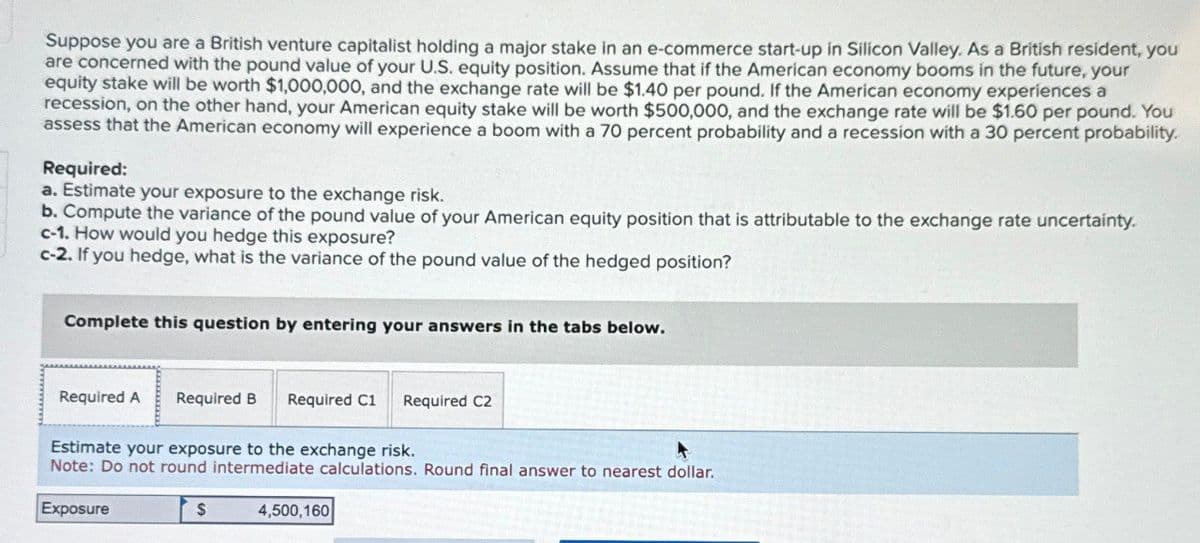

Suppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your equity stake will be worth $1,000,000, and the exchange rate will be $1.40 per pound. If the American economy experiences a recession, on the other hand, your American equity stake will be worth $500,000, and the exchange rate will be $1.60 per pound. You assess that the American economy will experience a boom with a 70 percent probability and a recession with a 30 percent probability. Required: a. Estimate your exposure to the exchange risk. b. Compute the variance of the pound value of your American equity position that is attributable to the exchange rate uncertainty. c-1. How would you hedge this exposure? c-2. If you hedge, what is the variance of the pound value of the hedged position? Complete this question by entering your answers in the tabs below. Required A Required B Required C1 Required C2 Estimate your exposure to the exchange risk. Note: Do not round intermediate calculations. Round final answer to nearest dollar. Exposure $ 4,500,160

Suppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your equity stake will be worth $1,000,000, and the exchange rate will be $1.40 per pound. If the American economy experiences a recession, on the other hand, your American equity stake will be worth $500,000, and the exchange rate will be $1.60 per pound. You assess that the American economy will experience a boom with a 70 percent probability and a recession with a 30 percent probability. Required: a. Estimate your exposure to the exchange risk. b. Compute the variance of the pound value of your American equity position that is attributable to the exchange rate uncertainty. c-1. How would you hedge this exposure? c-2. If you hedge, what is the variance of the pound value of the hedged position? Complete this question by entering your answers in the tabs below. Required A Required B Required C1 Required C2 Estimate your exposure to the exchange risk. Note: Do not round intermediate calculations. Round final answer to nearest dollar. Exposure $ 4,500,160

Chapter17: Multinational Capital Structure And Cost Of Capital

Section: Chapter Questions

Problem 4BIC

Related questions

Question

Transcribed Image Text:Suppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you

are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your

equity stake will be worth $1,000,000, and the exchange rate will be $1.40 per pound. If the American economy experiences a

recession, on the other hand, your American equity stake will be worth $500,000, and the exchange rate will be $1.60 per pound. You

assess that the American economy will experience a boom with a 70 percent probability and a recession with a 30 percent probability.

Required:

a. Estimate your exposure to the exchange risk.

b. Compute the variance of the pound value of your American equity position that is attributable to the exchange rate uncertainty.

c-1. How would you hedge this exposure?

c-2. If you hedge, what is the variance of the pound value of the hedged position?

Complete this question by entering your answers in the tabs below.

Required A Required B Required C1 Required C2

Estimate your exposure to the exchange risk.

Note: Do not round intermediate calculations. Round final answer to nearest dollar.

Exposure

$

4,500,160

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you