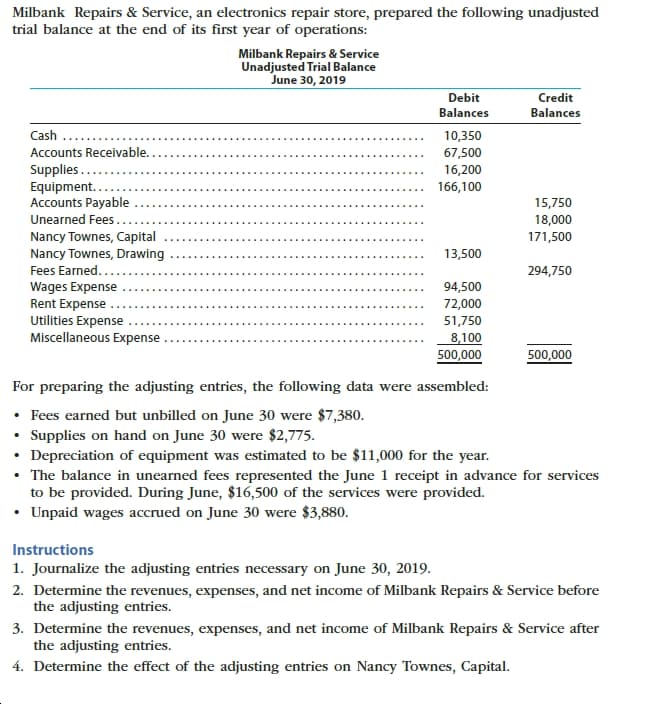

Milbank Repairs & Service, an electronics repair store, prepared the following unadjusted trial balance at the end of its first year of operations Milbank Repairs & Service Unadjusted Trial Balance June 30, 2019 Debit Credit Balances Balances Cash 10,350 67,500 16,200 Accounts Receivable. Supplies.. Equipment.... Accounts Payable Unearned Fees 166,100 15,750 18,000 Nancy Townes, Capital Nancy Townes, Drawing Fees Earned... 171,500 13,500 294,750 Wages Expense Rent Expense Utilities Expense Miscellaneous Expense 94,500 72,000 51,750 8,100 500,000 500,000 For preparing the adjusting entries, the following data were assembled: Fees earned but unbilled on June 30 were $7,380. Supplies on hand on June 30 were $2,775. Depreciation of equipment was estimated to be $11,000 for the year The balance in unearned fees represented the June 1 receipt in advance for services to be provided. During June, $16,500 of the services were provided. Unpaid wages accrued on June 30 were $3,880. Instructions 1. Journalize the adjusting entries necessary on June 30, 2019. 2. Determine the revenues, expenses, and net income of Milbank Repairs & Service before the adjusting entries. 3. Determine the revenues, expenses, and net income of Milbank Repairs & Service after the adjusting entries 4. Determine the effect of the adjusting entries on Nancy Townes, Capital

Milbank Repairs & Service, an electronics repair store, prepared the following unadjusted trial balance at the end of its first year of operations Milbank Repairs & Service Unadjusted Trial Balance June 30, 2019 Debit Credit Balances Balances Cash 10,350 67,500 16,200 Accounts Receivable. Supplies.. Equipment.... Accounts Payable Unearned Fees 166,100 15,750 18,000 Nancy Townes, Capital Nancy Townes, Drawing Fees Earned... 171,500 13,500 294,750 Wages Expense Rent Expense Utilities Expense Miscellaneous Expense 94,500 72,000 51,750 8,100 500,000 500,000 For preparing the adjusting entries, the following data were assembled: Fees earned but unbilled on June 30 were $7,380. Supplies on hand on June 30 were $2,775. Depreciation of equipment was estimated to be $11,000 for the year The balance in unearned fees represented the June 1 receipt in advance for services to be provided. During June, $16,500 of the services were provided. Unpaid wages accrued on June 30 were $3,880. Instructions 1. Journalize the adjusting entries necessary on June 30, 2019. 2. Determine the revenues, expenses, and net income of Milbank Repairs & Service before the adjusting entries. 3. Determine the revenues, expenses, and net income of Milbank Repairs & Service after the adjusting entries 4. Determine the effect of the adjusting entries on Nancy Townes, Capital

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 5PB: Reece Financial Services Co., which specializes in appliance repair services, is owned and operated...

Related questions

Question

Transcribed Image Text:Milbank Repairs & Service, an electronics repair store, prepared the following unadjusted

trial balance at the end of its first year of operations

Milbank Repairs & Service

Unadjusted Trial Balance

June 30, 2019

Debit

Credit

Balances

Balances

Cash

10,350

67,500

16,200

Accounts Receivable.

Supplies..

Equipment....

Accounts Payable

Unearned Fees

166,100

15,750

18,000

Nancy Townes, Capital

Nancy Townes, Drawing

Fees Earned...

171,500

13,500

294,750

Wages Expense

Rent Expense

Utilities Expense

Miscellaneous Expense

94,500

72,000

51,750

8,100

500,000

500,000

For preparing the adjusting entries, the following data were assembled:

Fees earned but unbilled on June 30 were $7,380.

Supplies on hand on June 30 were $2,775.

Depreciation of equipment was estimated to be $11,000 for the year

The balance in unearned fees represented the June 1 receipt in advance for services

to be provided. During June, $16,500 of the services were provided.

Unpaid wages accrued on June 30 were $3,880.

Instructions

1. Journalize the adjusting entries necessary on June 30, 2019.

2. Determine the revenues, expenses, and net income of Milbank Repairs & Service before

the adjusting entries.

3. Determine the revenues, expenses, and net income of Milbank Repairs & Service after

the adjusting entries

4. Determine the effect of the adjusting entries on Nancy Townes, Capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College