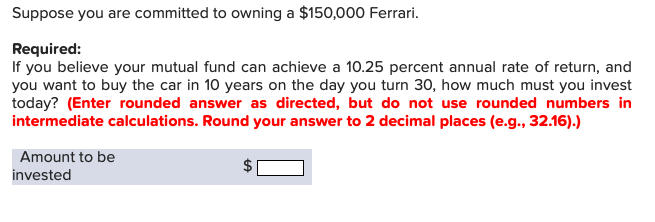

Suppose you are committed to owning a $150,000 Ferrari. Required: If you believe your mutual fund can achieve a 10.25 percent annual rate of return, and you want to buy the car in 10 years on the day you turn 30, how much must you invest today? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Amount to be invested

Suppose you are committed to owning a $150,000 Ferrari. Required: If you believe your mutual fund can achieve a 10.25 percent annual rate of return, and you want to buy the car in 10 years on the day you turn 30, how much must you invest today? (Enter rounded answer as directed, but do not use rounded numbers in intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Amount to be invested

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 16P

Related questions

Question

100%

Transcribed Image Text:Suppose you are committed to owning a $150,000 Ferrari.

Required:

If you believe your mutual fund can achieve a 10.25 percent annual rate of return, and

you want to buy the car in 10 years on the day you turn 30, how much must you invest

today? (Enter rounded answer as directed, but do not use rounded numbers in

intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).)

Amount to be

invested

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College