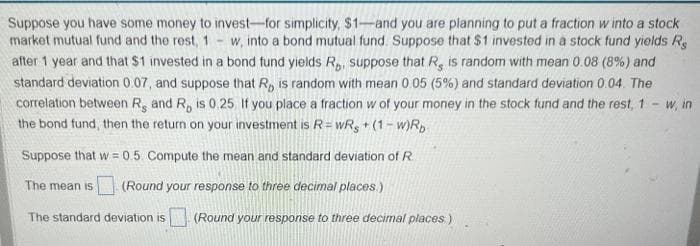

Suppose you have some money to invest-for simplicity, $1-and you are planning to put a fraction w into a stock market mutual fund and the rest, 1 w, into a bond mutual fund. Suppose that $1 invested in a stock fund yields Rs after 1 year and that $1 invested in a bond fund yields R., suppose that R, is random with mean 0.08 (8%) and standard deviation 0.07, and suppose that R, is random with mean 0.05 (5%) and standard deviation 0.04. The correlation between R and R, is 0.25 If you place a fraction w of your money in the stock fund and the rest, 1 - w, in the bond fund, then the return on your investment is R=wRs +(1-w)RD Suppose that w=0.5. Compute the mean and standard deviation of R The mean is (Round your response to three decimal places.) The standard deviation is (Round your response to three decimal places)

Suppose you have some money to invest-for simplicity, $1-and you are planning to put a fraction w into a stock market mutual fund and the rest, 1 w, into a bond mutual fund. Suppose that $1 invested in a stock fund yields Rs after 1 year and that $1 invested in a bond fund yields R., suppose that R, is random with mean 0.08 (8%) and standard deviation 0.07, and suppose that R, is random with mean 0.05 (5%) and standard deviation 0.04. The correlation between R and R, is 0.25 If you place a fraction w of your money in the stock fund and the rest, 1 - w, in the bond fund, then the return on your investment is R=wRs +(1-w)RD Suppose that w=0.5. Compute the mean and standard deviation of R The mean is (Round your response to three decimal places.) The standard deviation is (Round your response to three decimal places)

Chapter16: Labor Markets

Section: Chapter Questions

Problem 16.9P

Related questions

Question

Transcribed Image Text:-

Suppose you have some money to invest-for simplicity, $1-and you are planning to put a fraction w into a stock

market mutual fund and the rest, 1 w, into a bond mutual fund. Suppose that $1 invested in a stock fund yields Re

after 1 year and that $1 invested in a bond fund yields R₂, suppose that R, is random with mean 0.08 (8%) and

standard deviation 0.07, and suppose that R, is random with mean 0.05 (5%) and standard deviation 0.04. The

correlation between R, and R, is 0.25 If you place a fraction w of your money in the stock fund and the rest, 1 - w, in

the bond fund, then the return on your investment is R = wRs + (1-w)Rp

Suppose that w=0.5. Compute the mean and standard deviation of R

(Round your response to three decimal places.)

The mean is

The standard deviation is (Round your response to three decimal places:)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you