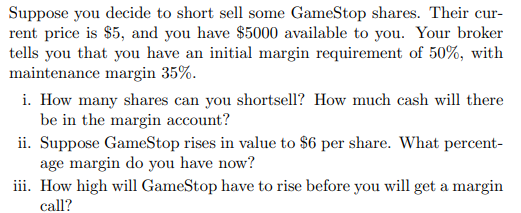

Suppose you decide to short sell some GameStop shares. Their cur- rent price is $5, and you have $5000 available to you. Your broker tells you that you have an initial margin requirement of 50%, with maintenance margin 35%. i. How many shares can you shortsell? How much cash will there be in the margin account? ii. Suppose GameStop rises in value to $6 per share. What percent- age margin do you have now? iii. How high will GameStop have to rise before you will get a margin call?

Q: A trader submits a market to sell 1,200 shares. The buy limit orders standing in the stock's order…

A: The market sell order will execute at the best available price or the highest available price. The…

Q: The present value of a deferred annuity of P4,800 every six months for 7 years, with the first…

A: Semi annual payment (P) = P4800 Period = 7 years Number of semi annual payments (n) = 7*2 = 14…

Q: Supposing the return from an investment has the following probability distribution Return…

A: Expected return: The entire amount of money an investor anticipates making or losing on a specific…

Q: A man owes P50,000.00 with interest at 9% payable semi-annually. What equal payments at the…

A: Semi-annual repayment is a payment made every six months to repay the debt amount with a certain…

Q: Kawesha Corporation has a premium bond making semiannual payments. The bond pays a 9 percent coupon,…

A: Bonds The financial security, which is the loan that a company obtains from its investors is known…

Q: What is the purpose of pro forma financial statements on this table?

A: Porforma financial statements are considered as forecasted financial statements for future years…

Q: You want to buy a home. You can borrow 95% of the purchase price. Assuming you can make a down…

A: To calculate the price of home we will use the below formula Home price = Down payment/(1-Loan to…

Q: firm has EBIT of $4.5 million, interest expense of $400,000, and pays taxes of $1.2 million. If…

A: EPS is earning per share that is available after doing all payments and that is available for each…

Q: Problem 2 Consider the yield curve above. Suppose the (expected) one-year interest rates in periods…

A: The profits on your assets can be significantly impacted by the yield curve, which is a tool for…

Q: Compute the present value of a $160 cash flow for the following combinations of discount rates and…

A: As per the given information: Cash flow - $160 Provided are different combinations of discount rates…

Q: What is the nominal rate of interest compounded semi-annually if the effective rate of interest on…

A: Effective interest rate (EAR) = 0.059 Number of compounding (n) = 2 Nominal rate of interest = ?…

Q: Why Softbank was willing to bail WeWork despite losses and mismanagement of funds (multiple answers…

A: SoftBank lost over 90% of its $10.3 billion investment in WeWork and was compelled to bail it out…

Q: 5. Panadera Bakeshop involved in livestock production having a loan of P250,000 from City Savings…

A: We have to find the maturity value of a loan subjected to compound interest.

Q: A(n) a. inventory turnover ratio b. current ratio is useful in evaluating liquidity policies. c.…

A: Liquidity refers to the company's ability to determine how quickly it can convert the assets and use…

Q: You are told you will receive a cash flow stream that gives you $2,150 at time 1, $2,750 at time 3,…

A: Present value of cash flow= (CF1/(1+r)^1) + (CF2/(1+r)^2) + (CF3/(1+r)^3) + (CF4/(1+r)^4) Where,…

Q: Analyze the financials for Wal-Mart and its competitor(s) in the online market in 2012 and 2016.…

A: Analysis of top line growth: Description Walmart…

Q: New share price|NPV > announced] The market cap of the firm is $100 million (10 million shares at…

A: Market price per share = (Market Capitalization + Present value of cash flow)/ No of shares…

Q: Can you explain the answer without excel please? Thanks.

A: Cost of Car is $52000 Interest rate is 6% Time period is 5 years Monthly Interest rate "rate" is…

Q: Period 1: June 1, 2021, to June 7, 2021: On June 4, 2021, Hardcore LLC sold 20% of its 50% holding…

A: From June 1 - June 7 OTC i.e. Over The Counter transaction took place which is trading outside the…

Q: Suppose that an investor has a chance of investing 90% fund in A with the remainder 10% purchasing…

A: Expected return of the portfolio means the mean of the probability distribution of investment…

Q: At the time of her grandson's birth, a grandmother deposits $9000 in an account that pays 8%…

A: Effective annual rate is the actual rate of return earned on the investment, after considering the…

Q: You ran a little short on your spring break vacation, so you put $1,000 on your other credit card.…

A: Given: The credit card balance is $1,000 and the rate of interest is 18% compounded quartely. The…

Q: Stephanie Carter has been gifted a sum of $50,000 by her grandparents on completing her graduation…

A: Stephanie Carter has tried to put together her investment philosophy and the possible investment…

Q: How do you maintain accurate and complete reporting of a budget? And how do you set up guardrails…

A: A budget is a financial plan that takes into account both income and costs. In other words, it is a…

Q: Postal Express has outlets throughout the world. It also keeps funds for transactions purposes in…

A: The exchange rate is the number of domestic currency units an individual require to purchase one…

Q: Complete the following, using exact interest. (Use Days in a year table.) Note: Do not round…

A: Principal Amount is $2100 Interest rate is 5% Date Borrowed is May 9 Date repaid is August 14 To…

Q: Please complete the balance sheet using the ratios that have been provided below.

A: Information Provided: Sales = $4,000,000 Gross profit margin = 25% Days sales outstanding = 45 days…

Q: Find the effective rate to the nearest hundredth for nominal interest rate. 5% compounded…

A: The nominal interest rate and the effective interest rate are the two variations of an interest…

Q: Compute for the effective interest rate. Payment period = semi-annual Interest period = 25.1%…

A: When compounding we look into the frequency of compounding. The frequency of compounding determines…

Q: If a certain stock sells for 33.812 dollars on the NYSE, how much will it sell for, in dollars, on…

A: 1) If a Stock is listed at more than one stock exchange, then the price traded at all the stock…

Q: he small happy Kingdom of Pollyanna does not trade with the rest of the world, but uses U.S dollars…

A: Tariff is a kind of levy or a tax. Here the import tariff is levied on the imports of tofu and the…

Q: Stock in Road Pave Zambia has a beta of .85. The market risk premium is 8 percent, and the Bank of…

A: Data given: Beta=0.85 Market risk premium =8 % Risk free rate = 5% (Zambia treasury bills are…

Q: In Question 7 consider the following data Acquirer Target Premium Synergy Pre-deal value Debt…

A: We have to find the leverage post the transaction of the combined entity. As a first step, we will…

Q: Northwest Corporation is estimating its WACC. Its target capital structure is 35 percent debt and 65…

A: Here, To Find: Part A. Cost of debt =? Part B. Cost of equity =? Part C. WACC =?

Q: Under a factory savings plan, a workman deposits P100.00 at the beginning of each month for 4 years,…

A: The simple rate of interest means the interest is determined on the principal amount, which means…

Q: ou have been asked by the president of your company to evaluate the proposed acquisition of a new…

A: Operating Cash Flow: The net amount of cash that a company generates from its operating activities…

Q: Cori's Corporation has a book value of equity of $13,380. Long-term debt is $8,550. Net working…

A: As per acounting principle, Total Assets = Total liabilities + Shareholders' equity Fixed Assets +…

Q: Jenna bought a bond that was issued by Sherlock Watson Industries (SWI) three years ago. The bond…

A: Par Value is $1,000 Coupon rate is 9% Maturity is 17 years Jenna bought 3 years ago James bought two…

Q: Wanda, one of your clients, is a state sheriff’s deputy. Wanda was injured while on duty. Under her…

A: First let us determine which item is taxable under Revenue Ruling 83-77. Under this ruling, sick pay…

Q: (True/False) When multiple risk factors are involved, the effect of these factors on VaR will always…

A: As per our guidelines we are supposed to answer only one question (if there are multiple questions…

Q: A new tablet computer from the R&D department will earn $20,000 in revenue in one year, which will…

A: A typical capital budgeting project is there. We need the quantum and timing of cash inflows. We…

Q: If a certain stock sells for 626.659 dollars on the NYSE, how much will it sell for, in dollars, on…

A: 1) If a Stock trades at more than one stock exchange, then the price at all the stock exchanges will…

Q: Select the type of risk that is most evident in the pairings. Investments in Junk Bonds VS…

A: Business risk is a risk that the company will not be able to achieve its financial target. SO risk…

Q: Among pay-mix alternatives, base pay is largest in work-life balance Osecurity or commitment…

A: Pay mix is a composition of the ratio between the base salary and the variable pay. It depends on…

Q: When the best bid in the market is $23.95 while the best offer or ask is $24.75: A limit sell…

A: We have; Best Bid or Highest price a buyer will pay is $23.95 Best Ask or Lowest price at which…

Q: Critically evaluate how hearding influences investment decision-making.

A: Herding behaviour will be reflective of behavioural bias in which the market participants are…

Q: next 12 years. If the profits wil compounded continuously, what is the 12-year present value of this…

A: Information Provided: Year 0 Profit = $393,000 Decline in profit annually = 4% Interest rate = 7%…

Q: what is its market-to-book ratio?

A: Market to book ratio is calculated with the formula below. This is also called Price to Book…

all subparts i, ii and iii please thank you

Step by step

Solved in 3 steps

- What makes for a good investment? Use the approximate yield formula or a financial calculator to rank the following investments according to their expected returns. Buy a stock for $30 a share, hold it for three years, and then sell it for $60 a share (the stock pays annual dividends of $2 a share). Buy a security for $40, hold it for two years, and then sell it for $100 (current income on this security is zero). Buy a one-year, 5 percent note for $1,000 (assume that the note has a $1,000 par value and that it will be held to maturity).Hager’s Home Repair Company, a regional hardware chain, which specializes in “do-it-yourself” materials and equipment rentals, is considering an acquisition of Lyon Lighting (LL). Doug Zona, Hager’s treasurer and your boss, has been asked to place a value on the target and he has enlisted your help. LL has 20 million shares of stock trading at $12 per share. Security analysts estimate LL’s beta to be 1.25. The risk-free rate is 5.5% and the market risk premium is 4%. LL’s capital structure is 20% financed with debt at an 8% interest rate; any additional debt due to the acquisition also will have an 8% rate. LL has a 25% federal-plus-state tax rate, which will not change due to the acquisition. The following data incorporate expected synergies and required levels of total net operating capital for LL should Hager’s complete the acquisition. The forecasted interest expense includes the combined interest on LL’s existing debt and on new debt. After 2024, all items are expected to grow at a constant 6% rate. Note: aDebt is added on the first day of the year, so the 2019 debt is LL’s debt prior to the acquisition. Hager’s management is new to the merger game, so Zona has been asked to answer some basic questions about mergers as well as to perform the merger analysis. To structure the task, Zona has developed the following questions, which you must answer and then defend to Hager’s board: What are the steps in valuing a merger using the compressed APV approach?Hager’s Home Repair Company, a regional hardware chain, which specializes in “do-it-yourself” materials and equipment rentals, is considering an acquisition of Lyon Lighting (LL). Doug Zona, Hager’s treasurer and your boss, has been asked to place a value on the target and he has enlisted your help. LL has 20 million shares of stock trading at $12 per share. Security analysts estimate LL’s beta to be 1.25. The risk-free rate is 5.5% and the market risk premium is 4%. LL’s capital structure is 20% financed with debt at an 8% interest rate; any additional debt due to the acquisition also will have an 8% rate. LL has a 25% federal-plus-state tax rate, which will not change due to the acquisition. The following data incorporate expected synergies and required levels of total net operating capital for LL should Hager’s complete the acquisition. The forecasted interest expense includes the combined interest on LL’s existing debt and on new debt. After 2024, all items are expected to grow at a constant 6% rate. Note: aDebt is added on the first day of the year, so the 2019 debt is LL’s debt prior to the acquisition. Hager’s management is new to the merger game, so Zona has been asked to answer some basic questions about mergers as well as to perform the merger analysis. To structure the task, Zona has developed the following questions, which you must answer and then defend to Hager’s board: Why can’t we estimate LL’s value to Hager’s by discounting the FCFs at the WACC? What method is appropriate? Use the projections and other data to determine the LL division’s free cash flows and interest tax savings for 2020 through 2024. Notice that the LL division’s sales are expected to grow rapidly during the first years before leveling off at a sustainable long-term growth rate.

- Hager’s Home Repair Company, a regional hardware chain, which specializes in “do-it-yourself” materials and equipment rentals, is considering an acquisition of Lyon Lighting (LL). Doug Zona, Hager’s treasurer and your boss, has been asked to place a value on the target and he has enlisted your help. LL has 20 million shares of stock trading at $12 per share. Security analysts estimate LL’s beta to be 1.25. The risk-free rate is 5.5% and the market risk premium is 4%. LL’s capital structure is 20% financed with debt at an 8% interest rate; any additional debt due to the acquisition also will have an 8% rate. LL has a 25% federal-plus-state tax rate, which will not change due to the acquisition. The following data incorporate expected synergies and required levels of total net operating capital for LL should Hager’s complete the acquisition. The forecasted interest expense includes the combined interest on LL’s existing debt and on new debt. After 2024, all items are expected to grow at a constant 6% rate. Note: aDebt is added on the first day of the year, so the 2019 debt is LL’s debt prior to the acquisition. Hager’s management is new to the merger game, so Zona has been asked to answer some basic questions about mergers as well as to perform the merger analysis. To structure the task, Zona has developed the following questions, which you must answer and then defend to Hager’s board: Briefly describe the differences between a hostile merger and a friendly merger.Suppose that you sell short 1,000 shares of Xtel, currently selling for $20 per share, and give your broker $15,000 to establish your margin account.a. If you earn no interest on the funds in your margin account, what will be your rate of return after one year if Xtel stock is selling at: (i) $22; (ii) $20; (iii) $18? Assume that Xtel pays no dividends.b. If the maintenance margin is 25%, how high can Xtel’s price rise before you get a margin call?c. Redo parts (a) and (b), but now assume that Xtel also has paid a year-end dividend of $1 per share. The prices in part (a) should be interpreted as ex-dividend, that is, prices after the dividend has been paid.Suppose that you sell short 1,000 shares of Xtel, currently selling for $20 per share, and give your broker $15,000 to establish your margin account. a. if you earn no interest on the funds in your margin account, what will be your rate of return after one year if Xtel stock is selling at: $22, $20, and $18? Assume that Xtel's pays no dividends. b. If the maintenance margin is 25%, how high can Xtel's price rise before you get a margin call? c. Redo parts a and b but now assume that Xtel has paid a year end dividend of $1 per share. The pruces in part a should be interpreted as ex-dividend, that is prices after the dividend has been paid.

- .Suppose that you sell short 1,000 shares of Xtel, currently selling for $20 per share, and give your broker $15,000 to establish your margin account. a.If you earn no interest on the funds in your margin account, what will be your rate of return after one year if Xtel stock is selling at: (i) $22; (ii) $20; (iii) $18? Assume that Xtel pays no dividends. b.If the maintenance margin is 25%, how high can Xtel’s price rise before you get a margin call? c.Redo parts (a) and (b), but now assume that Xtel also has paid a year-end dividend of $1 per share. The prices in part (a) should be interpreted as ex-dividend, that is, prices after the dividend has been paid.13.You are about to purchase OSTK, which is currently trading at $20 per share. You have $5,000 of your own to invest. You borrow an additional $5,000 from your broker and invest $10,000 in the stock. How far does the stock price have to fall for you to get a margin call if the maintenance margin requirement is 35%?You think that the stock of Fleetwood Corp is likely to rise within the next six months from its current price ($19.00 bid and $20.00 ask), and you want to maximize the amount of profit from your investment. So, you will use a margin account to borrow on margin in order to buy as many shares as you can. Your initial margin requirement is 45%, and you have $90,000 of your own money to invest in the shares. The minimum (maintenance) margin is 30%, and Fleetwood does not pay dividends. (Ignore interest for this problem.) If you buy Fleetwood on margin with the maximum margin loan, what is the maximum number of shares you can buy? Suppose you bought the maximum number of shares of Fleetwood as in (1). Assume that immediately after your purchase, Fleetwood’s share price drops to $18.00 per share. Calculate your new margin. Will you receive a margin call? How far can the price drop before you will receive a margin call? If the stock price falls to $14.00, you calculate that you would…

- You want to purchase IBM stock at $130 from your broker using as little of your own money as possible. If initial margin is 50% and you have $19, 600to invest, how many shares can you buy?Suppose you buy 700 shares of XYZ currently trading at $63 per share with a loan from your broker. Your initial margin requirement is 50%. The maintenance margin is 30%. Suppose the price suddenly (and instantaneously) jumps down to $42 per share, triggering a margin call. As a result of the margin call, you are required to get your margin back up to 50%, by selling off shares to pay down your margin loan (you could use cash, but you do not want to throw good money after bad). How many shares to you need to sell (using the proceeds to pay down your margin loan) to get your margin back up to 50%? Assume that you can sell shares at $42 per share and assume the interest rate on your margin loan is 0%. Ignore taxes and transaction costs. Important Hint: If you get a fractional number of shares as your answer, round up.Suppose that you sell short 1000 shares of Xtel, currently selling for $50 per share, and give your broker $40,000 to establish your margin account. a. If you earn no interest on the funds in your margin account, what will be your rate of return after one year if Xtel stock is selling at: (i) $55; (ii) $50; (iii) $46? Assume that Xtel pays no dividends. (Leave no cells blank - be certain to enter "0" wherever required. Negative values should be indicated by a minus sign. Round your answers to 2 decimal places.) b. If the maintenance margin is 25%, how high can Xtel’s price rise before you get a margin call? (Round your answer to 2 decimal places.) c. Redo parts (a) and (b), but now assume that Xtel also has paid a year-end dividend of $2 per share. The prices in part (a) should be interpreted as ex-dividend, that is, prices after the dividend has been paid. (Negative values should be indicated by a minus sign. Round your answers to 2 decimal places.)