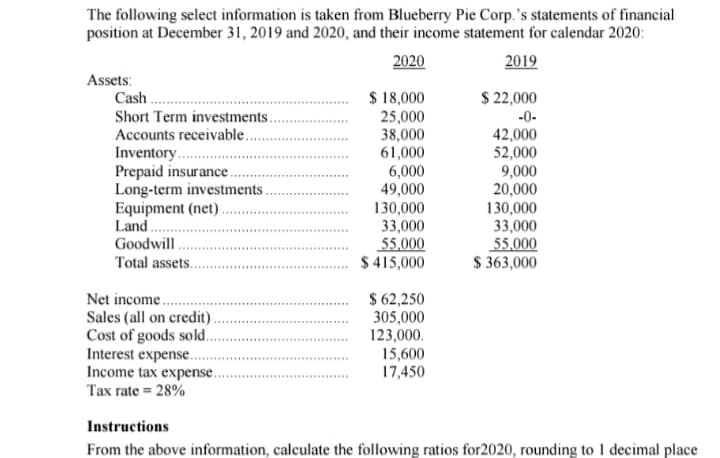

The following select information is taken from Blueberry Pie Corp.'s statements of financial position at December 31, 2019 and 2020, and their income statement for calendar 2020: 2020 2019 Assets: Cash. $ 18,000 25,000 38,000 61,000 6,000 49,000 130,000 33,000 55,000 $ 415,000 $ 2,000 -0- 42,000 52,000 9,000 20,000 130,000 33,000 55,000 $ 363,000 Short Term investments. Accounts receivable.. Inventory... Prepaid insurance. Long-term investments. Equipment (net). Land.. Goodwill. Total assets.. $ 62,250 305,000 123,000. Net income.. Sales (all on credit). Cost of goods sold.. Interest expense. Income tax expense. Tax rate = 28% 15,600 17,450 ......... Instructions From the above information, calculate the following ratios for2020, rounding to I decimal place

The following select information is taken from Blueberry Pie Corp.'s statements of financial position at December 31, 2019 and 2020, and their income statement for calendar 2020: 2020 2019 Assets: Cash. $ 18,000 25,000 38,000 61,000 6,000 49,000 130,000 33,000 55,000 $ 415,000 $ 2,000 -0- 42,000 52,000 9,000 20,000 130,000 33,000 55,000 $ 363,000 Short Term investments. Accounts receivable.. Inventory... Prepaid insurance. Long-term investments. Equipment (net). Land.. Goodwill. Total assets.. $ 62,250 305,000 123,000. Net income.. Sales (all on credit). Cost of goods sold.. Interest expense. Income tax expense. Tax rate = 28% 15,600 17,450 ......... Instructions From the above information, calculate the following ratios for2020, rounding to I decimal place

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 15E

Related questions

Question

Transcribed Image Text:The following select information is taken from Blueberry Pie Corp.'s statements of financial

position at December 31, 2019 and 2020, and their income statement for calendar 2020:

2020

2019

Assets:

Cash

Short Term investments..

Accounts receivable...

Inventory..

Prepaid insurance.

Long-term investments .

Equipment (net)..

Land..

$ 18,000

25,000

38,000

61,000

6,000

49,000

130,000

33,000

55,000

$ 415,000

$ 22,000

-0-

42,000

52,000

9,000

20,000

130,000

33,000

55,000

$ 363,000

Goodwill.

Total assets.

$ 62,250

305,000

123,000.

15,600

17,450

Net income..

Sales (all on credit).

Cost of goods sol..

Interest expense..

Income tax expense.

Tax rate = 28%

Instructions

From the above information, calculate the following ratios for2020, rounding to 1 decimal place

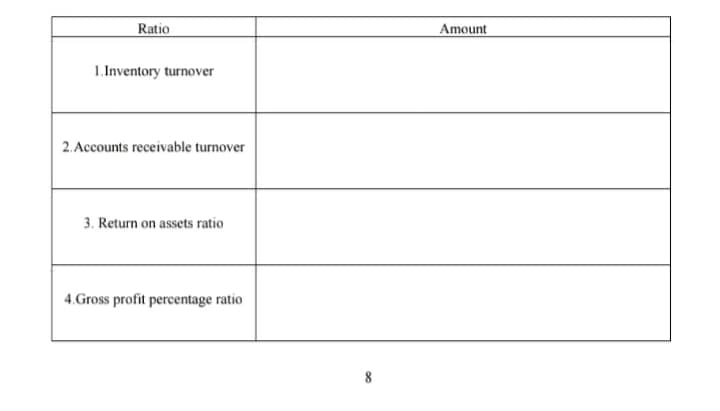

Transcribed Image Text:Ratio

Amount

1.Inventory turnover

2. Accounts receivable turnover

3. Return on assets ratio

4.Gross profit percentage ratio

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning