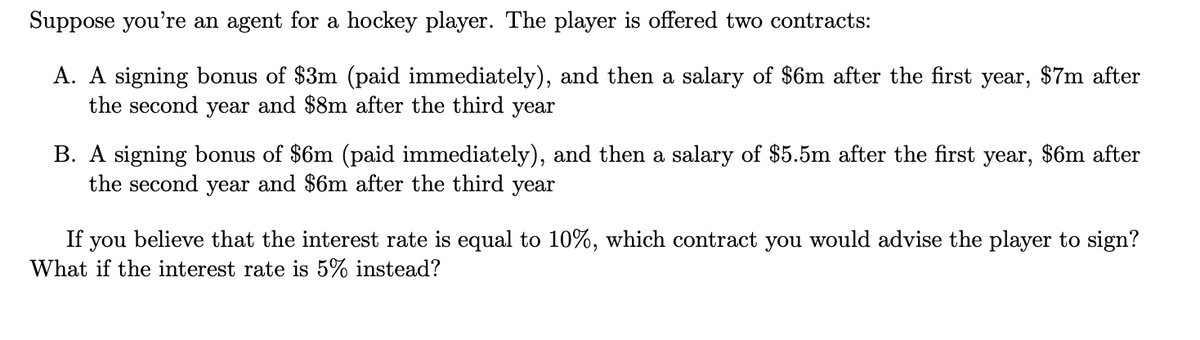

Suppose you're an agent for a hockey player. The player is offered two contracts: A. A signing bonus of $3m (paid immediately), and then a salary of $6m after the first year, $7m after the second year and $8m after the third year B. A signing bonus of $6m (paid immediately), and then a salary of $5.5m after the first year, $6m after the second year and $6m after the third year If you believe that the interest rate is equal to 10%, which contract you would advise the player to sign? What if the interest rate is 5% instead?

Suppose you're an agent for a hockey player. The player is offered two contracts: A. A signing bonus of $3m (paid immediately), and then a salary of $6m after the first year, $7m after the second year and $8m after the third year B. A signing bonus of $6m (paid immediately), and then a salary of $5.5m after the first year, $6m after the second year and $6m after the third year If you believe that the interest rate is equal to 10%, which contract you would advise the player to sign? What if the interest rate is 5% instead?

Chapter13: Capital, Interest, Entrepreneurship, And Corporate Finance

Section: Chapter Questions

Problem 4.8P

Related questions

Question

Transcribed Image Text:Suppose you're an agent for a hockey player. The player is offered two contracts:

A. A signing bonus of $3m (paid immediately), and then a salary of $6m after the first

the second year and $8m after the third year

B. A signing bonus of $6m (paid immediately), and then a salary of $5.5m after the first

the second year and $6m after the third year

year,

$7m after

year, $6m after

If you believe that the interest rate is equal to 10%, which contract you would advise the player to sign?

What if the interest rate is 5% instead?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning