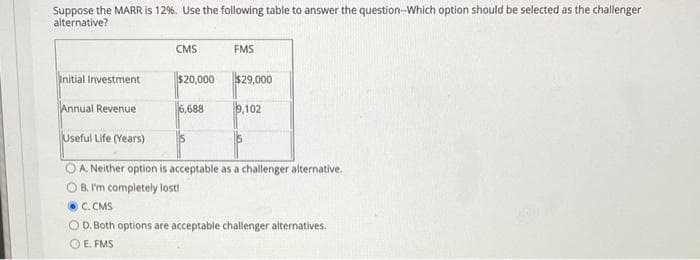

Suppose the MARR is 12%. Use the following table to answer the question-Which option should be selected as the challenger alternative? CMS FMS nitial Investment $20,000 $29,000 Annual Revenue 6,688 9,102 Useful Life (Years)

Q: Wayne Company is considering a long-term investment project called ZIP. ZIP will require an…

A: IRR calculated using excel. So IRR is in between 12% and 13%

Q: A company that manufactures rigid shaft couplings has $600,000 to invest. The company is considering…

A: The overall return generated by an organization by investing in various projects/asset class is…

Q: Project L costs $40,000, its expected cash inflows are $8,000 per year for 8 years, and its WACC is…

A: Investment appraisal techniques are used while investing in any project. These techniques tell us…

Q: Data for two alternatives are as follows: A в INVESTMENT 35,000 50,000 ANNUAL BENEFITS 20,000 25,000…

A: IRR: In capital budgeting, the internal rate of return, or IRR, is a metric that is used to assess…

Q: Complete the following analysis of investment alternatives and select the preferred alternative. The…

A: The present value is the value of the sum received at time 0 or the current period. It is the value…

Q: Which alternative in the table below should be selected when the MARR = 5% per year? The life of…

A: Given information : Year (A-DN) (B-A) (C-B) (D-C) 0 $ (800.00) $ (500.00) $ (1,200.00) $…

Q: Compare the alternatives shown below on the basis of their present worth, using an interest rate of…

A: Capital budgeting is a financial tool that helps to evaluate a capital investment's profitability…

Q: Wayne Company is considering a long-term investment project cll useful life of 4 years and no…

A: Solution: Initial investment = $112,860 Net annual cash inflows = Increase in annual cash inflows -…

Q: For the following table, assume a MARR of 10% per year and a useful life for each alternative of six…

A: IRR in the rate of return a project generates in its lifetime. It is expressed in annual terms. IRR…

Q: A project has an initial cost of $90,400, a life of 9 years, and equal annual cash inflows. The…

A: The term profitability index is used to access the attractiveness of a project. The profitability…

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: Internal Rate of Return: When evaluating projects or investments, the internal rate of return is…

Q: Which alternative in the table below should be selected when the MARR = 4% per year? The life of…

A: IRR is a rate at which NPV of the project is equal to the zero or it can be said that PV of cash…

Q: An investment has an initial cost of $410,000 and will generate the net income amounts shown below.…

A: Average Accounting Rate of Return (ARR) = Average Annual Profit / Average Investment

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: Here, Useful Life of all investment is 10 years MARR is 20% Details of Alternative A: Capital…

Q: You are faced with a decision on an investment proposal. Specifically, the estimated additional…

A: Capital Budgeting and capital budgeting techniques: The process of evaluating several prospective…

Q: ur goal is to be able to withdraw $5,000 for each of the next ten years beginning one year from toda…

A: The amount that needs to be invested today Amount of withdrawal * cumulative present value factor…

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub parts for…

Q: Lily Company is considering investing P8,000,000 in a project, for a required return of 9%. The…

A: The payback period indicates the time period under which the initial investment or initial outlay is…

Q: Cooper Industries is considering a project that would require an initial investment of P235,000. The…

A: IRR is the modern technique of capital budgeting. It helps in choosing the most feasible and…

Q: The Corporation is considering two alternative investment proposals with the following data: …

A: Solution:- Calculation of the accounting rate of return for Proposal X as follows under:-

Q: George Company is evaluating two mutually exclusive projects with 3-year lives. Each project…

A: Under the capital budgeting technique, the projects are evaluated on the basis of different methods.…

Q: Para Co. is reviewing the following data relating to an energy saving investment proposal: Cost…

A:

Q: HW-Chp-8-1: A company is considering the following projects. If the MARR is 1 % / monthicompounded…

A: Capital budgeting is the process by which a corporation examines potential large projects or…

Q: XYZ is considering a 3-yr project. The initial outlay is -$120,000, annual cash flow is $50,000 and…

A: Calculation of Net present value (NPV):Answer:Net present value (NPV) is $4,988.13

Q: Apply incremental B/C analysis at an interest rate of 8% per year to determine which alternative…

A: The relation between the cost of the project and the benefits from the project is known as…

Q: Compare alternatives A and B with the equivalent worth method of your choice if the MARR is 15% per…

A: Equivalent annual worth analysis is one of the most used analysis techniques for the evaluation of…

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: IRR -Internal rate of return It is the discount rate which makes net present value (NPV) of a…

Q: Consider the three small mutually exclusive investment alternatives in the table below. The feasible…

A: As per bartlebyguidelines, "Since you have posted a question with multiple sub-parts, we will solve…

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: The capital budgeting is a technique that helps to analyze the profitability of the project.

Q: A company with a required rate of return of 12 percent is considering a project with an RM40,000…

A: IRR is the internal rate of return for a project. It is that rate at which the present value of the…

Q: An investment has an initial cost of $3.2 million. This investment will be depreciated by $900,000 a…

A: The average accounting return or average rate of return is an accounting metric which helps in…

Q: Raysut cement has taken up a new project with an initial investment of 125000 OMR.The expected…

A: Capital project appraisal involves the evaluation of profitability and liquidity position based on…

Q: Consider the three small mutually exclusive investment alternatives in the table below. The feasible…

A: As the cash flow is the same for the time period we can use the present value of the annuity so that…

Q: Alternative G has a first cost of $250,000 and annual costs of $73,000. Alternative H has a first…

A: The present value is the value of the sum received at time 0. It is the current value of the sum…

Q: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each…

A: MARR = 20℅ Cash flows: Year Project A Project B Project C Reference 0 -28000 -55000 -40000…

Q: XYZ is considering a 3-yr project. The initial outlay is -$120,000, annual cash flow is $50,000 and…

A: The NPV can be calculated with the help of present value of all cash flows.

Q: A firm must decide between two designs A and B. Their effective income rate is 50%. If the desired…

A: Explanation : NPV method is a capital budgeting technique which help in decision making of project…

Q: u) Project P rcquires an mvcsiment of $95,000 and is expecled lo pro of $20,000 per year for 8…

A: (a): Payback = initial investment/annual cash flow

Q: Flextire Manufacturing is considering two mutually exclusive proposals. Each will cost $80,000 and…

A: Problem solving or decision making is done with a structured non-parametric approach is known as…

Q: Which altenative in the table below should be selected when the MARR = 4% per year? The life of each…

A: MARR = 4% Time Period = 10 Years Increment Considered Δ(A-DN) Δ(B-A) Δ(C-B) Δ(D-C) Δ Investment…

Q: Sierra Company is considering a long-term investment project called ZIP. ZIP will require an…

A: Solution:- We know, Internal Rate of Return (IRR) is the rate of return the project is yielding ie.…

Q: &takeAssignmentSessionLocator=D&inpro... to ... Determine the average rate of return for a project…

A: Average rate of return on project means how much net income is generated by investing a particular…

Q: Your goal is to be able to withdraw $4,800 for each of the next seven years beginning one year from…

A: Amount need to be invested today = Annual amount withdrawal x Present value factor (12%, 7 years)

Q: An investment of s80.000 is expected to generate a net annuol income of $27,000 for 5 years f the…

A: Investment = 80,000 Net Annual Income = 27,000 for 5 years MARR = 13% Total Time Period = 20 years…

Q: George Company is evaluating two mutually exclusive projects with 3-year lives. Each project…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: man investment project, the initial cost of investment is $400,000. The annual revenues are expected…

A: We will have to use different tools of capital budgeting here. Simple payback and the internal rate…

Q: You are considering a five-year project with initial investment of $40,446.46. The required return…

A: The net present value is the technique of evaluation of the performance of long-term capital…

Not use excel

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of 150,000 and will operate for five years. The cash flows associated with these projects are as follows: Statens required rate of return is 10%. Using the net present value method and the present value table provided in Appendix A, which of the following actions would you recommend to Staten? a. Accept Project X and reject Project Y. b. Accept Project Y and reject Project X. c. Accept Projects X and Y. d. Reject Projects X and Y.Redbird Company is considering a project with an initial investment of $265,000 in new equipment that will yield annual net cash flows of $45,800 each year over its seven-year life. The companys minimum required rate of return is 8%. What is the internal rate of return? Should Redbird accept the project based on IRR?For the following table, assume a MARR of 15%per year and a useful life for each alternative of eightyears which equals the study period. The rank-orderof alternatives from least capital investment to greatestcapital investment is Z → Y → W → X. Completethe incremental analysis by selecting the preferredalternative. “Do nothing” is not an option. (6.4)FE PRACTICE PROBLEMS 307Z → Y Y → W W → X! Capital −$250 −$400 −$550investment! Annual cost 70 90 15savings! Market 100 50 200value! PW(15%) 97 20 ???(a) Alternative W (b) Alternative X(c) Alternative Y (d) Alternative ZThe following mutually exclusive investment alternatives have been presented to you.

- Project P has a cost of $1,000 and cash flows of $300 per year for3 years plus another $1,000 in Year 4. The project’s cost of capital is15%. What are P’s regular and discounted paybacks? (3.10, 3.55) Ifthe company requires a payback of 3 years or less, would the projectbe accepted? Would this be a good accept/reject decision, consideringthe NPV and/or the IRR? (NPV = $256.72, IRR =24.78%)Complete the following analysis of cost alternatives and select the preferred alternative. The study period is 10 years and the MARR=15%per year. "Do Nothing" is not an option. A B C D Capital investment $15,000 $15,900 $13,500 $18,000 Annual costs 240 310 450 90 Market value at EOY 10 900 1,250 1,750 2,000 FW (15%) −$64,656 −$69,369 ??? −$72,647 The FW of the alternative C is ... nothing.(Round to the nearest dollar.) Select the preferred alternative. Choose the correct answer below. A. Alternative D B. Alternative B C. Alternative C D. Alternative AThe following mutually exclusive investment alternatives have been presented to you. The life of all alternatives is 10 years. Use this information to solve, Using a MARR of 15%, the preferred Alternative is: (a) Do Nothing (b) Alternative A (c) Alternative B (d) Alternative C (e) Alternative D (f) Alternative E.

- Bausch Company is presented with the following two mutually exclusive projects. The required return for both projects is 20 percent. Year Project M Project N 0 –$139,000 –$356,000 1 63,600 152,000 2 81,600 181,000 3 72,600 137,000 4 58,600 111,000 a. What is the IRR for each project? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Which, if either, of the projects should the company accept?For the following table, assume a MARR of 15% per year and a useful life for each alternative of eight years which equals the study period. The rank-orderof alternatives from least capital investment to greatest capital investment is Z → Y → W → X. Complete the incremental analysis by selecting the preferred alternative. “Do nothing” is not an option. Solve, (a) Alternative W (b) Alternative X (c) Alternative Y (d) Alternative Z.Bausch Company is presented with the following two mutually exclusive projects. The required return for both projects is 20 percent. Year Project M Project N 0 -$142,000 -$363,000 1 64,300 148,500 2 82,300 188,000 3 73,300 133,500 4 59,300 118,000 a. What is the IRR for each project? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Which, if either, of the projects should the company accept? % a. Project M % Project N b. Project M Project N c. Accept project

- Consider the six indivisible investment alternatives shown below. The planning horizon is 8 years. The MARR is 15%. $60,000 is available for investment. a. Which investments should be made in order to maximize present worth? b. Solve part a when investments N and P are mutually exclusive and R is contingent on Q.Project P has a cost of $1,000 and cash flows of $300 per year for 3 years plus another$1,000 in Year 4. The project’s cost of capital is 15%. What are Project P’s regular anddiscounted paybacks? If the company requires a payback of 3 years orless, would the project be accepted? Would this be a good accept/reject decisionconsidering the NPV and/or the IRR?2. Your firm is considering the following 3 mutually exclusive alternatives. Interest rate is10%. A B CInitial Cost $35,000.00 $21,000.00 $42,000.00Annual Benefit $4,200.00 $3,300.00 $5,000.00Salvage value 0 $1,000 $1500Project life Forever 20 year 50 a. Calculate the Benefit-Cost ratio of each projectb. Which of the 3 alternatives should be selected using B/C ratio analysis (show yourwork)?