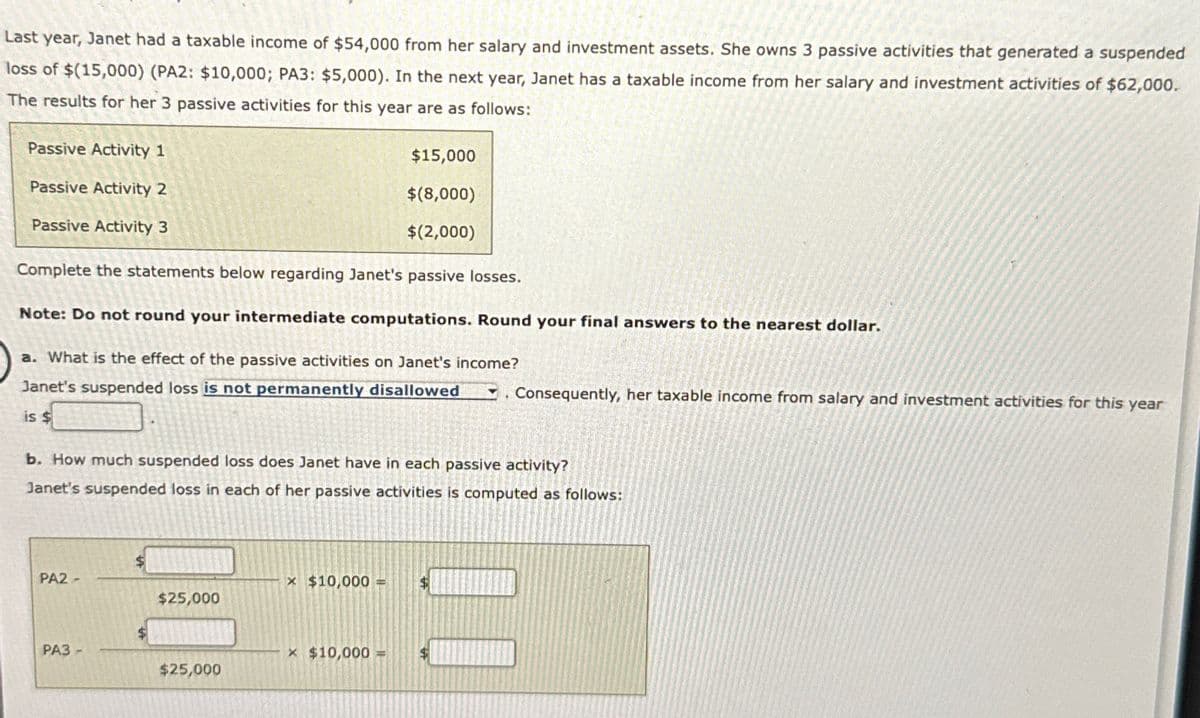

Last year, Janet had a taxable income of $54,000 from her salary and investment assets. She owns 3 passive activities that generated a suspended loss of $(15,000) (PA2: $10,000; PA3: $5,000). In the next year, Janet has a taxable income from her salary and investment activities of $62,000. The results for her 3 passive activities for this year are as follows: Passive Activity 1 Passive Activity 2 Passive Activity 3 $15,000 $(8,000) $(2,000) Complete the statements below regarding Janet's passive losses. Note: Do not round your intermediate computations. Round your final answers to the nearest dollar. a. What is the effect of the passive activities on Janet's income? Janet's suspended loss is not permanently disallowed Consequently, her taxable income from salary and investment activities for this year is $ b. How much suspended loss does Janet have in each passive activity? Janet's suspended loss in each of her passive activities is computed as follows: PA2- × $10,000 = $ $25,000 PA3- × $10,000 $25,000

Last year, Janet had a taxable income of $54,000 from her salary and investment assets. She owns 3 passive activities that generated a suspended loss of $(15,000) (PA2: $10,000; PA3: $5,000). In the next year, Janet has a taxable income from her salary and investment activities of $62,000. The results for her 3 passive activities for this year are as follows: Passive Activity 1 Passive Activity 2 Passive Activity 3 $15,000 $(8,000) $(2,000) Complete the statements below regarding Janet's passive losses. Note: Do not round your intermediate computations. Round your final answers to the nearest dollar. a. What is the effect of the passive activities on Janet's income? Janet's suspended loss is not permanently disallowed Consequently, her taxable income from salary and investment activities for this year is $ b. How much suspended loss does Janet have in each passive activity? Janet's suspended loss in each of her passive activities is computed as follows: PA2- × $10,000 = $ $25,000 PA3- × $10,000 $25,000

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 34P

Related questions

Question

100%

Transcribed Image Text:Last year, Janet had a taxable income of $54,000 from her salary and investment assets. She owns 3 passive activities that generated a suspended

loss of $(15,000) (PA2: $10,000; PA3: $5,000). In the next year, Janet has a taxable income from her salary and investment activities of $62,000.

The results for her 3 passive activities for this year are as follows:

Passive Activity 1

Passive Activity 2

Passive Activity 3

$15,000

$(8,000)

$(2,000)

Complete the statements below regarding Janet's passive losses.

Note: Do not round your intermediate computations. Round your final answers to the nearest dollar.

a. What is the effect of the passive activities on Janet's income?

Janet's suspended loss is not permanently disallowed

Consequently, her taxable income from salary and investment activities for this year

is $

b. How much suspended loss does Janet have in each passive activity?

Janet's suspended loss in each of her passive activities is computed as follows:

PA2-

× $10,000 = $

$25,000

PA3-

× $10,000

$25,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT