Information for a company's Investment centers follows. Investment Center Mobile devices Customer support Income $309,400 223,600 Sales $ 3,739,000 1,789,000 Average Assets $ 1,700,000 1,300,000 Enter answers in the tabs below. Required 1 Required 2 Required 3 Assuming a target income of 10% of average assets, compute each center's residual income and determine which the higher residual income. Income Investment Center Mobile devices 5 309,400 S Customer support 223,500 Residual income Which center generated the higher residual income? Required 2 > Information for a company's Investment centers follows. Investment Center Mobile devices Customer support Income $ 309,400 223,600 Sales $3,739,000 1,789,000 Average Assets $1,700,000 1,300,000 Enter answers in the tabs below. 2 Required 3 Required 1 Required 2 Compute each center's return on investment and determine which is most efficient at using assets to make income, based on return on investment. Mobile devices Customer support Most efficient center Numerator: Return on Investment Denominator Return on Investment

Information for a company's Investment centers follows. Investment Center Mobile devices Customer support Income $309,400 223,600 Sales $ 3,739,000 1,789,000 Average Assets $ 1,700,000 1,300,000 Enter answers in the tabs below. Required 1 Required 2 Required 3 Assuming a target income of 10% of average assets, compute each center's residual income and determine which the higher residual income. Income Investment Center Mobile devices 5 309,400 S Customer support 223,500 Residual income Which center generated the higher residual income? Required 2 > Information for a company's Investment centers follows. Investment Center Mobile devices Customer support Income $ 309,400 223,600 Sales $3,739,000 1,789,000 Average Assets $1,700,000 1,300,000 Enter answers in the tabs below. 2 Required 3 Required 1 Required 2 Compute each center's return on investment and determine which is most efficient at using assets to make income, based on return on investment. Mobile devices Customer support Most efficient center Numerator: Return on Investment Denominator Return on Investment

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter14: Decentralized Operations

Section: Chapter Questions

Problem 14.11E

Related questions

Question

need these

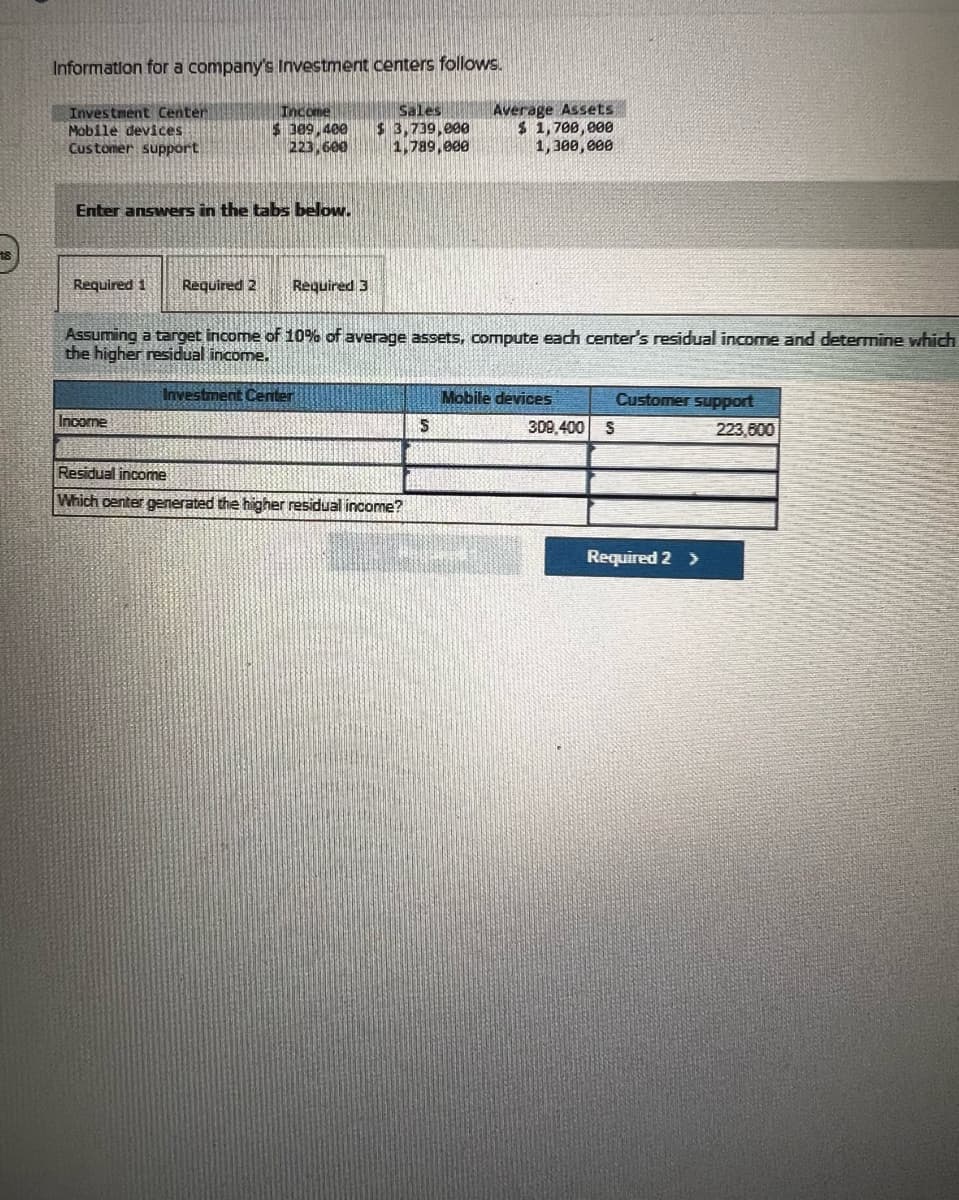

Transcribed Image Text:Information for a company's Investment centers follows.

Investment Center

Mobile devices

Customer support

Income

$309,400

223,600

Sales

$ 3,739,000

1,789,000

Average Assets

$ 1,700,000

1,300,000

Enter answers in the tabs below.

Required 1 Required 2 Required 3

Assuming a target income of 10% of average assets, compute each center's residual income and determine which

the higher residual income.

Income

Investment Center

Mobile devices

5

309,400

S

Customer support

223,500

Residual income

Which center generated the higher residual income?

Required 2 >

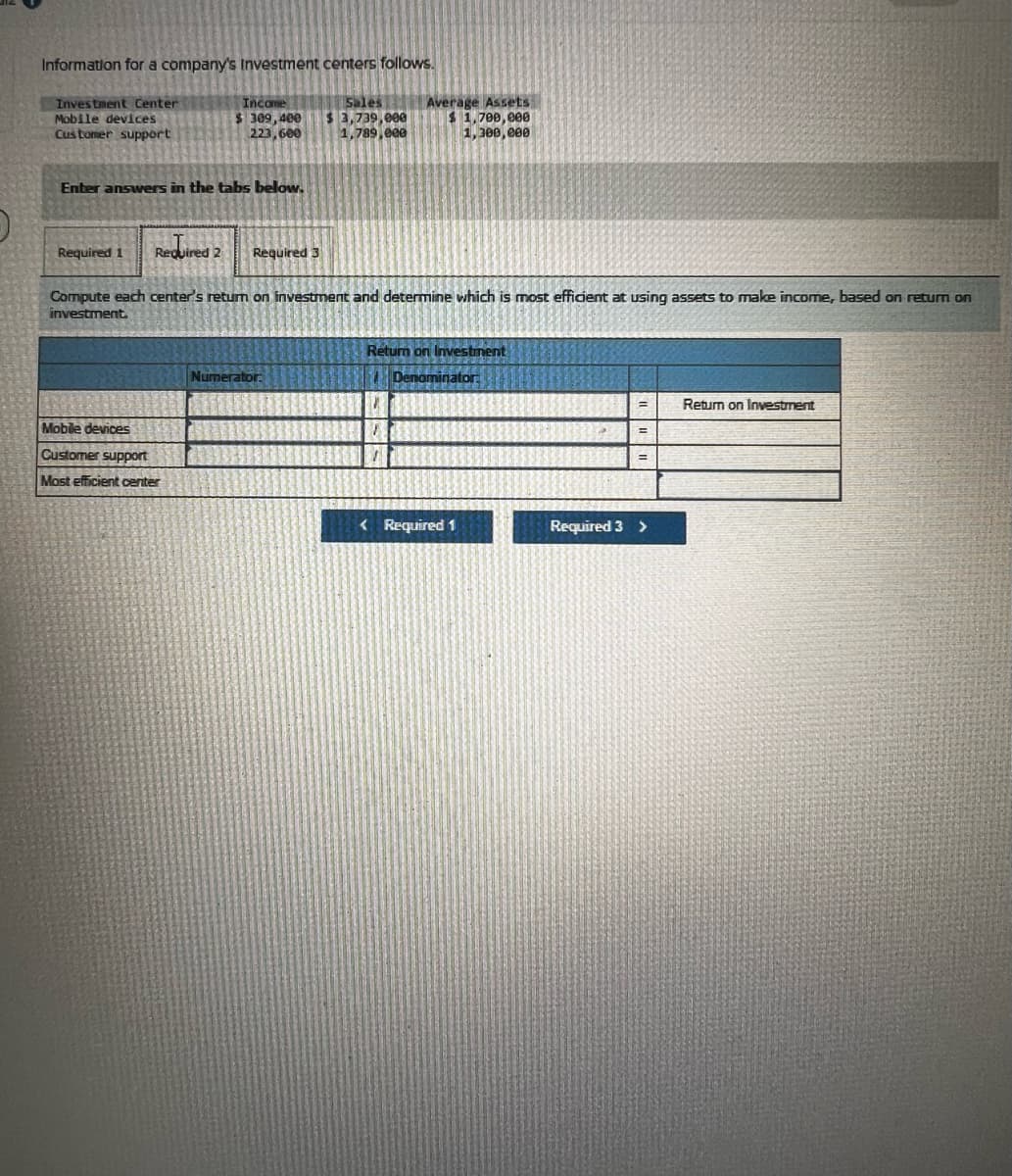

Transcribed Image Text:Information for a company's Investment centers follows.

Investment Center

Mobile devices

Customer support

Income

$ 309,400

223,600

Sales

$3,739,000

1,789,000

Average Assets

$1,700,000

1,300,000

Enter answers in the tabs below.

2

Required 3

Required 1 Required 2

Compute each center's return on investment and determine which is most efficient at using assets to make income, based on return on

investment.

Mobile devices

Customer support

Most efficient center

Numerator:

Return on Investment

Denominator

<Required 1

Required 3 >

Return on Investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning