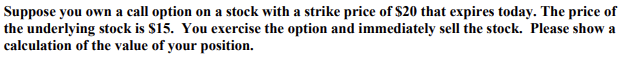

Suppose you own a call option on a stock with a strike price of $20 that expires today. The price of the underlying stock is $15. You exercise the option and immediately sell the stock. Please show a calculation of the value of your position.

Q: For a project that has a net investment of $1,500,000 and net cash flows of $400,000 for 5 years; Is…

A: We need to IRR function in excel to calculate Internal Rate of Return(IRR) Formula is…

Q: compounding are different for investors so that re< Tb. Show that the no-arbitrage forward price…

A: Given SaerlT <=F(0,T)<=SaerbT Requirement : Show that the no-arbitrage forward price F(0,T)…

Q: Cheese & Cake Factory is looking at a project with the following forecasted sales: first-year sales…

A: The depreciation rates of 7-year equipment as per MACRS table are 10.71% for year 1, 25.51% for year…

Q: The quoted rate of interest is calculated using the following formula. Quoted Rate = r* + IP +…

A: Given r* = 2% IP = 3% MRP = 3% LP = .6% DRP = .4%

Q: A firm is considering a project that requires an immediate investment of $520. The project will then…

A: We need to find the payback period of the project.

Q: Between 1980 and 1987, the average home price Keene, NH increased from $42,000 to $97,000. What is…

A: The percentage increase is the compounding growth rate of price and due to which the growth is too…

Q: discuss the advantages and disadvantages of using return on capital employed ?

A: We have to find the advantages and disadvantages of using return on capital employed (ROCE).

Q: he balance sheet for Quinn Corporation is shown here in market value terms. There are 12,000 shares…

A: Data given: Market value of equity=$404,300 No. of shares outstanding= 12000 Dividend declared per…

Q: Purchase price of a used car Down payment Number of monthly payments Amount financed Total of…

A: The loans are paid by the equal monthly installments and these are fixed payments and these carry…

Q: Leonard, a company that manufactures explosion-proof motors, is considering two alternatives for…

A: Present worth represents teh value present today that is more worthful than the amount will receive…

Q: As the tax assessor for Indian Creek County, you have been informed that due to budgetary demands, a…

A: Tax compliance is a mandatory financial charge or other type of levy imposed on a taxpayer by a…

Q: thomas smith places an order to buy 100 shares of Google. Explain how the order will be processed if…

A: A Market Order refers to an order that will be processed as soon as the market session opens or as…

Q: An owner of the ATRIUM Tower Office Building is currently negotiating a five-year lease with ACME…

A: Concept. Cash inflows to lessor = lease rental paid by lessee. Net present value for lessor =present…

Q: Caribbean Hotel Services (CHS) is a small company specialising in services to the hotel industry.…

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts…

Q: Madison Manufacturing is considering a new machine that costs $350,000 and would reduce pre-tax…

A: NPV is the net present value and one of most used capital budgeting method that is based on time…

Q: sider the following annual returns of Estee Lauder and Lowe’s Companies: Estee Lauder Lowe’s…

A: Standard deviation is the statistical measure of the risk of the stock and it is measured as…

Q: Shares Jak and Turner have the following historical returns: Year 2016 2017 2018 2019 2020 2021 2022…

A: The statistical indicator of market volatility, or how widely prices vary from the average price, is…

Q: A firm evaluates all its projects by applying the IRR rule. the current proposed project has a cash…

A: IRR is the rate at which present value of cash inflows will be equal to initial cost. If IRR is…

Q: Calculate the price of a 5.2 percent coupon bond with 18 years left to maturity and a market…

A: Lets assume par value of the bond = $1,000 P0 = Price of the bond C = Semiannual coupon amount…

Q: Here are data on $1,000 par value bonds issued by Microsoft, GE Capital, and Morgan Stanley at the…

A: Honor Code: Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Troy Juth wants to purchase new dive equipment for Underwater Connection, his retail store in…

A: concept. Interest payments and principal payments are required to be made on loan taken.

Q: First America Bank’s monthly payment charge on a 48-month, $20,000 loan is $488.26. U.S. Bank’s…

A: Months 48 Loan amount $ 20,000.00 First America Bank's monthly payment charge $ 488.26 U.S.…

Q: A firm evaluates all of its projects by applying the IRR rule. If the required return is 18 percent,…

A: Required return = 18% Year Cash flow 0 -30000 1 20000 2 14000 3 11000

Q: An office park is considering investing in upgrades to make its buildings more energy efficient.…

A: According to fischer effect , (1+nominal rate ) = ( 1+ real rate) × ( 1+ inflation rate) Nominal…

Q: A $5,000 loan was to be repaid with 8% simple interest. A total of $5,350 was paid. How many months…

A:

Q: Ramon Hernandez saw the following advertisement for a used Volkswagen Bug and decided to work out…

A: Here, Particulars Values Cash price $ 7,850.00 Down payment $ - Amount…

Q: A stock had returns of 10% 3% and -6% over the past 3 years. What is the mean of the stock return…

A: Mean of the returns is the average calculated using the below formula. Standard deviation formula…

Q: Iry again. To calculate the beta after recapitalization,, use the following formula: 93 크레 PUMANIUM…

A: The beta is risk related to the overall market and it increases with increase in debt and reduces…

Q: Determine the values K, L, M, and N in the table. 3.2 Calculate the total present value of the net…

A: Net present value is the one of the important capital budegting method based on time value of money…

Q: You are considering starting a new factory producing small electric heaters. Each unit will sell at…

A: In a typical capital budgeting project, we have all the relevant cash flows emanating from the…

Q: You want to buy a $195,000 home. You plan to pay 5% as a down payment, and take out a 30 year loan…

A: The Down-payment is the sum of money first paid for something. No interest will be charged on…

Q: You want to buy a $175,000 home. You plan to pay 20% as a down payment, and take out a 30 year loan…

A: We have a mortgage transaction on a home. We have to find some amounts based on the mortgage.

Q: One of important indicators of the firm's ability to repay its loans. O Net working capital O…

A: Solution: Loans represent the amount of borrowings by the firm.

Q: Indell stock has a current market value of $110 million and a beta of 2.00. Indell currently has…

A: Here, Current market value = $110 million Beta = 2.00 Additional risk-free debt = $44.45 million…

Q: Stock Y has a beta of 1.6 and an expected return of 16.6 percent. Stock Z has a beta of 8 and an…

A: We need to calculate the reward to risk ratio for two different stocks, and then need to find out…

Q: Subject: Islamic banking & applied finance Q): What is Riba & what are the types of riba?…

A: in charge of the loan on the borrower, the charge may be small or large. As we know the Islamic…

Q: Consider the following information about three stocks: State of Economy Boom Normal Bust a-2. a-3.…

A: A portfolio is a group of investments in which an investor has invested funds or money. A portfolio…

Q: n aunt wants to make a gift of $120,000.00 to their niece's for her college education on her 21st…

A: The the future value of the amount includes the amount being deposited over the period of time and…

Q: Indell stock has a current market value of $160 million and a beta of 1.50. Indell currently has…

A: Here, Current market value = $160 million Beta = 1.50 Additional risk-free debt = $69.34 million…

Q: Normal Manufacturing Co. is purchasing a production facility at a cost of $22.5 million. The firm…

A: I Year Cash flow 0 -22.5 1 7 2 7 3 7 4 7 5 7

Q: Given the following information: Interest rate 9% Tax rate 30% Dividend $2.50 Common stock on the…

A: A company's average after-tax cost of capital from all sources, including common stock, preferred…

Q: QUESTION 2 You are considering starting a new factory producing small electric heaters. Each unit…

A: concept. Working capital is required for smooth functioning of the project. It represent cash…

Q: 23. Boricua stock is currently trading at a market price (S) of $95. have an options strategy in…

A: Profit to a long position in put option Profit to a long position in put option is calculated as…

Q: ose that the current exchange rate between the Japanese yen (¥) and the U.S. dollar ($) is ¥100 =…

A: According to the purchase power parity the prices must be in equilibrium with each other and should…

Q: You are considering investing $1,000 in a complete portfolio. The complete portfolio is composed of…

A:

Q: You are trying to pick the least-expensive car for your new delivery service. You have two choices:…

A: EAC stands for Equivalent annual cost refers to the cost that is spent on owning, operating, and…

Q: Istanbul's Issues. The Turkisk lira (TL) was officially devalued by the Turkish government in…

A: The exchange rate refers to the rate that is used for converting one country's currency into the…

Q: b. Suppose Cumma Technology stock currently trades for $10.74 per share. What arbitrage opportunity…

A: concept. according to MM proposition I, Value of levered firm = Value of unlevered firm levered firm…

Q: The USDSGD (Singapore dollar) spot rate is 1.60, the USDCAD spot rate is 1.33 and CADSGD 1.15.…

A: Given: 1$ = 1.6 SGD 1SGD = 1.15 CAD 1USD = 1.33 CAD Amount = $1,000,000

Q: q 12 A 5.65 percent coupon bond with 18 years left to maturity is offered for sale at $1,035.25.…

A: Yield to maturity refers to the internal rate of return which is earned by the investor who makes…

Step by step

Solved in 2 steps

- Suppose that a March call option to buy a share for $50 costs $2.50 and is held until March. The holder of the option will gain if the price of the stock is above 52.50 in March. True or False?Calculate the profit or loss per share of stock to an investor who buys a call option on a stock whose price is K90 but a call option exercise price if K100 if the stock price at expiration is K105. Calculate the profit or loss for a purchaser of a put option with the same exercise price and expiration?Suppose that a June call option to buy a share for $65 costs $3.5 and is held until June. Under what circumstances will the holder of the option make profit Under what circumstances will the option be exercised? Draw a diagram showing how the profit on a long position in the option depends on the stock price at the maturity of the option.

- Suppose you own a put option that gives you the right to sell 300 shares of Brad’s Drink to another investor for $28 per share anytime during the next six months. Brad’s Drink stock currently sells for $29 per share. Should you exercise the option and sell the stock to the option writer (seller) if the stock price stays at $29 per share? Why?speculator may write a put option on stock with an exercise price of $15 and earn a $3 premium only if he thought A-the stock price would rise above $18 or fall below $12. B-the stock price would stay above $15. C-the stock price would stay below $12. D-the stock price would fall below $18.You have written a call option on Walmart common stock. The option has an exercise price of $81, and Walmart’s stock currently trades at $79. The option premium is $1.60 per contract. a. How much of the option premium is due to intrinsic value versus time value? b. What is your net profit if Walmart’s stock price decreases to $77 and stays there until the option expires? c. What is your net profit on the option if Walmart’s stock price increases to $87 at expiration of the option and the option holder exercises the option?

- A collar is established by buying a share of stock for $50, buying a 6-month put option with exercise price $45, and writing a 6-month call option with exercise price $55. On the basis of the volatility of the stock, you calculate that for a strike price of $45 and expiration of 6 months, N(d1) = .60, whereas for the exercise price of $55, N(d1) = .35.a. What will be the gain or loss on the collar if the stock price increases by $1?b. What happens to the delta of the portfolio if the stock price becomes very large?c. What happens to the delta of the portfolio if the stock price becomes very small?An investor buys a stock for $40 per share and simultaneously sells a call option on the stock with an exercise price of $42 for a premium of $3 per share. Ignoring the dividends and transaction costs, what is the maximum profit the writer of this covered call can earn if the position is held to expiration?You have taken a long position in a call option on IBM common stock. The option has an exercise price of $176 and IBM’s stock currently trades at $180. The option premium is $5 per contract. What is your net profit on the option if IBM’s stock price increases to $190 at expiration of the option and you exercise the option? What is your net profit if IBM’s stock price decreases to $170?

- Suppose you own a put option that gives you the right to sell 300 shares of Brad’s Drink to another investor for $28 per share anytime during the next six months. Brad’s Drink stock currently sells for $29 per share. Should you exercise the option if the stock's price increases to $33? What would be your gain (loss) if you bought the stock at $33 and then exercised the option?In follow an Ito process with >0, a stock is worth $80 today, if the price of an option that pays the holder $2 exactly the first time the stock price reaches $200, what is the price of an option? Show all calculation.A stock price is $30. An investor buys one call option contract on the stock with a strike price of $28 and sells a call option contract on the stock with a strike price of $27. The market prices of the options are $2 and $1.7, respectively. The options have the same maturity date. Describe the investor’s position and the possible gain/loss he will get (taking into account the initial investment). Make a graph of your gain/loss.