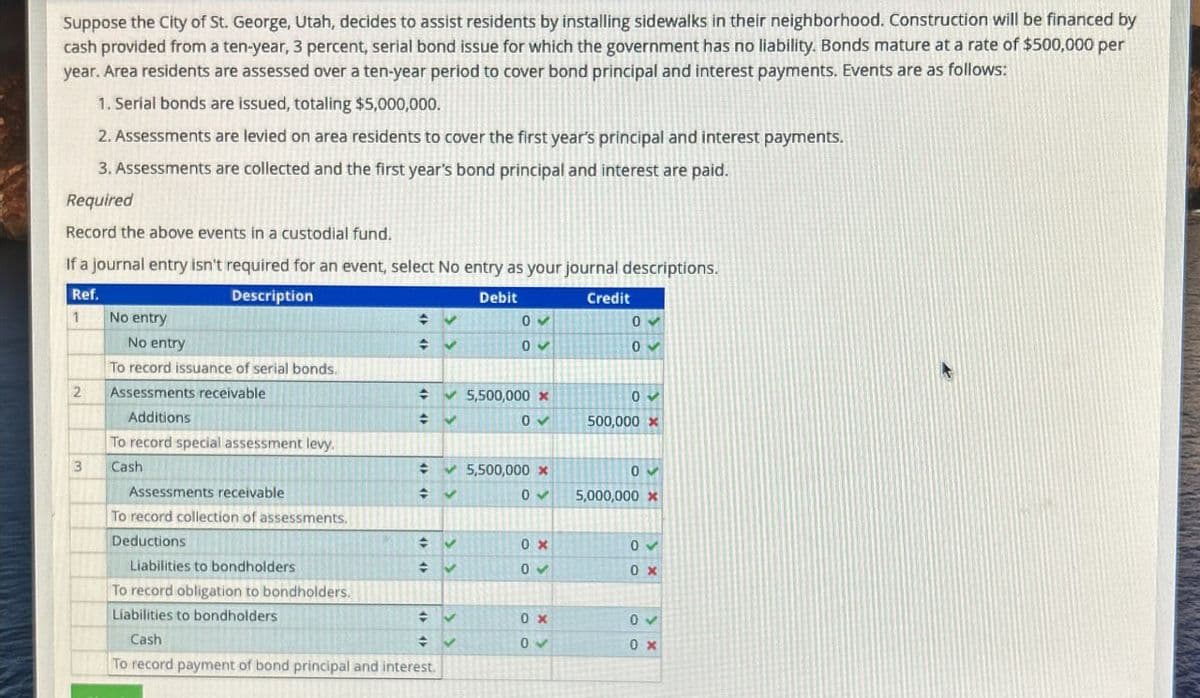

Suppose the City of St. George, Utah, decides to assist residents by installing sidewalks in their neighborhood. Construction will be financed by cash provided from a ten-year, 3 percent, serial bond issue for which the government has no liability. Bonds mature at a rate of $500,000 per year. Area residents are assessed over a ten-year period to cover bond principal and interest payments. Events are as follows: 1. Serial bonds are issued, totaling $5,000,000. 2. Assessments are levied on area residents to cover the first year's principal and interest payments. 3. Assessments are collected and the first year's bond principal and interest are paid. Required Record the above events in a custodial fund. If a journal entry isn't required for an event, select No entry as your journal descriptions. Ref. Description 1 No entry No entry Debit Credit 0 0 0 0 To record issuance of serial bonds. 2 Additions Assessments receivable To record special assessment levy. 3 Cash Assessments receivable 5,500,000 × 0 03 500,000 x 5,500,000 x 0✔ 0~ 5,000,000 x To record collection of assessments. Deductions ÷ 0 x 0✓ Liabilities to bondholders 03 0x To record obligation to bondholders. Liabilities to bondholders ÷ 0x Cash ÷ 0✓ 0% To record payment of bond principal and interest.

Suppose the City of St. George, Utah, decides to assist residents by installing sidewalks in their neighborhood. Construction will be financed by cash provided from a ten-year, 3 percent, serial bond issue for which the government has no liability. Bonds mature at a rate of $500,000 per year. Area residents are assessed over a ten-year period to cover bond principal and interest payments. Events are as follows: 1. Serial bonds are issued, totaling $5,000,000. 2. Assessments are levied on area residents to cover the first year's principal and interest payments. 3. Assessments are collected and the first year's bond principal and interest are paid. Required Record the above events in a custodial fund. If a journal entry isn't required for an event, select No entry as your journal descriptions. Ref. Description 1 No entry No entry Debit Credit 0 0 0 0 To record issuance of serial bonds. 2 Additions Assessments receivable To record special assessment levy. 3 Cash Assessments receivable 5,500,000 × 0 03 500,000 x 5,500,000 x 0✔ 0~ 5,000,000 x To record collection of assessments. Deductions ÷ 0 x 0✓ Liabilities to bondholders 03 0x To record obligation to bondholders. Liabilities to bondholders ÷ 0x Cash ÷ 0✓ 0% To record payment of bond principal and interest.

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter11: Linear Optimization Models

Section: Chapter Questions

Problem 11P: The employee credit union at State University is planning the allocation of funds for the coming...

Related questions

Question

Transcribed Image Text:Suppose the City of St. George, Utah, decides to assist residents by installing sidewalks in their neighborhood. Construction will be financed by

cash provided from a ten-year, 3 percent, serial bond issue for which the government has no liability. Bonds mature at a rate of $500,000 per

year. Area residents are assessed over a ten-year period to cover bond principal and interest payments. Events are as follows:

1. Serial bonds are issued, totaling $5,000,000.

2. Assessments are levied on area residents to cover the first year's principal and interest payments.

3. Assessments are collected and the first year's bond principal and interest are paid.

Required

Record the above events in a custodial fund.

If a journal entry isn't required for an event, select No entry as your journal descriptions.

Ref.

Description

1

No entry

No entry

Debit

Credit

0

0

0

0

To record issuance of serial bonds.

2

Additions

Assessments receivable

To record special assessment levy.

3

Cash

Assessments receivable

5,500,000 ×

0

03

500,000 x

5,500,000 x

0✔

0~

5,000,000 x

To record collection of assessments.

Deductions

÷

0 x

0✓

Liabilities to bondholders

03

0x

To record obligation to bondholders.

Liabilities to bondholders

÷

0x

Cash

÷

0✓

0%

To record payment of bond principal and interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning