Suppose the comparative balance sheets of Nike, Inc. are presented here. Nike, Inc. Comparative Balance Sheets May 31 ($ in millions) 2020 2019 Assets Current assets $ 9,040 $ 8,000 Property, plant, and equipment (net) 2,100 2,000 Other assets 1,710 1,900 Total assets $ 12,850 $ 11,900 Liabilities and Stockholders’ Equity Current liabilities $ 3,069 $ 3,100 Long-term liabilities 1,209 1,300 Stockholders’ equity 8,572 7,500 Total liabilities and stockholders’ equity $ 12,850 $ 11,900 (a) Prepare a horizontal analysis of the balance sheet data for Nike, using 2019 as a base. (Show the amount of increase or decrease as well.) (Enter amounts in millions. Enter negative amounts and percentages using either a negative sign preceding the number e.g. -45, -45% or parentheses e.g. (45), (45%). Round percentages to 1 decimal place, e.g. 12.3%.)

Suppose the comparative balance sheets of Nike, Inc. are presented here. Nike, Inc. Comparative Balance Sheets May 31 ($ in millions) 2020 2019 Assets Current assets $ 9,040 $ 8,000 Property, plant, and equipment (net) 2,100 2,000 Other assets 1,710 1,900 Total assets $ 12,850 $ 11,900 Liabilities and Stockholders’ Equity Current liabilities $ 3,069 $ 3,100 Long-term liabilities 1,209 1,300 Stockholders’ equity 8,572 7,500 Total liabilities and stockholders’ equity $ 12,850 $ 11,900 (a) Prepare a horizontal analysis of the balance sheet data for Nike, using 2019 as a base. (Show the amount of increase or decrease as well.) (Enter amounts in millions. Enter negative amounts and percentages using either a negative sign preceding the number e.g. -45, -45% or parentheses e.g. (45), (45%). Round percentages to 1 decimal place, e.g. 12.3%.)

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 30E

Related questions

Question

100%

Suppose the comparative balance sheets of Nike, Inc. are presented here.

|

Nike, Inc.

Comparative Balance Sheets May 31 ($ in millions) |

||||

|---|---|---|---|---|

|

2020

|

2019

|

|||

| Assets | ||||

|

Current assets

|

$ 9,040 | $ 8,000 | ||

|

Property, plant, and equipment (net)

|

2,100 | 2,000 | ||

|

Other assets

|

1,710 | 1,900 | ||

|

Total assets

|

$ 12,850 | $ 11,900 | ||

| Liabilities and |

||||

|

Current liabilities

|

$ 3,069 | $ 3,100 | ||

|

Long-term liabilities

|

1,209 | 1,300 | ||

|

Stockholders’ equity

|

8,572 | 7,500 | ||

|

Total liabilities and stockholders’ equity

|

$ 12,850 | $ 11,900 |

(a)

Prepare a horizontal analysis of the

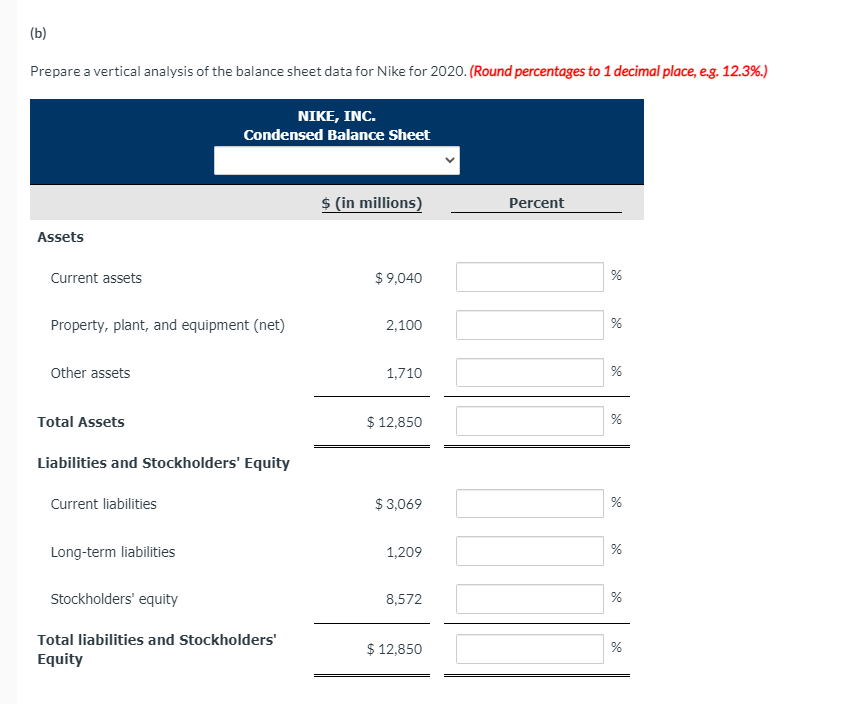

Transcribed Image Text:(b)

Prepare a vertical analysis of the balance sheet data for Nike for 2020. (Round percentages to 1 decimal place, e.g. 12.3%.)

NIKE, INC.

Condensed Balance Sheet

$ (in millions)

Percent

Assets

Current assets

$ 9,040

Property, plant, and equipment (net)

2,100

Other assets

1,710

Total Assets

$ 12,850

%

Liabilities and Stockholders' Equity

Current liabilities

$ 3,069

%

Long-term liabilities

1,209

Stockholders' equity

8,572

Total liabilities and Stockholders'

$ 12,850

%

Equity

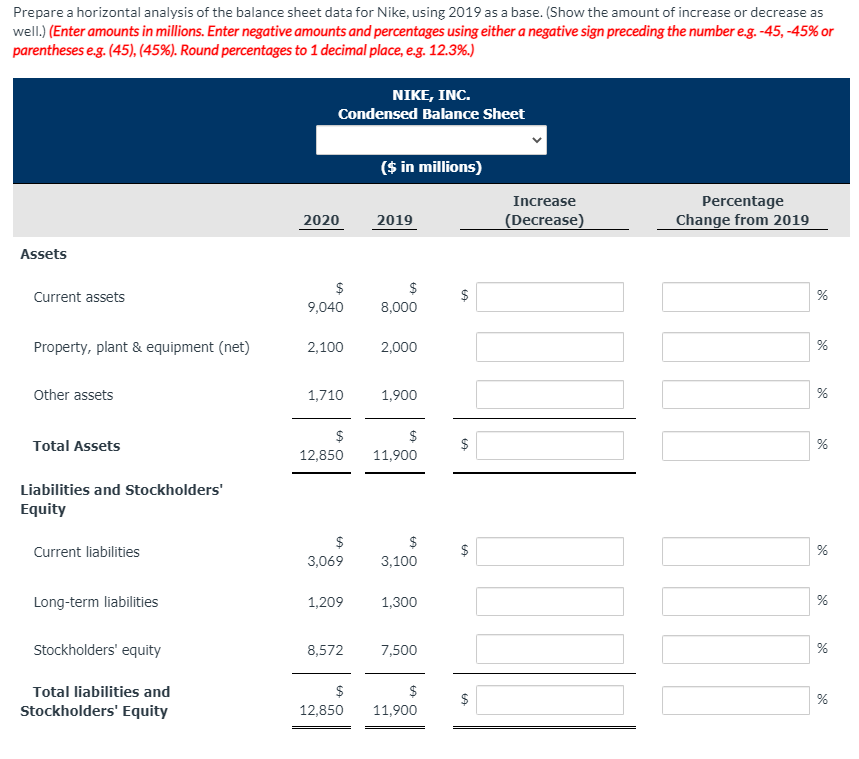

Transcribed Image Text:Prepare a horizontal analysis of the balance sheet data for Nike, using 2019 as a base. (Show the amount of increase or decrease as

well.) (Enter amounts in millions. Enter negative amounts and percentages using either a negative sign preceding the number eg. -45, -45% or

parentheses e.g. (45), (45%). Round percentages to 1 decimal place, e.g. 12.3%.)

NIKE, INC.

Condensed Balance Sheet

($ in millions)

Percentage

Change from 2019

Increase

2020

2019

(Decrease)

Assets

$

$

Current assets

%

9,040

8,000

Property, plant & equipment (net)

2,100

2,000

Other assets

1,710

1,900

$

$

Total Assets

$

%

12,850

11,900

Liabilities and Stockholders'

Equity

$

$

Current liabilities

$

%

3,069

3,100

Long-term liabilities

1,209

1,300

%

Stockholders' equity

8,572

7,500

%

Total liabilities and

$

$

Stockholders' Equity

12,850

11,900

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning