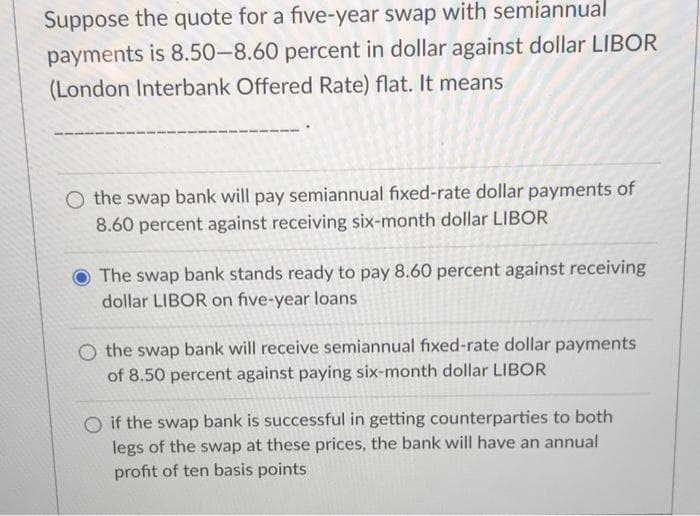

Suppose the quote for a five-year swap with semiannual payments is 8.50-8.60 percent in dollar against dollar LIBOR (London Interbank Offered Rate) flat. It means the swap bank will pay semiannual fixed-rate dollar payments of 8.60 percent against receiving six-month dollar LIBOR O The swap bank stands ready to pay 8.60 percent against receiving dollar LIBOR on five-year loans the swap bank will receive semiannual fixed-rate dollar payments of 8.50 percent against paying six-month dollar LIBOR O if the swap bank is successful in getting counterparties to both legs of the swap at these prices, the bank will have an annual profit of ten basis points

Suppose the quote for a five-year swap with semiannual payments is 8.50-8.60 percent in dollar against dollar LIBOR (London Interbank Offered Rate) flat. It means the swap bank will pay semiannual fixed-rate dollar payments of 8.60 percent against receiving six-month dollar LIBOR O The swap bank stands ready to pay 8.60 percent against receiving dollar LIBOR on five-year loans the swap bank will receive semiannual fixed-rate dollar payments of 8.50 percent against paying six-month dollar LIBOR O if the swap bank is successful in getting counterparties to both legs of the swap at these prices, the bank will have an annual profit of ten basis points

Chapter8: Relationships Among Inflation, Interest Rates, And Exchange Rates

Section: Chapter Questions

Problem 38QA

Related questions

Question

2

Transcribed Image Text:Suppose the quote for a five-year swap with semiannual

payments is 8.50-8.60 percent in dollar against dollar LIBOR

(London Interbank Offered Rate) flat. It means

O the swap bank will pay semiannual fixed-rate dollar payments of

8.60 percent against receiving six-month dollar LIBOR

O The swap bank stands ready to pay 8.60 percent against receiving

dollar LIBOR on five-year loans

the swap bank will receive semiannual fixed-rate dollar payments

of 8.50 percent against paying six-month dollar LIBOR

O if the swap bank is successful in getting counterparties to both

legs of the swap at these prices, the bank will have an annual

profit of ten basis points

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning