Suppose you pay $25 to enter into a raffle with a $400 prize. If you have a 5% chance of winning, the expected value of buying a raffle ticket is $

Suppose you pay $25 to enter into a raffle with a $400 prize. If you have a 5% chance of winning, the expected value of buying a raffle ticket is $

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter16: Bargaining

Section: Chapter Questions

Problem 2MC

Related questions

Question

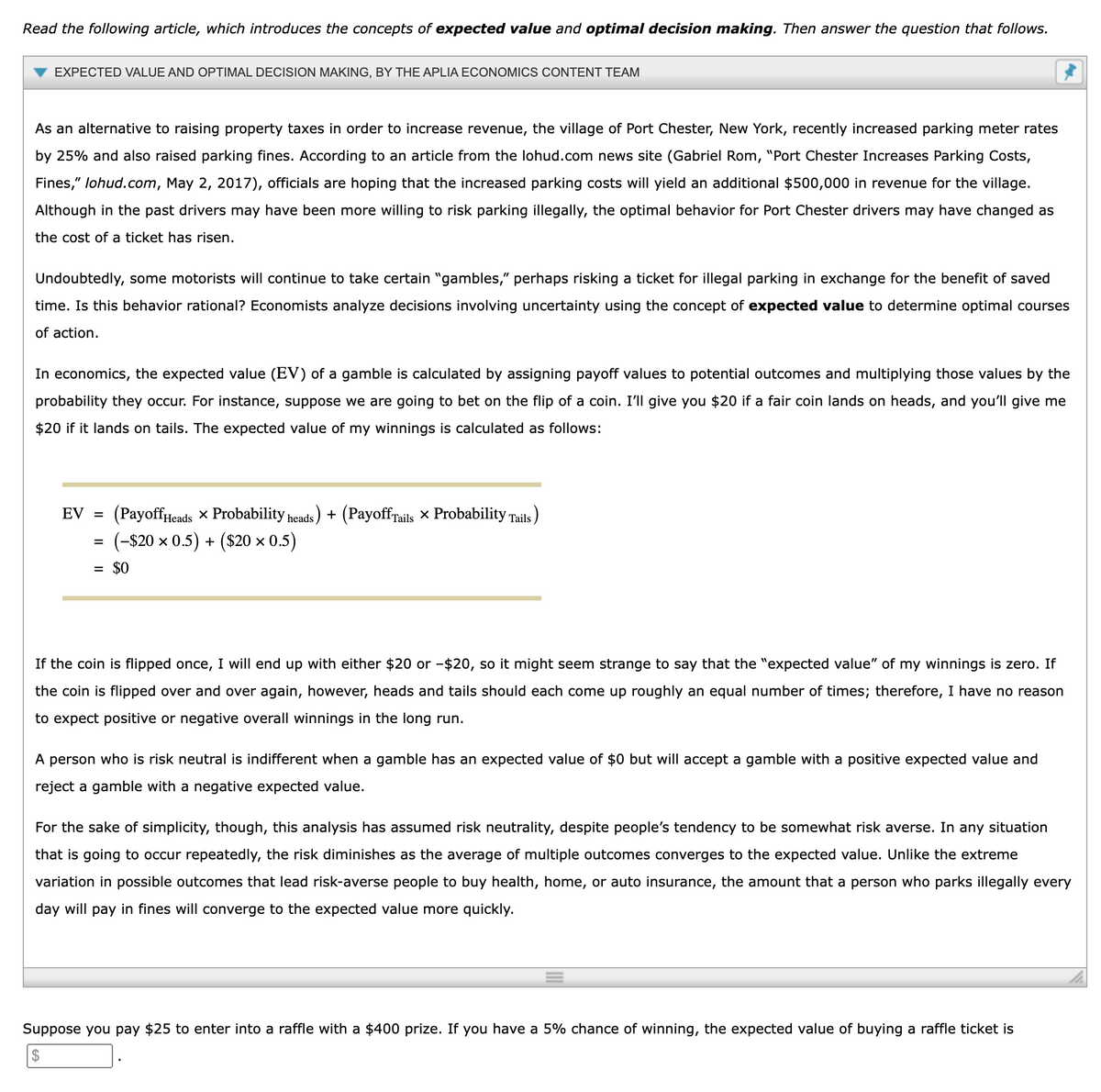

Transcribed Image Text:Read the following article, which introduces the concepts of expected value and optimal decision making. Then answer the question that follows.

EXPECTED VALUE AND OPTIMAL DECISION MAKING, BY THE APLIA ECONOMICS CONTENT TEAM

As an alternative to raising property taxes in order to increase revenue, the village of Port Chester, New York, recently increased parking meter rates

by 25% and also raised parking fines. According to an article from the lohud.com news site (Gabriel Rom, "Port Chester Increases Parking Costs,

Fines," lohud.com, May 2, 2017), officials are hoping that the increased parking costs will yield an additional $500,000 in revenue for the village.

Although in the past drivers may have been more willing to risk parking illegally, the optimal behavior for Port Chester drivers may have changed as

the cost of a ticket has risen.

Undoubtedly, some motorists will continue to take certain "gambles," perhaps risking a ticket for illegal parking in exchange for the benefit of saved

time. Is this behavior rational? Economists analyze decisions involving uncertainty using the concept of expected value to determine optimal courses

of action.

In economics, the expected value (EV) of a gamble is calculated by assigning payoff values to potential outcomes and multiplying those values by the

probability they occur. For instance, suppose we are going to bet on the flip of a coin. I'll give you $20 if a fair coin lands on heads, and you'll give me

$20 if it lands on tails. The expected value of my winnings is calculated as follows:

EV = (PayoffHeads × Probability heads) + (PayoffTails × Probability Tails)

×

(-$20 × 0.5) + ($20 ×

= $0

=

0.5)

If the coin is flipped once, I will end up with either $20 or -$20, so it might seem strange to say that the "expected value" of my winnings is zero. If

the coin is flipped over and over again, however, heads and tails should each come up roughly an equal number of times; therefore, I have no reason

to expect positive or negative overall winnings in the long run.

A person who is risk neutral is indifferent when a gamble has an expected value of $0 but will accept a gamble with a positive expected value and

reject a gamble with a negative expected value.

For the sake of simplicity, though, this analysis has assumed risk neutrality, despite people's tendency to be somewhat risk averse. In any situation

that is going to occur repeatedly, the risk diminishes as the average of multiple outcomes converges to the expected value. Unlike the extreme

variation in possible outcomes that lead risk-averse people to buy health, home, or auto insurance, the amount that a person who parks illegally every

day will pay in fines will converge to the expected value more quickly.

Suppose you pay $25 to enter into a raffle with a $400 prize. If you have a 5% chance of winning, the expected value of buying a raffle ticket is

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning