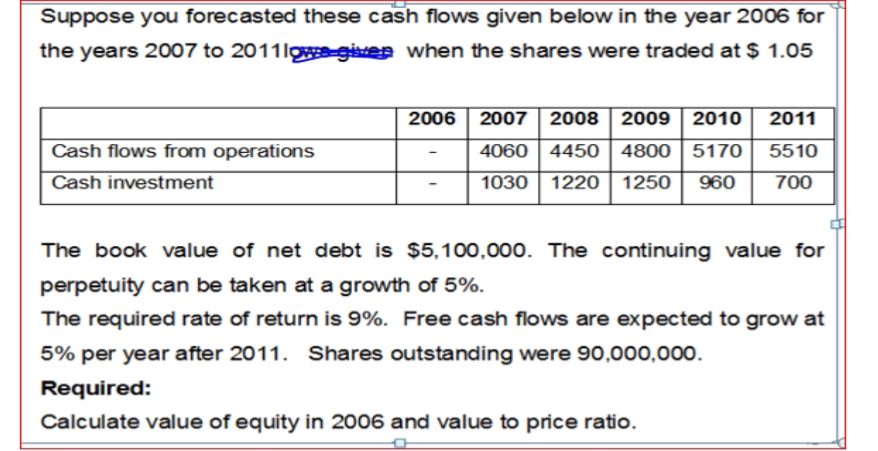

Suppose you forecasted these cash flows given below in the year 2006 for the years 2007 to 2011lowa given when the shares were traded at $ 1.05 2006 2007 2008 2009 2010 2011 Cash flows from operations 4060 | 4450 4800 | 5170 5510 Cash investment 1030 1220 1250 960 700 The book value of net debt is $5,100,000. The continuing value for perpetuity can be taken at a growth of 5%. The required rate of return is 9%. Free cash flows are expected to grow at 5% per year after 2011. Shares outstanding were 90,000,000. Required: Calculate value of equity in 2006 and value to price ratio.

Suppose you forecasted these cash flows given below in the year 2006 for the years 2007 to 2011lowa given when the shares were traded at $ 1.05 2006 2007 2008 2009 2010 2011 Cash flows from operations 4060 | 4450 4800 | 5170 5510 Cash investment 1030 1220 1250 960 700 The book value of net debt is $5,100,000. The continuing value for perpetuity can be taken at a growth of 5%. The required rate of return is 9%. Free cash flows are expected to grow at 5% per year after 2011. Shares outstanding were 90,000,000. Required: Calculate value of equity in 2006 and value to price ratio.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter7: Corporate Valuation And Stock Valuation

Section: Chapter Questions

Problem 25SP: Start with the partial model in the file Ch07 P25 Build a Model.xlsx on the textbook’s Web site....

Related questions

Question

100%

Transcribed Image Text:Suppose you forecasted these cash flows given below in the year 2006 for

the years 2007 to 2011lwa given when the shares were traded at $ 1.05

2006

2007 2008 2009 | 2010

2011

Cash flows from operations

4060 4450 | 4800 | 5170

5510

Cash investment

1030 1220 | 1250

960

700

The book value of net debt is $5,100,000. The continuing value for

perpetuity can be taken at a growth of 5%.

The required rate of return is 9%. Free cash flows are expected to grow at

5% per year after 2011. Shares outstanding were 90,000,000.

Required:

Calculate value of equity in 2006 and value to price ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning