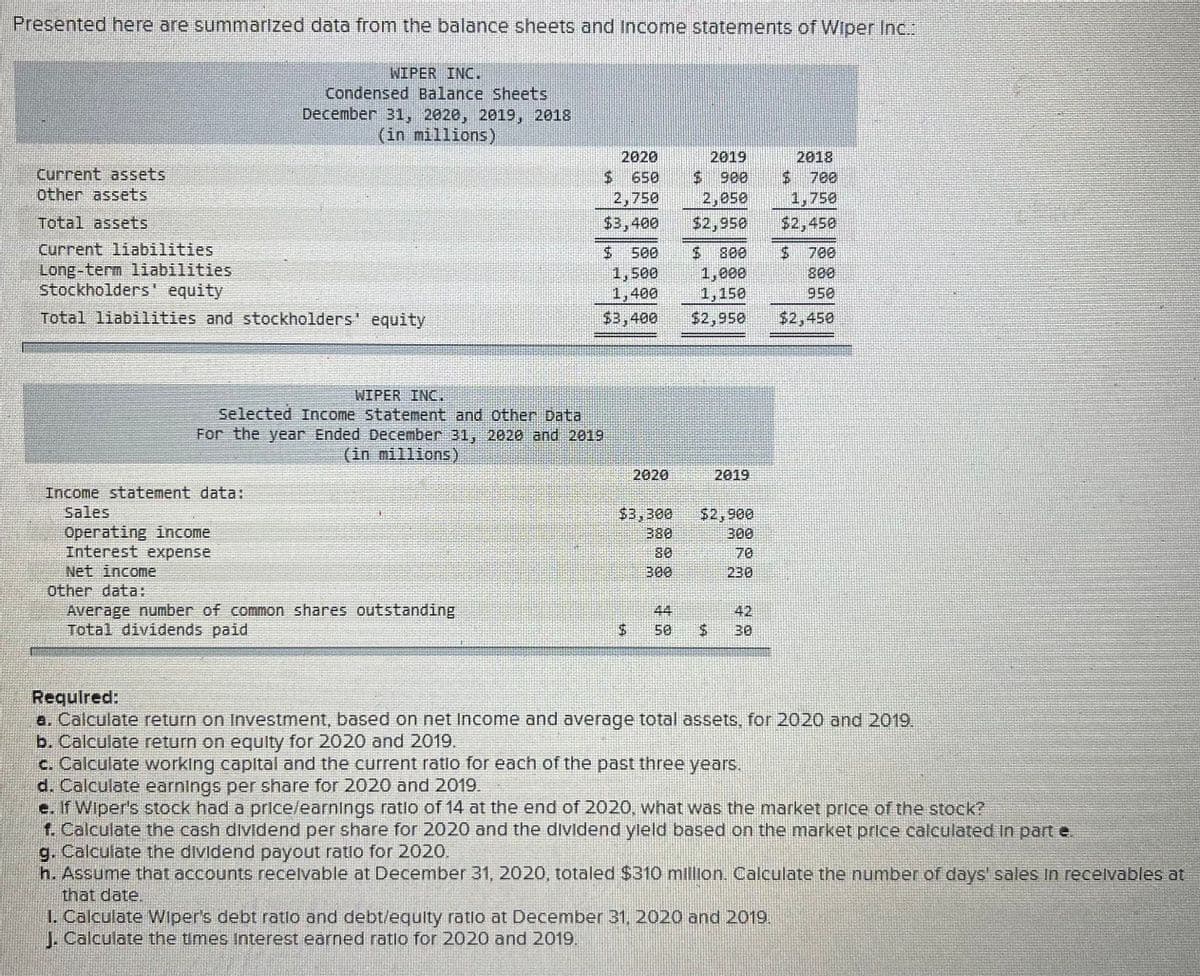

Presented here are summarized data from the balance sheets and Income statements of Wiper Inc.: WIPER INC. Condensed Balance Sheets December 31, 2020, 2019, 2018 (in millions) 2020 $ 650 2019 2018 Current assets other assets $ 900 2,050 24 700 2,750 $3,400 1,750 $2,450 Total assets $2,950 Current liabilities $ 500 1,500 1,400 800 $ 700 Long-term liabilities stockholders' equity 1,000 1,150 800 950 Total liabilities and stockholders' equity $3,400 $2,950 $2,450 WIPER INC. selected Income statement and other Data For the year Ended December 31, 2020 and 2019 (in millions) 2020 2019 Income statement data: Sales Operating income Interest expense Net income $3,300 $2,900 300 380 80 70 300 230 other data: Average number of common shares outstanding Total dividends paid 44 42 24 50 $4 30

Presented here are summarized data from the balance sheets and Income statements of Wiper Inc.: WIPER INC. Condensed Balance Sheets December 31, 2020, 2019, 2018 (in millions) 2020 $ 650 2019 2018 Current assets other assets $ 900 2,050 24 700 2,750 $3,400 1,750 $2,450 Total assets $2,950 Current liabilities $ 500 1,500 1,400 800 $ 700 Long-term liabilities stockholders' equity 1,000 1,150 800 950 Total liabilities and stockholders' equity $3,400 $2,950 $2,450 WIPER INC. selected Income statement and other Data For the year Ended December 31, 2020 and 2019 (in millions) 2020 2019 Income statement data: Sales Operating income Interest expense Net income $3,300 $2,900 300 380 80 70 300 230 other data: Average number of common shares outstanding Total dividends paid 44 42 24 50 $4 30

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.4C

Related questions

Question

100%

Transcribed Image Text:Presented here are summarized data from the balance sheets and Income statements of Wiper Inc.:

WIPER INC.

Condensed Balance Sheets

December 31, 2020, 2019, 2018

(in millions)

2019

$ 900

2,050

$2,950

2018

$700

2020

Current assets

other assets

$ 650

2,750

$3,400

1,750

$2,450

Total assets

Current liabilities

Long-term 1iabilities

Stockholders' equity

$ 700

800

500

800

1,500

1,400

$3,400

1,000

1,150

$2,950

950

Total liabilities and stockholders equity

$2,450

WIPER INC.

Selected Income Statement and other Data

For the year Ended December 31, 2020 and 2019

(in millions)

2020

2019

Income statement data:

Sales

$3,300

380

80

300

$2,900

300

Operating income

Interest expense

Net income

other data:

Average number of common shares outstanding

Total dividends paid

70

230

44

42

50

30

Requlred:

a. Calculate return on Investment, based on net Income and average total assets, for 2020 and 2019.

b. Calculate return on equlty for 2020 and 2019.

c. Calculate working capital and the current ratlo for each of the past three years.

d. Calculate earnings per share for 2020 and 2019.

e. If Wiper's stock had a price/earnings ratlo of 14 at the end of 2020, what was the market price of the stock?

f. Calculate the cash dividend per share for 2020 and the dividend yleld based on the market price calculated In part e.

g. Calculate the dividend payout ratlo for 2020.

h. Assume that accounts recelvable at December 31, 2020, totaled $310 million. Calculate the number of days' sales In recelvables at

that date.

L. Calculate Wiper's debt ratlo and debt/equlty ratlo at December 31, 2020 and 2019.

J. Calculate the times Interest earned ratlo for 2020 and 2019.

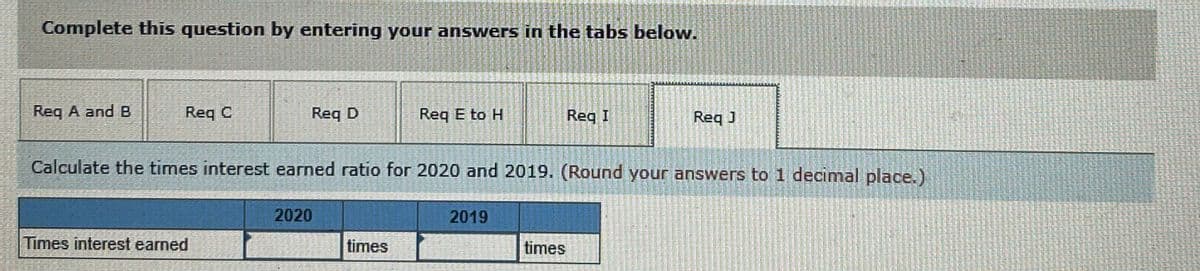

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Reg A and B

Req C

Req D

Req E to H

Reg I

Req J

Calculate the times interest earned ratio for 2020 and 2019. (Round your answers to 1 decimal place.)

2020

2019

Times interest earned

times

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College