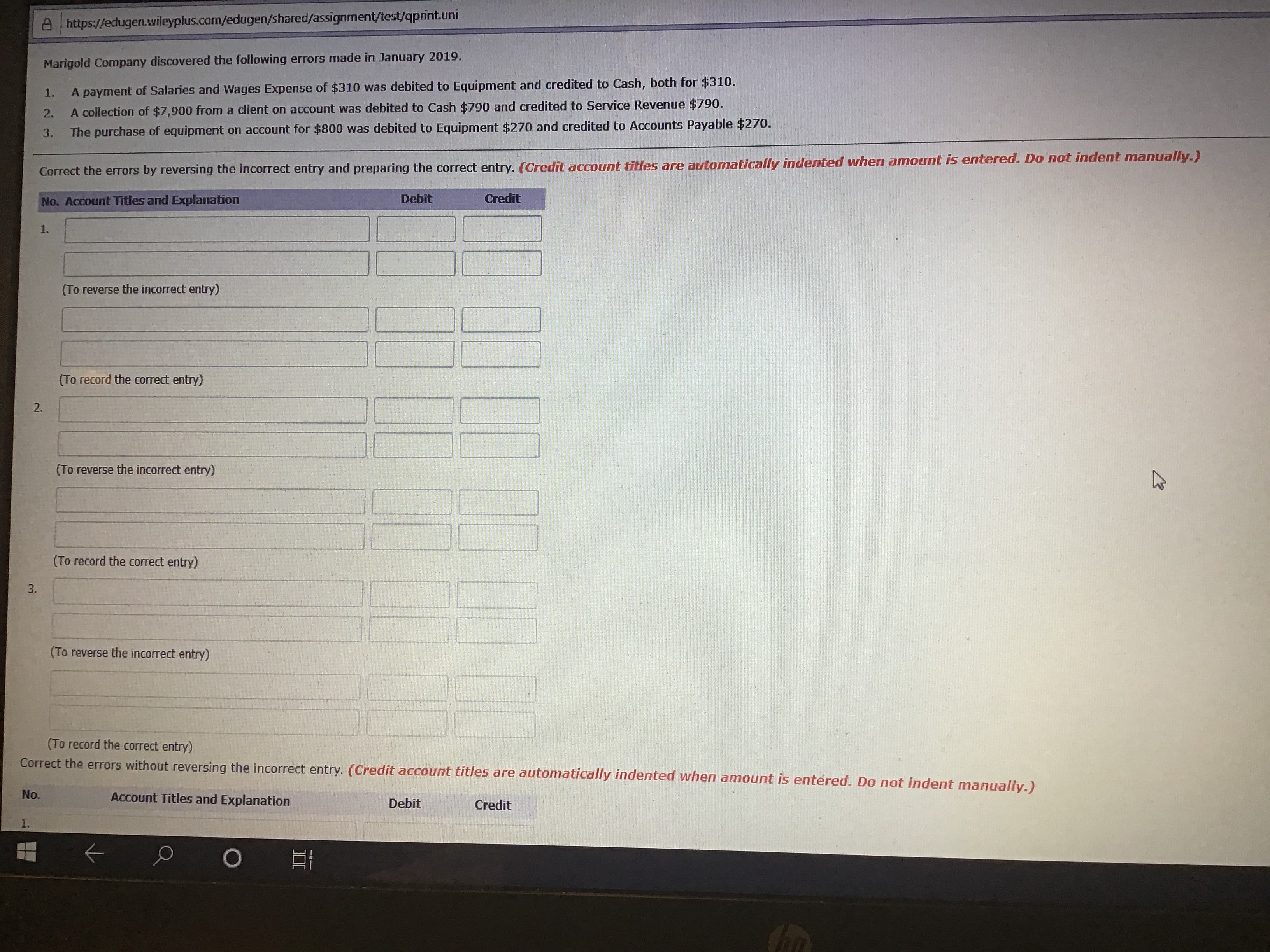

Marigold Company discovered the following errors made in January 2019. 1. A payment of Salaries and Wages Expense of $310 was debited to Equipment and credited to Cash, both for $310. 2. A collection of $7,900 from a client on account was debited to Cash $790 and credited to Service Revenue $790. 3. The purchase of equipment on account for $800 was debited to Equipment $270 and credited to Accounts Payable $270.

Q: Custom Cupcakes, Inc. Adjusted Trial Balance For the Year Ended December 31, 2021 Cash Debit Credit…

A: Financial statement means the trading and profit and loss account and balance sheet of the company…

Q: The trial balance prepared by GD Villa Consulting as at September 30, 2020 was not in balance. In…

A: Trial balance: It is worksheet which shows all the accounts an organization has like assets,…

Q: The undermentioned errors were discovered in the books of Marco after the Profit and Loss Account…

A: In the context of the given question, we are required to prepare journal entries to rectify their…

Q: As at 30 June 2019, the unadjusted trial balance of Green Ltd was noted as follows: Green Ltd…

A: Adjusting entries are entries that are passed at the end of the year in order to accurately reflect…

Q: Salaries payable amounting to P 34,000 was not recorded in 2021. Accrued vacation pay for the year…

A: Rectification of error refers to the process of finding out the mistakes made in recording the…

Q: Records showed that as of December 31, 2020, accrued salaries payable of P21,000 were not recorded…

A: Records appearing on 31st December 2020 which were not recorded or error appeared are as follows:-…

Q: Below is the trial balance of Matilde Gascon Repair Service, which does not balance. Gascon Repair…

A: TB termed as Trial balance refers to the worksheet which includes the list of all the general ledger…

Q: On November 1, 2020, the account balances of Cullumber Equipment Repair were as follows. No. Debits…

A: Journal entries:

Q: BLACK WIDOW Corporation failed to recognize accruals and prepayments since the inception of its…

A: Unused Office Supplies: If unused office supplies of $ 25,000 are not recorded, supplies expense is…

Q: When DeSoto Water Works purchased equipment at the end of 2020 at a cost of $64,000, the company…

A: No. General Journal Debit Credit 1. Correct Entry: Equipment $64,000…

Q: On November 1, 2020, the account balances of Cullumber Equipment Repair were as follows. No. Debits…

A: Ledger accounts:

Q: The unadjusted trial balance for Lamb Company at December 31, 2022 is as follows: LAMB…

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the…

Q: Oriole Company discovered the following errors made in January 2020. A payment of Salaries and Wages…

A: The incorrect entries are corrected after reversing the previous incorrect entries.

Q: Below are three independent and unrelated errors. On December 31, 2020, Wolfe-Bache Corporation…

A: Financial statements: Financial statements are the final reports of a company, prepared at the end…

Q: A company receives a $50,000 cash deposit from a customer on October 15 but will not deliver the…

A: Solution:- Introduction:- The following basic information as follows:- company receives a $50,000,…

Q: Presented below is the adjusted trial balance of Elvie CPA for the year ended December 31,2020…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Below is the trial balance of Matilde Gascon Repair Service, which does not balance. Gascon Repair…

A: Adjustment (a)=Correct amount-Incorrect amount=P 19,600-P 16,900=P 2,700

Q: These errors were discovered in the account of Golden Arches Company: Salaries payable amounting to…

A: Following is the error correction.

Q: E4-12 Max Weinberg Company discovered the following errors made in January 2010. 1. A payment of…

A: Rectification Rectification is correcting the errors that are made in recording or posting the…

Q: Zuhoor Muscat Company is a manufacturer of thermal imaging cameras . On 31 March 2021, the following…

A: Retained earnings is the accumulated balance of earnings made by the business. Ending balance of…

Q: Consider the following information from a company's unadjusted trial balance at December 31, 2018.…

A: Trial Balance: Trial balance is a statement in which closing balance of all ledger accounts are…

Q: April 2020. Horace accumulated all the ledger balances per Pulsar's records and found the following.…

A: Since we only answer upto 3 sub-parts, we will answer the first three. Please resubmit the question…

Q: On December 31, Yates Co. prepared an adjusting entry for $12,000 of earned but unrecorded…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: Cook Enterprises purchased goods from a supplier on credit for $2,000 on December 31, 2020. No…

A: The question is based on the concept of Financial Accounting. When any asset is purchased on credit…

Q: Lowell Corporation has used the accrual basis of accounting for several years. A review of the…

A: Net income: The bottom line of income statement which is the result of excess of earnings from…

Q: For this example, Zion Corporation discovers the following errors in January 2017 relating to 2016…

A: The question is related to the correcting entries in the books of Zion Company. The details are…

Q: Year-end wages to be paid in January of 2022 have already been recorded, however, the accountant…

A: To record an expense payable the expense account is debited and the expense payable account is…

Q: B. While examining the accounts of Granny Co. on December 31, 2020, the following errors were…

A: Part1: Corrected Net Income of 2019 Unadjusted Net Income of 2019…

Q: The following transactions occurred in ABC Company: The accrued salaries at December 31,2020…

A: Journal entry recording is the first step in accounting process. For every transaction, atleast one…

Q: Kevin & Friends, Inc., which was organized on January 2, 2018, two years ago, has not maintained…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Pharoah Company discovered the following errors made in January 2020. 1. A payment of Salaries…

A: A journal entry is used to record day-to-day transactions of the business by debiting and crediting…

Q: Clock Company showed the following errors in their account during December 31, 2021: Dividends of P…

A: Solution Concept Failure to record dividend has no impact on the net income as dividend paid is the…

Q: Bolitho Company is a service firm. It established a Deferred Revenue account because prepayments are…

A: The deferred revenue is the revenue that is received but not earned yet. The Accrued Expense is the…

Q: Below are three independent and unrelated errors. On December 31, 2017, Wolfe-Bache Corporation…

A: Solution:- Explanation of the effect of each error on the income statement and the balance sheet in…

Q: On March 1, it was discovered that the following errors took place in journalizing and posting…

A: a. Rent expense of $3,220 paid for the current month was recorded as a debit to Miscellaneous…

Q: When adjusting entries were made at the end of the year, the accountant for Parker Company did not…

A: a)Wages of $2,900 had been earned by employees but were unpaid. This error will understate expenses…

Q: Zuhoor Muscat Company is a manufacturer of thermal imaging cameras. On 31 March 2021, the following…

A: Formula: Net income = Revenues - expenses Ending retained earnings = Beginning retained earnings +…

Q: Zuhoor Muscat Company is a manufacturer of thermal imaging cameras. On 31 March 2021, the following…

A: Particulars Amount Fees income RO 60625 Less: expenses Wages expense 22855 Depreciation…

Q: Cesar Mahusay operates an accounting firm. Shown below are selected accounts that appear in the…

A: In accounting books, there are several type of accounts. These can be asset accounts, liability…

Q: Cesar Mahusay operates an accounting firm. Shown below are selected accounts that appear in the…

A: Adjusting journal entries.

Q: As at 30 June 2019, the unadjusted trial balance of Green Ltd was noted as follows: Green Ltd…

A: The Journal entries are prepared to keep the record of day to day transactions of the business.

Q: Zuhoor Muscat Company is a manufacturer of thermal imaging cameras. On 31 March 2021, the following…

A: Retained earnings is the part of equity shareholders balance in the company. It means accumulated…

Q: The following information relates to the Muscat Company at the end of 2019. The .accounting period…

A: Total Service Revenue = OMR 48,000 Total Revenue to be recognized = OMR 48,000 x 636 = OMR 8,000

Q: Swaggy Steve's Clothing Company just completed their fiscal year ending August 31, 2019. The…

A: The errors in posting or recording the transactions, may lead to errors in the trial balance.

Q: Zuhoor Muscat Company is a manufacturer of thermal imaging cameras. On 31 March 2021, the following…

A: Retained earnings refer to the accumulated portion of the earnings left with the company after the…

Q: Near the end of its first year of operations, December 31, 2021, Vaughn Designs Ltd. approached the…

A: Statement of changes in equity shows how much equity value of the business has changed over the…

Q: On Sept. 1, 2021, Christopher Abelinde establ Find six errors that were made in recording the…

A: General explanation - for every transaction, there will be debit and credit. If we pay any expenses…

Q: On September 1, Zuhoor Muscat Company received RO4,800 in advance from a customer for services to be…

A: Adjusting entries are prepared at the end of the accounting period to ensure the accrual base…

Q: Zuhoor Muscat Company is a manufacturer of miniature security cameras. On 31 March 2021, the…

A: Following are the some example of intangible assets: Goodwill Franchises Patents Trademarks…

Q: Clock Company showed the following errors in their account during December 31, 2021: • Dividends of…

A: Solution Concept Failure to record dividend has no impact on the net income as dividend paid is the…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- Tech Support Services has the following unadjusted trial balance as of January 31, 2019: The debit and credit totals are not equal as a result of the following errors: a. The cash entered on the trial balance was overstated by 8,000. b. A cash receipt of 4,100 was posted as a debit to Cash of 1,400. c. A debit of 12,350 to Accounts Receivable was not posted. d. A return of 235 of defective supplies was erroneously posted as a 325 credit to Supplies. e. An insurance policy acquired at a cost of 3,000 was posted as a credit to Prepaid Insurance. f. The balance of Notes Payable was overstated by 21,000. g. A credit of 3,450 in Accounts Payable was overlooked when the balance of the account was determined. h. A debit of 6,000 for a withdrawal by the owner was posted as a debit to Thad Engelberg, Capital. i. The balance of 28,350 in Advertising Expense was entered as 23,850 in the trial balance. j. Miscellaneous Expense, with a balance of 4,600, was omitted from the trial balance. Instructions 1. Prepare a corrected unadjusted trial balance as of January 31, 2019. 2. Does the fact that the unadjusted trial balance in (1) is balanced mean that there are no errors in the accounts? Explain.Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Shannon Corporation above. Ignoring income taxes, what is the total effect of the errors on the amount of working capital (current assets minus current liabilities) at December 31, 2020? a. working capital overstated by 4,200 b. working capital understated by 5,800 c. working capital understated by 6,000 d. working capital understated by 9,800The accounts in the ledger of Hickory Furniture Company as of December 31, 2019, are listed in alphabetical order as follows. All accounts have normal balances. The balance of the cash account has been intentionally omitted. Prepare an unadjusted trial balance, listing the accounts in their normal order and inserting the missing figure for cash.

- At the beginning of 2020, Tanham Company discovered the following errors made in the preceding 2 years: Reported net income was 27,000 in 2018 and 35,000 in 2019. The allowance for doubtful accounts had a zero balance at the beginning of 2018. No accounts were written off during 2018 or 2019. Ignore income taxes. Required: 1. What is the correct net income for 2018 and 2019? 2. Prepare the adjusting journal entry in 2020 to correct the errors.Pharoah Company discovered the following errors made in January 2020. 1. A payment of Salaries and Wages Expense of $310 was debited to Equipment and credited to Cash, both for $310. 2. A collection of $7,900 from a client on account was debited to Cash $790 and credited to Service Revenue $790. 3. The purchase of equipment on account for $480 was debited to Equipment $720 and credited to AccSandhill Company discovered the following errors made in January 2020. 1. A payment of Salaries and Wages Expense of $360 was debited to Equipment and credited to Cash, both for $360. 2. A collection of $1,100 from a client on account was debited to Cash $110 and credited to Service Revenue $110. 3. The purchase of equipment on account for $270 was debited to Equipment $800 and credited to Accounts Payable $800. (a) Correct the errors by reversing the incorrect entry and preparing the correct entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit 1. enter an account title to reverse the incorrect entry enter a debit amount enter a credit amount enter an account title to reverse the incorrect entry enter a debit amount enter a credit amount (To reverse the incorrect entry) enter an account title to record the…

- These errors were discovered in the account of Golden Arches Company: Salaries payable amounting to P 34,000 was not recorded in 2021. Accrued vacation pay for the year 2021 for P 62,500 was not recorded due to lack of knowledge by the bookkeeper. Insurance for a 12-month period purchased on November 1, 2021 was charged to expenses in the amount of P 37,200. a. P 6,200 under b. P 65,500 over c. P 59,300 over d. P 64,500 underHorace Culpepper, CA, was retained by Pulsar Cable to prepare financial statements for April 2020. Horace accumulated all the ledger balances per Pulsar’s records and found the following. Analyze errors and prepare correcting entries and trial balance. Pulsar Cable Trial Balance April 30, 2020 Debit Credit Cash £ 4,100 Accounts Receivable 3,200 Supplies 800 Equipment 10,800 Accumulated Depreciation—Equip. £ 1,350 Accounts Payable 2,100 Salaries and Wages Payable 700 Unearned Service Revenue 890 Share Capital—Ordinary 10,100 Retained Earnings 2,800 Service Revenue 5,650 Salaries and Wages Expense 3,300 Advertising Expense 600 Miscellaneous Expense 290 Depreciation Expense 500 £23,590 £23,590 Horace Culpepper found the following errors. 1. Cash received from a customer on account was recorded as £950 instead of £590. 2. A payment of £75 for advertising expense was entered as a debit to Miscellaneous Expense £75 and a credit to Cash £75. 3. The first salary payment this month was…These errors were discovered in the account of Golden Arches Company: Salaries payable amounting to P 34,000 was not recorded in 2021. Accrued vacation pay for the year 2021 for P 62,500 was not recorded due to lack of knowledge by the bookkeeper. Insurance for a 12-month period purchased on November 1, 2021 was charged to expenses in the amount of P 37,200. P 64,500 under P 6,200 under P 65,500 over P 59,300 over

- Below are three independent and unrelated errors. On December 31, 2017, Wolfe-Bache Corporation failed to accrue office supplies expense of $1,850. In January 2018, when it received the bill from its supplier, Wolfe-Bache made the following entry: Office supplies expense 1,850 Cash 1,850 On the last day of 2017, Midwest Importers received a $91,000 prepayment from a tenant for 2018 rent of a building. Midwest recorded the receipt as rent revenue. At the end of 2017, Dinkins-Lowery Corporation failed to accrue interest of $8,100 on a note receivable. At the beginning of 2018, when the company received the cash, it was recorded as interest revenue. Required:For each error:1. What would be the effect of each error on the income statement and the balance sheet in the 2017 financial statements?2. Prepare any journal entries each company should record in 2018 to correct the errors.Lowell Corporation has used the accrual basis of accounting for several years. A review of the records, however, indicates that some expenses and revenues have been handled on a cash basis because of errors made by an inexperienced bookkeeper. Income statements prepared by the bookkeeper reported $29,000 net income for 2019 and $37,000 net income for 2020. Further examination of the records reveals that the following items were handled improperly. 1. Rent was received from a tenant in December 2019. The amount, $1,000, was recorded as revenue at that time even though the rental pertained to 2020. 2. Salaries and wages payable on December 31 have been consistently omitted from the records of that date and have been entered as expenses when paid in the following year. The amounts of the accruals recorded in this manner were: December 31, 2018 $1,100 December 31, 2019 1,200 December 31, 2020 940 3. Invoices for supplies purchased have been charged to expense…As at 30 June 2019, the unadjusted trial balance of Green Ltd was noted as follows: Green Ltd TRIAL BALANCE AS AT 30 JUNE 2019 Accounts Debit ($) Credit ($) Cash at bank 8 985 Account receivables 31 200 Prepaid insurance 3 900 Office Supplies 4 680 Office equipment 14 100 Accumulated depreciation - equipment 2 850 Accounts payable 315 Salary payable Unearned service revenue 1 230 Loan payable 10 500 Capital 33 300 Drawings 60 000 Service revenue 159 270 Salary expenses 66 000 Depreciation expenses - equipment Miscellaneous expenses 18 600 TOTAL 207 465 207 465 The following additional information is available at the end of June for adjustments: A physical count of office supplies on 30 June shows $660 of unused supplies on hand Depreciation of the office equipment is 10% each year (straight line…